WEEKLY MARKET REPORT

By Moksh Rajput

Friday September 28, 2018

Pretty nice stocks found this week…

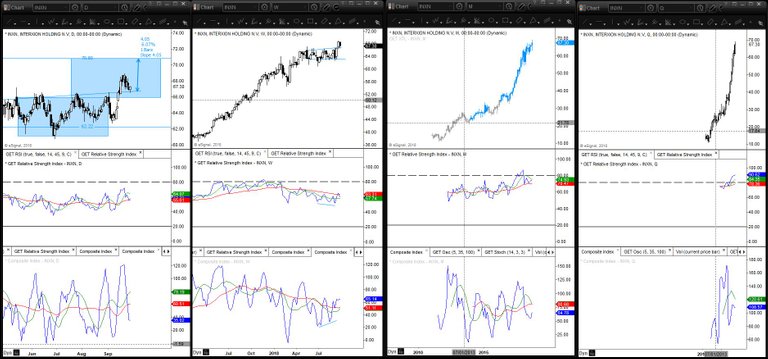

INXN, Interxion Holding. A multi month H&S has taken place and INXN already broke out of it, but it has came back to retest this neckline. I entered at $67.30 with a stop loss at $64.50. My target is at $70.80. Also there is a nice divergence with the rsi and comp index in weekly chart.

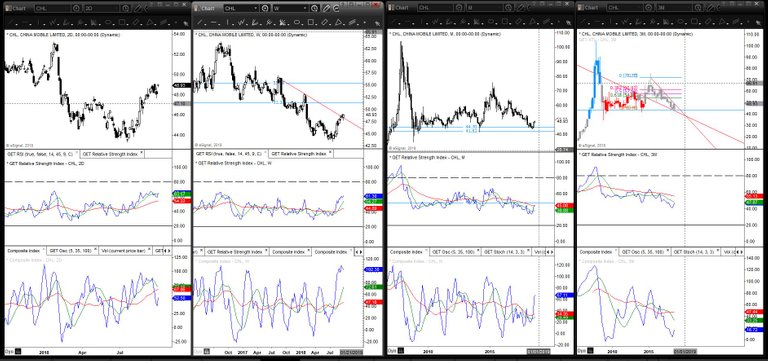

I have my eyes on CHL for the upcoming future, I am just waiting for my buy signal. In weekly chart it looks like it has broken out of the downwards trendline and in the 3M chart it is still within the range in two red trendlines.

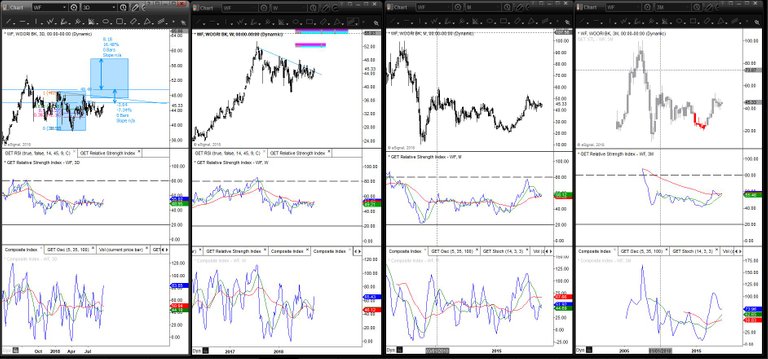

I am really liking the stock I am about to show and one other mentioned down below. The sector? Financials/Banking. This one is WFC aka Wells Fargo. WFC has a nice H&S forming, it just needs a close under $49.25 for me to enter this stock. My target is $35.27 but many fibos are saying $37-38 which again is very close to the target. The stop loss would be at $60.01.

