Summary

- A shrinking business leads to mounting losses.

- Owens-Illinois' poor performance continues despite the general bull market.

- Triangle as a reversal pattern broke lower.

- Looking for a helping hand in the market? Members of The Lead-Lag Report get exclusive ideas and guidance to navigate any climate. Get started today »

When things get really bad, just raise your glass and stamp your feet and do a little jig. That's about all you can do. - Leonard Cohen

Owens-Illinois (NYSE:OI) needs to do much more than that. While things got bad, the danger is they'll go from bad to worse.

When Michael Owens built the first automated bottle-making machine at the start of the 1900s, he revolutionized the industry. The successor of Owens Bottle Company founded in 1903, Owens-Illinois is one of the leading manufacturers of packaging products in the world, having a strong foothold in the glass industry.

It makes glass in over twenty countries around the world, creating distinctive packaging for brands part of our everyday life.

Its 24,000 square foot building at the global headquarters allows it to advance innovation more quickly by making the most of the two production lines used to trial new processes and designs before production en masse begins.

The last few years have not been kind to Owens-Illinois shareholders. While stock indices in the United States made all-time highs, Owens-Illinois struggled to stay alive. Peaking in 2008 right before the financial crisis, it never recovered ground in the decade that followed. If anything, the price formed a series of lower highs against a horizontal base - a bearish picture, especially because it took so long without any meaningful retracement.

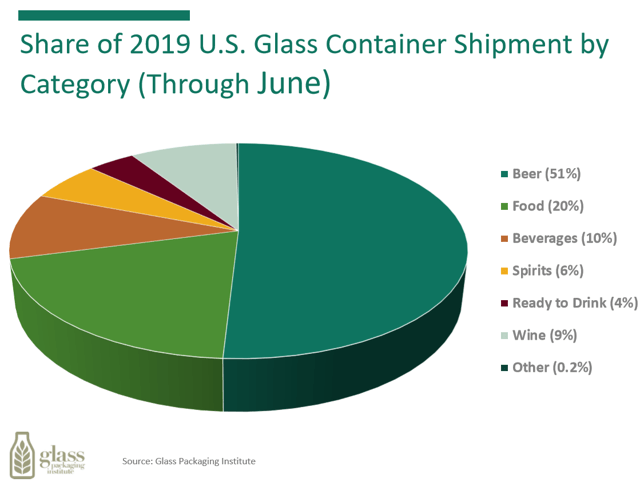

The company seems to be aligned with industry trends, having more than 1,800 active patents. A 2014 study conducted by Nielsen Global on Corporate Social Responsibility reveals that over half of consumers are willing to pay much more for goods and products made by socially and environmentally committed companies.

Glass serves this purpose - it is an ideal packaging choice for consumer's health, and producing it from recycled glass reduces air pollution by 20% and water pollution by 50%. Moreover, glass is 100% recyclable and can be recycled over and over again.

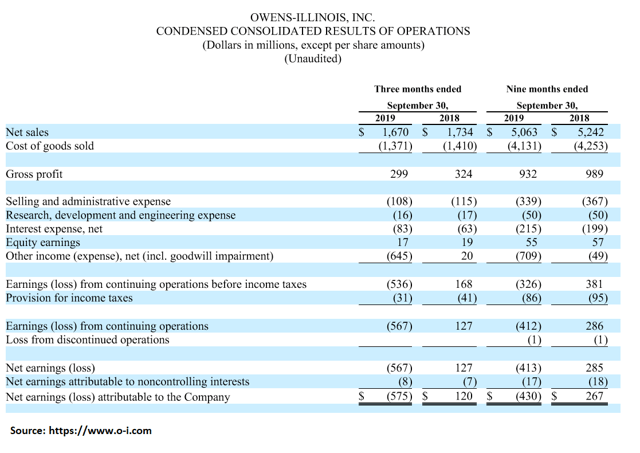

Yet, Owens-Illinois struggles. According to Q3 2019, it reported a net loss of $430 million at the nine months ended 2019 when compared with a profit of $267 million in a similar period the year before. Moreover, Q3 2019 net loss spells further troubles ahead.

Stiff competition from other global market players like Saint-Gobain (OTCPK:CODGF) [COD.L] or Corning (NYSE:GLW) makes it difficult to retain market share. Despite paying a dividend every three months, Owens' share price looks depressed when compared with Saint-Gobain, for instance, that recently formed an inverse head and shoulders - a bullish pattern.

...Read the Full Article On Michael A. Gayed's Blog on Seeking Alpha

Author Bio:

This article was written by Michael A. Gayed. An author on Seeking Alpha and founder of the Lead Lag Report.

Steem Account: @leadlagreport

Twitter Account: leadlagreport

Learn more about Michael A. Gayed on Seeking Alpha

Steem Account Status: Unclaimed

Are you Michael A. Gayed (a.k.a. leadlagreport)? If so, you have a Steem account that is unclaimed with pending cryptocurrency rewards sitting in it from your content. Your account was reserved by the Steemleo team and is receiving the rewards of all posts syndicated from your content on other sites.

If you want to claim this account and the rewards that it has been collecting, please contact the Steemleo team via twitter or discord to claim the account. You can also view the rewards currently sitting in the account by visiting the wallet page for this account.

What is Steemleo Content Syndication?

The Steemleo community is syndicating high-quality financial content from across the internet. We're also creating free Steem accounts for the authors of that content who have not yet discovered the Steem blockchain as a means to monetizing their content and we're listing those accounts as the 100% beneficiaries to all the rewards. If you want to learn more about Steemleo's content syndication strategy, click here.

This stock is a no touch with limited upside. However, if one is going to play in the sandbox, the levels to be aware of are in yellow.