Summary

- 14 new stocks make our Most Attractive list this month, and 15 new stocks fall onto the Most Dangerous list this month.

- Most Attractive stocks have high and rising returns on invested capital (ROIC) and low price to economic book value ratios.

- Most Dangerous stocks have misleading earnings and long growth appreciation periods implied by their market valuations.

- Looking for more stock ideas like this one? Get them exclusively at Value Investing 2.0 . Get started today »

Most Attractive Stocks Feature for December: C.H. Robinson Worldwide

C.H. Robinson Worldwide (CHRW) is the featured stock from December’s Most Attractive Stocks Model Portfolio.

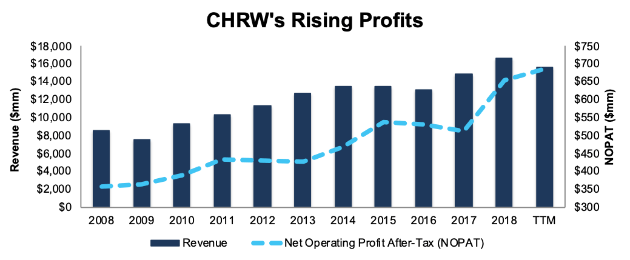

Over the past decade, CHRW has grown after-tax profit ((NOPAT)) by 6% compounded annually. CHRW’s trailing twelve month NOPAT is up 12% over the prior TTM period as well. CHRW’s NOPAT margin has averaged 4% over the past decade and is 4.4% over the TTM period. After declining during 2015-2017, CHRW’s return on invested capital ((ROIC)) improved from 17% in 2017 to 21% TTM.

Figure 1: CHRW’s Revenue & NOPAT Since 2008

Sources: New Constructs, LLC and company filings

CHRW Valuation Offers Upside Potential

At its current price of $76/share, CHRW has a price-to-economic book value (PEBV) ratio of 1.0. This ratio means the market expects CHRW’s NOPAT to never meaningfully grow from current levels. This expectation seems overly pessimistic for a firm that has grown NOPAT by 6% compounded annually over the past decade and 15% compounded annually over the past two decades.

If CHRW can maintain its TTM NOPAT margin (4.4%) and grow NOPAT by just 4% compounded annually for the next decade, the stock is worth $101/share today – a 33% upside. See the math behind this reverse DCF scenario.

Critical Details Found in Financial Filings by Our Robo-Analyst Technology

As investors focus more on fundamental research, research automation technology is needed to analyze all the critical financial details in financial filings as shown in the Harvard Business School and MIT Sloan paper, "Core Earnings: New Data and Evidence”.

Below are specifics on the adjustments we make based on Robo-Analyst findings in C.H. Robinson’s 2018 10-K:

Income Statement: we made $95 million of adjustments, with a net effect of removing $9 million in non-operating income (<1% of revenue). You can see all the adjustments made to CHRW’s income statement here.

Balance Sheet: we made $359 million of adjustments to calculate invested capital with a net increase of $264 million. One of the largest adjustments was $219 million in operating leases. This adjustment represented 7% of reported net assets. You can see all the adjustments made to CHRW’s balance sheet here.

Valuation: we made $1.6 billion of adjustments with a net effect of decreasing shareholder value by $1.6 billion. There were no adjustments that increased shareholder value. Apart from total debt, which includes the operating leases noted above, the largest adjustment to shareholder value was $104 million in outstanding employee stock options. This adjustment represents 1% of CHRW’s market cap. See all adjustments to CHRW’s valuation here.

Most Dangerous Stocks Feature: Heska Corporation

Heska Corporation (HSKA) is the featured stock from December’s Most Dangerous Stocks Model Portfolio.

HSKA’s NOPAT has declined from $14 million in 2017 to just $4 million TTM, per Figure 2. HSKA’s NOPAT margin has fallen from 11% in 2017 to 3% TTM while ROIC fell from 13% to 3% over the same time.

...Read the Full Post On Seeking Alpha

Author Bio:

Twitter Account: NewConstructsSteem Account: @davidtrainer

Steem Account Status: Unclaimed

Are you David Trainer? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.