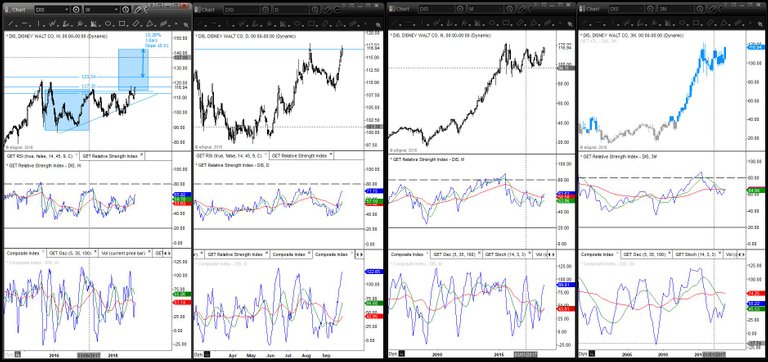

DIS, Disney is giving mixed signs. In the 3M the RSI may revert from 64.84 down, but in the short term the stock may give a buy signal soon. If we go to the daily chart, if the stock can break above $123.54, so essentially make a new ATH, then this stock can thrust to $140 area. My stop would be at around $109.50.

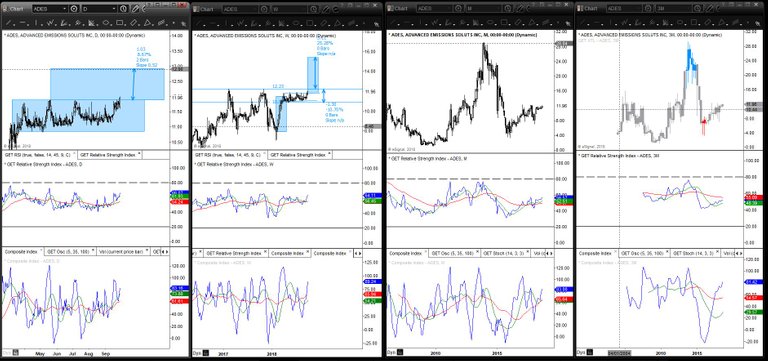

I am liking ADES, Advanced Emission Solutions for the short term because of its bullish signs in timeframes from Daily to Monthly. Weekly and Monthly RSI’s are showing bullish nature. I will purchase this stock after $12.50 is breached with a stop at $10.50 and a target of $15.50.

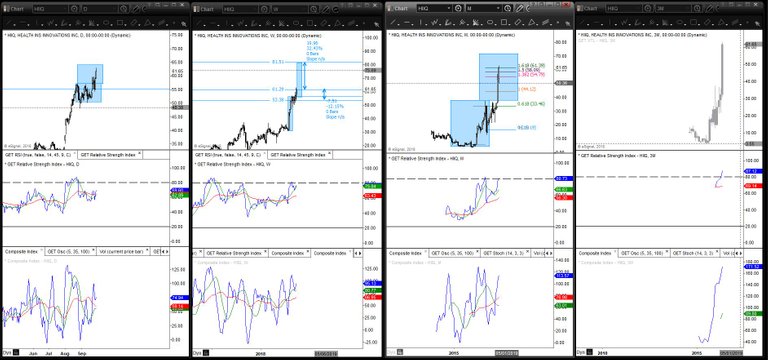

HIIQ may be continuing its bull run. It looks like a bull flag has occurred with a target at $81.51. Our stop would be at 53.38 and only enter after $62 is breached.

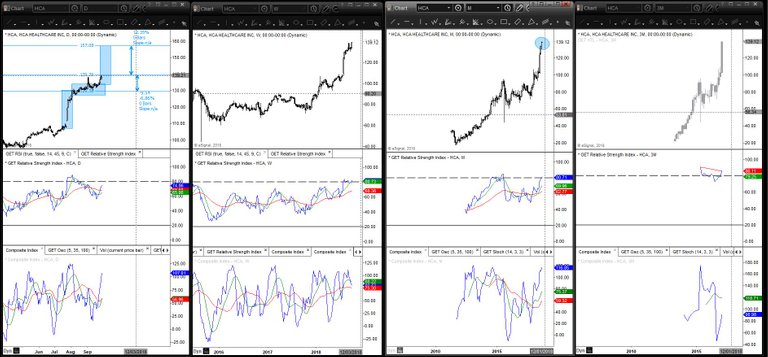

My opinions are a bit fluctuated for the stock HCA, HCA Healthcare. On one hand in the daily, it has formed a bull flag on the daily chart, but in the monthly there is a hanging man doji present. Possibly, HCA will reach its target, but for the month of October, it will close below. Thus, the target only being a large wick. Anyway, I will enter at $140 with a stop at $129.38 and a target of $157.08.

