I am going to build my #watchlist for tomorrow and ill show every step of my process.

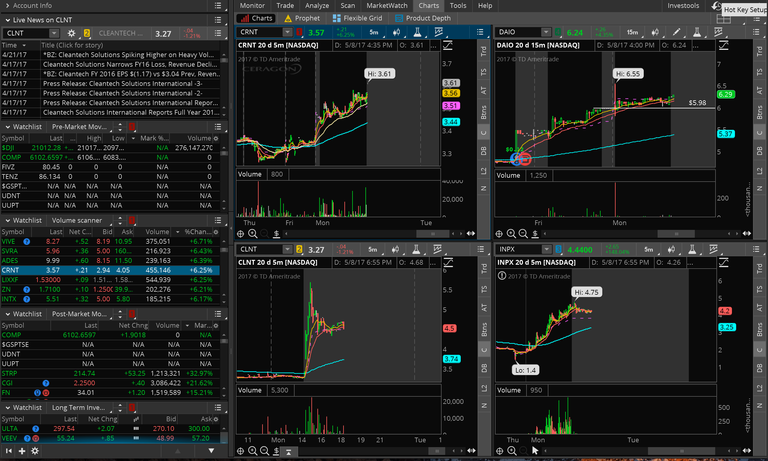

First I use TOS (Think or Swim) it's a TD Ameritrade platform you can download, it has my stock scanners, news, and charts with indicators. The only other site's I use are Yahoo finance for finding the Float for a company and Discord witch is where I talk and trade with my trading group.

On the left side of the picture you can see at the top there is a box for the News on whatever stock I chose, it is filtered latest news to oldest, below that is my pre-market scanner that I use about 1h before the market opens, under that is my Volume scanner it looks for stocks that are $1 to $10 and have over 100k volume being traded on them that day. those are usually the momentum stocks. Then for this time of the day when the regular trading hours are over I have my post-market scanner that picks up stocks that are moving after the closing bell.

I go through the list one by one to find something that looks interesting, stocks that are moving up usually over 5%, unfortunately I couldn't find anything that I really liked so I go to my chat room.

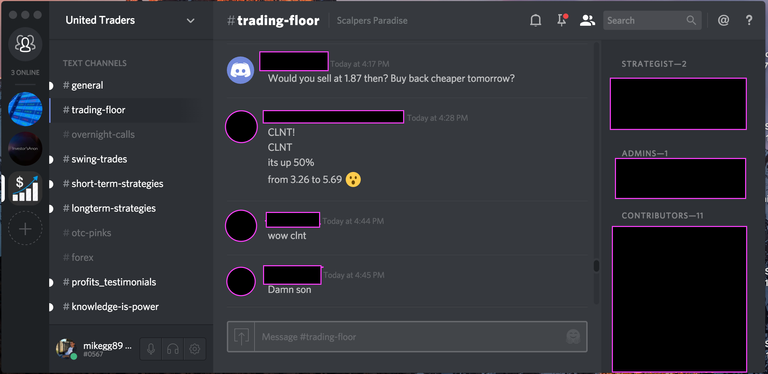

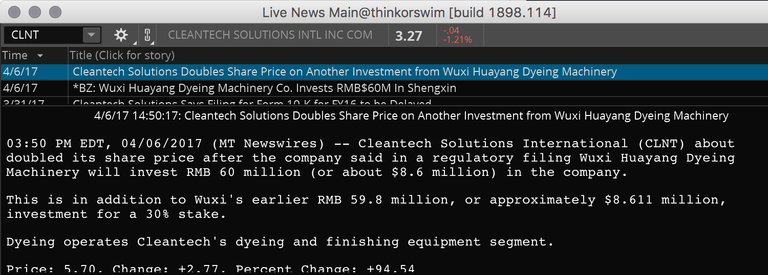

Awesome! some one called out the stock CLNT, it's up 50%, now I try to find out why it is moving. I check the news block.

