You might already know that I spend a lot of time thinking about money, economics, and personal finance. For whatever reason it's always been an area of avid interest to me. I remember being around 10 or 12 years old and asking my dad if they could afford my college. (Turns out they could without too much trouble).

As I got older, into my 20s and 30s, I've read all the books, been to the seminars, and got experience in several different markets.

At one point I even got my Investment Adviser license (Series 65) with the idea that I would open a small, high-touch advisory company.

All of that is to say, I know how the numbers work.

And through it all, I couldn't shake the thought that the standard financial advice of saving and investing through your 401k and IRA through index funds was not the panacea that it is touted as being.

There are 3 main reasons for this:

- Systemic Risk

- Inflation

- Fees

Systemic Risk

You might have heard systemic risk back in the most recent financial crisis referring to one entity, like AIG, being able to take down the whole system. That's part of what I'm talking about. More generally, the future is not guaranteed to be like the present or past.

The SEC requires all prospectuses to have a statement saying something to the effect of past performance is not a guarantee of future performance. They mandate this clause because it is absolutely true. Just because investment fund ABC did well over the last 20 years doesn't mean it won't crater down to zero tomorrow.

And we've seen this in multiple economies over the past few decades. The biggest of which was probably the Japanese bubble that burst around 1989-1990. They still haven't recovered from that. For you youngsters out there, it was a serious concern that Japan was going to take over the world economically. There were several incidents of Japan bashing where people would take sledge hammers to Hondas and Toyotas. I even took 3 years of Japanese in high school because I thought I would need it for business.

But the bubble burst, and all that went away... quickly.

If you were an index investor in Japan and were about 35 years or older, your investments failed and never recovered. Fortunately for them, people in the Japanese culture are very high savers and have strong family obligations to help cushion the blow to their portfolios.

We've seen the market in Cyprus fall 99% when they had their bank bail-ins a couple years ago.

These are systemic risks playing out.

If you're an American, we still have the strongest economy in the world. But there are no guarantees that it will stay that way.

And yet all the standard financial advice is based on the future playing out like the past did. You'll hear things like, "Mutual funds have averaged 12%," (bald faced lie) or more accurately, "The CAGR of the stock market has been over 8% for the last 100 years."

OK, sure. But like the SEC says, past performance is not an indicator of future value.

Inflation

Inflation is a wealth killer. It's a hidden tax on everything. If you read a lot of financial advice books, you'll see the same basic idea played out over and over again.

It's a chart that shows a young person, let's call him Billy, investing 10,000 USD when he's 25 or so each year for a few years into an index mutual fund. Then he stops investing, sits back, and when he turns 65 he's a millionaire.

It looks great. But there is just one teensy-weensy problem with it: inflation.

Today's dollars aren't worth what yesterday's dollars were because the supply of dollars has gone way, way up. That's the way our monetary system works. New money is created when a bank creates a loan that only has fractional reserves. Crypto is an attempt to bring this under control, but it's far from a complete project.

More honest financial authors will try to show inflation-adjusted returns and results, but that doesn't really show the real impact. You can't spend inflation-adjusted dollars. All you have is nominal dollars.

To illustrate this effect, I downloaded the income quintile data from the US Census reports going back to 1972. I calculated the median income for each of those years.

In 1972, the median household income was 9,664 USD per year.

In 2002, the median household income was 42,587 USD per year. A 340% increase over those 30 years.

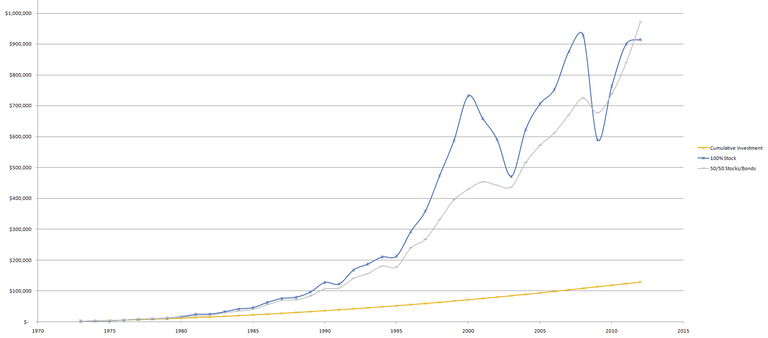

So I ran the numbers on a simulation. Let's say you were our median American. Your household made that median income, and you invested 10% of your income each and every year in either a portfolio of 100% stocks or 50/50 stocks/bonds.

Let's also say you are paying no fees and no taxes all along the way.

And just as a cherry on top, you did this for 40 years, from age 25 to age 65.

You didn't panic and sell at the wrong time. You just dollar-cost-averaged your way into wealth. And you made the market average each and every year.

What's the result of that after 40 years of following this golden plan?

Whether you picked 100% stocks or 50/50 stocks/bonds you ended up with 914k or 971k. Almost to that magical million dollar mark. To get there, 130k was invested over 40 years and if provides an income of about 37k if you follow the 4% safe withdrawal rate rule - well below the previous standard of living.