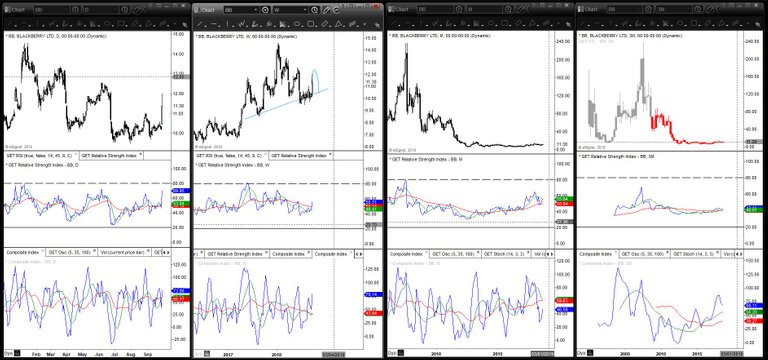

I have been watching BB, BlackBerry for a while now. I think BB has bottomed out, but in the short term weekly timespan, a H&S may be forming to drive the price of BB lower. Anyway, in 3M signal is flashing a buy sign, only time will tell. Will see if a H&S forms and enter after that.

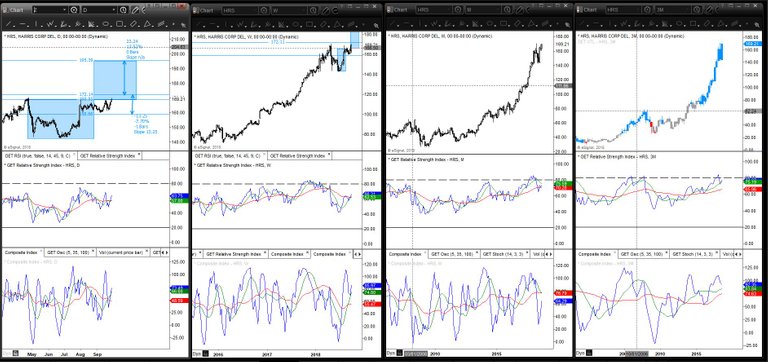

Again mixed signals with the stock HRS, Harrris Corp. There is a nice cup and handle pattern for this stock with target being $195.39 and stop at $159. I will enter after a strong white body emerges from $172.14.

This is the other banking stock which I like. It is WF. This stock seems like it is going to blow off, in all time spans, the RSI is flashing massive buy signals. Anyway, in the 3D chart there is a nice Inverse H&S forming, its target being around $58 and a stop loss at $41. I will purchase this stock at $50.50. My first target would be the target of the in. H&S, but in the future I believe this stock will be going up even higher because of the bullish signals it is flashing. Will keep you updated.

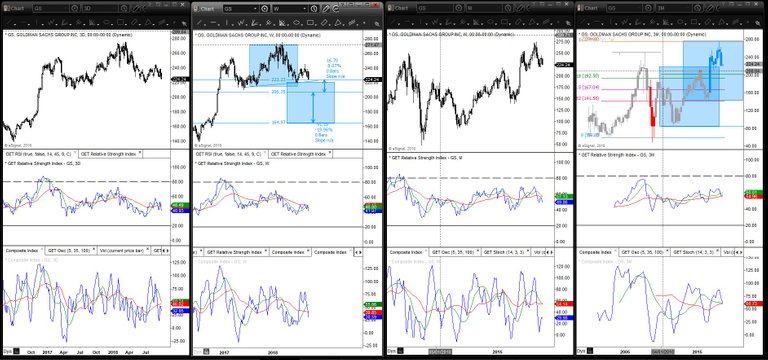

This is the final stock, also part of the banking sector. GS, Goldman Sachs, has a major H&S forming since last couple of months! If the neckline breaks and a close under $206.35 occurs, then GS will lose 19.96% of its value! That is a target of $165 and a stop loss of $250. I will cover some of my position at the primary target but I will be holding this stock for a while because I believe it will be going down much lower.

Lots of these US banking stocks are showing weakness. The market may have very well topped! TSLA is also down so much, Elon is paying $20M in the lawsuit and will be stepping down from Chairman! Lots of tremulous things going on, while people panic, I am screaming opportunity!