How Free Market Entrepreneurs Outperformed Subsidy-Driven Businesses and What We Can Learn Today

In his 2010 lecture “The Myth of the Robber Barons”, Dr. Burt Folsom explains many examples of how private entrepreneurs without government subsidies often outperformed companies that received subsidies from the government. Subsidies were seen as necessary tools for the federal government of the United States of America to compete with other nations or to achieve a common interest. However, as Dr. Folsom explains, there are many such cases where the private entrepreneur, without subsidies, achieved more, and was more profitable and efficient than businesses that were receiving subsidies from the national government. I embark on some reflections on the lecture below.

Subsidies Failed to Produce Expected Outcomes

Folsom gives many examples of private entrepreneurs and how they outperformed those who were receiving subsidies. One of the most interesting examples was the steamship industry. The Collins Line of steamships was seen as an important investment for the national government to compete with the United Kingdom in the fight to industrialize first. The government gave subsidies to the Collins Line again and again, despite poor performance and repeated mismanagement. Then, Vanderbilt arrived on the scene and told Congress he could do the same job for half the price, but Congress did not accept his offer. Vanderbilt and Collins continued to compete with each other year after year, and Vanderbilt eventually became more profitable and more efficient than the Collins line. And yet, the Collins Line was continually subsidized by Congress, despite being less efficient and a money pit. Vanderbilt became more efficient because of innovations, such as the “third fare” which allowed people to ride for cheaper prices. Eventually, the government stopped subsidizing the Collins line, but only after investing millions of dollars into the failed business.

Folsom also discusses other examples of failed subsidies, which include the creation of a transcontinental railroad and the invention of the airplane. In these cases, just as in the case with the steamship, the private company outperformed the subsidized business every single time. It is clear from these examples that subsidies often only prop up inefficient ventures and do not require creativity or merit to be funded. While not all subsidized projects have failed, I think it does stifle creativity as it isn’t required once the company is subsidized initially. I think that the public bidding process, as seen in the fulfillment of government contracts, does encourage creativity, but a company or industry that can rely on subsidies forevermore is not sustainable.

Free Markets, Entrepreneurship…and Yes, Immigrants Too

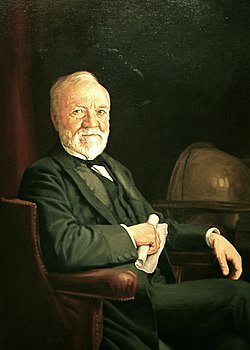

From Folsom’s dialogue, it is clear that the free market is more efficient than government-funded industry. While it is certainly necessary for the government to make investments from time to time, as a general rule, entrepreneurship that is based on the creativity of the people of America is much more reliable (and profitable) than government-mandated businesses. This is evident in Andrew Carnegie and U.S. Steel production. Carnegie outperformed European steel producers through efficiency and innovation, even though the steel industry in the United Kingdom had a head start of years. Additionally, the first billionaire in the United States, John D. Rockefeller, is a prime example of how the free market can drive competition and drive prices down more than subsidies can. Rockefeller dominated global oil markets by having 60-70% of the market share of oil usage, which is crazy. Through innovation, integration, and efficiency, Standard Oil was able to outperform every oil company in the world, and it did so without government subsidies. Additionally, Rockefeller found ways to preserve the environment by using less whale oil and using ‘sludge’ waste to produce new projects through research and development.

It is clear that the United States’ strength and economic might are not a result of subsidies, but instead a consequence of the value creation of the populous and the free markets that allowed this innovation to exist and thrive. I also think it is important that Folsom notes that Carnegie was an immigrant from the United Kingdom. In the current cultural climate of America, I think many people look down on diversity and see it as a weakness. I know that the conversation of DEI is a nuanced one and that most of those who oppose DEI are not against diversity in the free market based on merit, but I certainly think that immigrants are seen not as benefits, but as liabilities by many today in our country. Again, this is just a generalization. Though I think it is important to say that immigrants have an important role to play in value creation and innovation in the United States, just as Andrew Carnegie and countless others have displayed.

While I have explored various perspectives in this essay, it is important to note that I do not necessarily ascribe to any argument made here 100%. This is a writing exercise, and I sought to explore various perspectives after watching the lecture, as per the assignment instructions.