Options are a zero-sum game. Winners and losers. Buying or selling risk. They also offer leverage, low costs, and the potential for unbelievable returns. On the downside, they can can be very risky if entered into lightly. I still have a LOT to learn before being comfortable buying, selling, and exercising options. Prior to this week, I have made some shame-inducing options trades on ETF's resulting in some unpleasant losses. I have been digging into the basics and share my knowledge to hopefully scare you into doing your research and not make the same mistakes I have. I have decided to start over from ground zero with the basics of puts and calls in order to determine if any advanced trading strategies would be an option for me as a means of putting my assets and holdings to work.

First, a quick disclaimer is in order. I am no expert when it comes to options, finance, or the stock market. I have heard of butterfly spreads, iron condors, calendar spreads and other advanced trading strategies. Merely reading about how to enter one of those positions melts my brain, let alone trying to figure out how to successfully exit one of those. Information herein does not constitute financial advice. This is for informational purposes only. DO YOUR OWN REASEARCH!!!

What is a call?

A call is a contract that gives its holder the right, but not the obligation to buy shares of a stock at the strike price of the option from the writer of the option.

What is a put?

A put is the opposite of a call. It is a contract that gives the holder the right, but not the obligation to sell shares of a stock at the strike price to the writer of the option.

Assume the Position

There are a number of options when it comes to buying and selling options (Sorry. I'll stop with the awful puns). Buying an option is one of two ways to open a position on a stock. Buying an option gives you the right to buy/sell the underlying stock at the strike price. This is often referred to as "buy to open." Selling the option will close your position. Any change in price of the option will be your profit/loss. This is often referred to as "sell to close." Writing options are another way to open a position. When you write and sell an option, you are selling someone the right to buy (for a call)/sell (for a put) shares at the strike price. For your trouble, you collect an option premium. If the option is exercised, you are obligated to sell shares to the person exercising the option at the strike price. Writing an option is often referred to as "sell to open." Exiting the position can be achieved by buying an option at the same strike price and expiration date. This is often referred to as "sell to close."

Strike Price

The strike price is the buy/sell price of an option. If an option is exercised, it is the price the stock will be bought or sold at. In-the-money calls have a strike price lower than the stock's price. In-the-money puts have a strike price that is higher than the stock's price.

Time Value

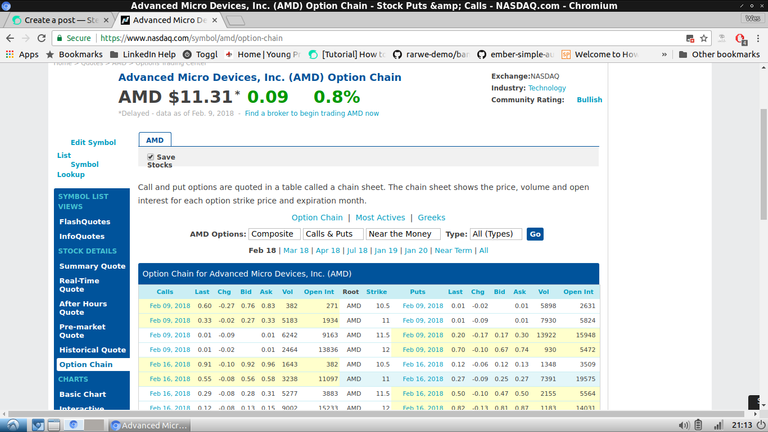

Options have an expiration date. Options have a value that is higher than the difference between an option's strike price and the underlying stock's price. Take a look at AMD's option chain below:

As you can see, the prices are higher than you would expect. The call option with a strike price of 10.5 has a bid price of 0.92. The difference between the price of the stock and the strike price of the option is 0.81. Even the out-of the money options have value -- time value.

Bid-Ask Spreads

The bid price is the lowest price an investor is willing to buy an option at. The ask price is the lowest price an investor is willing to sell an option at. The difference between the ask price and bid price is a measure of the liquidity of an option. The lower the bid-ask spread, the easier an option is to buy or sell. Like everything else in the stock market, both are constantly changing.

The Money

Options can be bought and sold in-the-money, out-of-the-money, and at-the-money. Many options strategies involve buying and/or writing options at different strike prices--out of the money and in the money.

Nice post. What kind of options strategies do you use?(Ex: iron condors, spreads, calendars, etc.)

Options are awesome because you can do so many things with them to make the trade in your favor if you understand the aspects behind trading/investing along with how options work.

I post frequent analysis on the stock market if you want to take a look at my blog. I talk about AMD often. Here are my most recent AMD charts :

Right click then open in new tab to zoom in

Posted January 26th

Today

It is trading in a triangle. $10.00 is a good support level that I would recommend going long at.

The only option strategy I have opened myself up to at this point is protective puts and covered call writing.

I wouldn't be comfortable with any others at this point. I need more time, practice, and study. Especially practice particularly with making limit orders.

I usually don’t advertise my posts on other people’s blogs, but if you want to learn about trading options, you can read my lessons on options trading.

If done right, it is not a zero sum game. It is a math game:

I also urge you to watch www.tastytrade.com

It’s the best source on the internet and it’s free. https://steemit.com/money/@stehaller/introduction-into-option-trading-lesson-1 https://steemit.com/money/@stehaller/introduction-into-option-trading-lesson-2