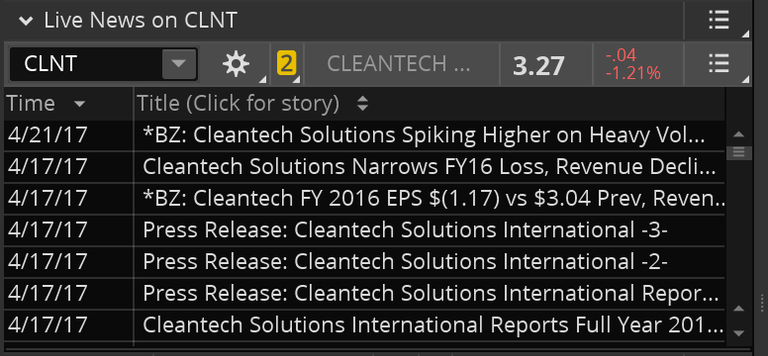

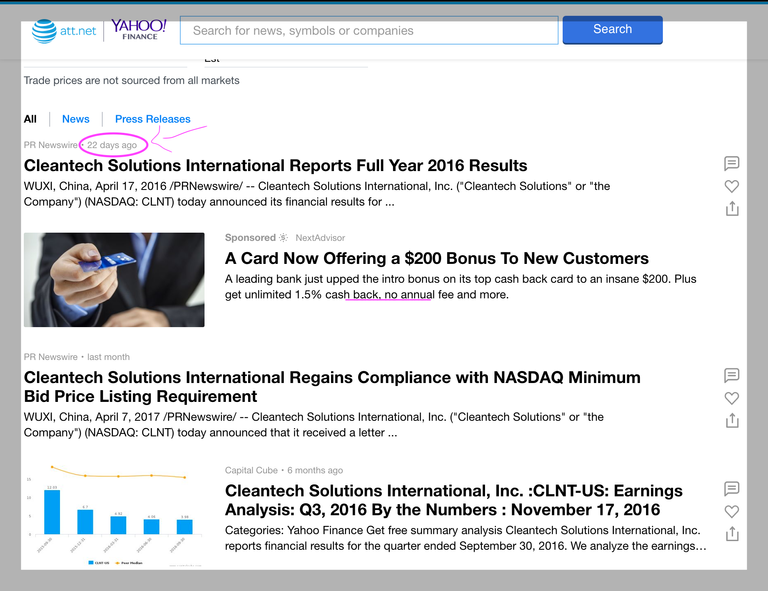

Nothing, The latest news is from the 21st of April... So I go to Yahoo finance...

Same thing, so now I know it doesn't have a fundamental reason for moving like this... At least not right now, in the morning there could be a news release, I'll make a note and watch for that. For now i'll look at the Technicals and see if there was a technical breakout and i'll check the float.

990k Float, thats a really small float. The float is the number of shares actually available for trading. If there is a lower supply of shares available to trade, it wont take much demand for the stock to really get going, that is why we look at volume.

Now for the technicals, or chart analysis.

Right away I see that back in March there was a huge breakout where this stock ran from about $.70 to $10.70 a share in 2 weeks, now that initial resistance it saw is becoming new support. This stock really could just be running on technicals. Tomorrow I will be looking for a position on this stock, I would like to see another news catalyst tomorrow but I think it could still be a good play...

here is the news that really got it to $10.70

Tomorrow when the market opens at 8:30AM Texas time, I will be looking at the 1m and 5m charts, some people like to get in right at the open but I like to wait, I like to see it go up in the first 30m to 1h of the market being open then I get in as it's going up, some times if it looks like it has enough strength I will chase it and some times ill wait for a small pull back. If this doesn't happen then I look for it to drop down right at the open to a support level, usually the 1m charts 200ema (exponential moving average) or a horizontal trend line.

I'm never sure of where the stocks will go but all I can do is play the probabilities of continued strength and or support levels holding, then when i'm in the trade I never know how high they will go or if it will drop right away. my stop loss is right below the closest support and I like to sell for a profit or a partial profit into strength... It may only go up .10c or it could go a whole dollar, these are the real challenges with trading. finding good stocks, building a watchlist and knowing good entry points are the easy part.

Good luck to anyone who goes on this crazy adventure of trading, It's fun, it's frustrating, you will have the best days and the worst days, and that can some times be in the same day.

If any one has any question or would like my personal help, I'm just a comment away.

Copy this link http://tos.mx/8spYzZ and put it into your TOS platform under "open shared items" to have my setup with my scanners and chart settings.