But wait. What about Billy and his millions? That's inflation at work. Billy can't put in 10,000 40 years ago because that was more than his whole income. Or if puts in 10,000 this year, it won't be worth as much in 40 years as it is now.

So that compound growth that has the longest time to build is done on the smallest investment in actual dollars.

Fees

And then there are fees. In a qualified plan like a 401k the investor is paying fees twice. Once to the plan administrator and again to the actual mutual funds.

In an IRA administrator fees are rarer, and investment options are wider, so fees are typically lower. So if you're savvy, you can pay very low fees in an IRA. But then contribution limits are lower as well.

Outside of a qualified plan, you're going to be paying taxes as well as maybe paying fees.

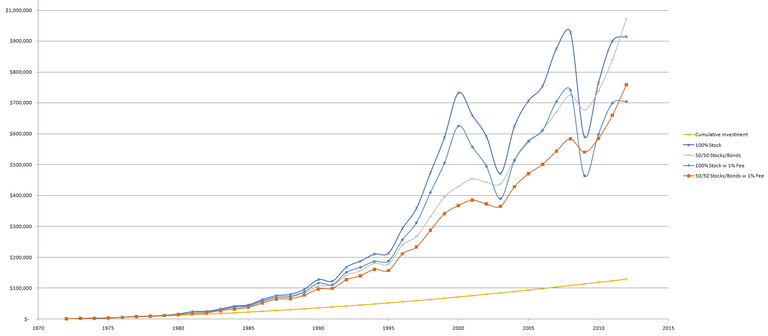

Most financial planning these days occurs in 401ks/403bs/457s, and that is where most of the retirement money is held. Let's look at the effect of a 1% total fee looks like. 1% doesn't sound so bad.

For the 100% stock portfolio, instead of ending up with 914k, you end up with 704k. In the 50/50 portfolio instead of 971k, you end up with 758k.

Compounding works both ways. The 1% drag on performance causes a net drop of 23% and 22% respectively. So instead of living off 37k a year from your investments, you're now living off 29k. You're going to miss that 8k per year.

And 1% is on the low side. I see clients all the time paying over half their annual earnings in fees of one kind of another.

Let's Get Real

And the numbers above are the best case scenario! In real life, people don't save 10% of their income. The average American saves something like 2%.

They don't invest for 40 years. It's very hard to convince a 25 year old to do something that will pay off in 40 years. It usually takes a decade or two of watching the years pass before people wake up and realize they should probably put something away for retirement.

In real life they don't get the market average because they pick bad mutual funds and sell at the wrong time.

And they don't leave the money to grow. Very few 401ks or IRAs actually make it intact to retirement age. They are usually cashed out to buy or remodel houses, for new cars, for college expenses, for medical expenses, to cover a period of unemployment, or all kinds of other purchases, penalties or no penalties.

Is it All a Lie?

So I wonder, is all of the financial advice just one big lie? Or, let's be more charitable, is it a carefully chosen narrative to paint the rosiest scenario possible?

I know, I know. I can hear the purists yelling in my head. "That's why you have to invest more." "You don't make a median income your whole career." "If people cash out early, that's their own fault." "People should pick no load funds." And all of those have an element of truth to them. In fact I will run the same scenario with an increasing income tomorrow.

But there are also real world constraints to be acknowledged. Some people do make around the median income their whole careers. A lot of people have very little choice in what funds are offered in their qualified plans. Don't even get me started on the mess that is the public employee pension systems!

So again, I ask myself, has the past 40 years of financialization really just been one big con job that convinced America and most of the rest of the world to line the pockets of Wall St?

Upvoted ($0.17) and resteemed by @investorsclub

Join the Investors Club if you are interested in investing.

Upvoted and resteeming this post! I have pondered these thoughts as well.. and lean towards the thought that yes, financialization has benefited a select minority of individuals and institutions, while exploiting everyone else (and increasing the risk of cataclysm in the global markets).

Wealth transfers happen all the time.. 2008 is the most recent, prime example. The major investment banks profited greatly, while Joe Sixpack had his life savings virtually wiped out. No one even went to jail. Execs still got their $100+ million bonuses.

It really is criminal on so many levels.

And now with the bail-in provision in Dodd-Frank, we can foretell what will happen the next time we see another 2008-esque situation (and this time it will be worse, since QE and artificially low interest rates have turned the global economy into more of a Frankenstein-monster than ever).

I know I rambled a bit, but it was all related to your well-put-together post. Thanks for sharing your knowledge and thoughts on the subject. I appreciated reading your post (and trying to contribute some myself).

All true. I am still not 100% convinced those clauses in Dodd-Frank will be used though. The public outrage will be enormous.

I hope you're correct! ;)

Yes it's one big game. Moving to Eastern Europe have made me realize that. A Taxi cost 10x more in West Europe. It's a joke! The currency is worth nothing! Add to that the lovely 50% tax that people pay. Or for some even 70%! Especially since there are so many hidden fees and costs. I welcome cryptocurrency haha. At least we have more options now and can have a closer relationship to value.