BOSTON—Criminals are ramping up efforts to make artificial IDs at monetary establishments then commit fraud—as one Cu that recently suffered $200,000 in losses will attest.

Julie Conroy, director of research at Aite cluster, told CUToday.info there are ways that to handle this speedily rising crime.

Feature artificial ID

“Synthetic ID fraud has full-grown well over the past few years,” aforesaid Conroy. “And it’s solely visiting exacerbate.”

Conroy pointed to Aite cluster knowledge that shows that U.S. losses from artificial ID card fraud alone reached $820 million in 2017 and are projected to grow to $1.25 billion in 2020.

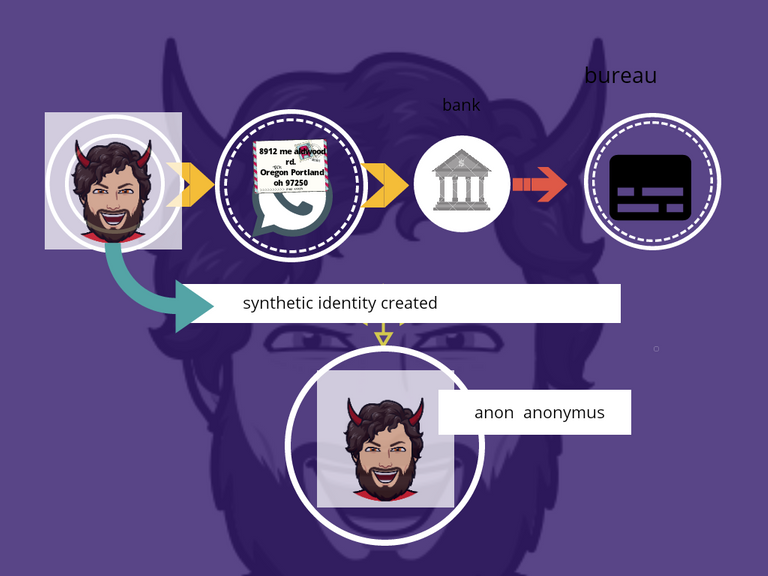

Synthetic fraud depends on making identities instead of stealing existing ones. artificial fraudsters obtain taken Social Security numbers or try and guess numbers not in use, then mix them with a sham identity. victimisation alternative people's real addresses, the crooks begin committing their crimes, like confiscating loans and failing to create a payment.

Conroy aforesaid she is tuned in to a depository financial institution that recently suffered $200,000 in losses in but 3 months from artificial ID fraud.

“The depository financial institution aforesaid these crooks passed all of their ID and verification checks and were asked dynamic, knowledge-based authentication queries,” she said. “They passed all of them with flying colours, as a result of they'd nurtured these identities.”

Years within the Works

Experts have explicit that fraudsters can pay years dependably paying the monthly bills on a mastercard tied to a false identity whereas observance credit limits tick higher. once the theme is ripe, the fraudsters charge everything to the handle, a part usually called “busting out.”

As CUToday.info has according, criminals are moving to new fraud ways and removed from stealing card knowledge as EMV makes it far more tough for thieves at the purpose of sale.

As consultants have any explicit , and Conroy agrees, all of the info breaches, like the Experian hack, have created the crime easier to commit because the results of huge amounts of in person identifiable info being avaialble on the dark net.

“In the past few years we've got seen this good storm ace that's driving the increase in artificial ID fraud,” Conroy aforesaid. “So several factors are operating in criminals’ favor. We’ve been during this steady economic recovery that's resulting in lenders loosening standards and creating it easier to urge credit and so easier to get an artificial ID through the door. we've got currently AN unexampled quantity of private knowledge on the dark net. And, in 2015, the Social Security Administration set to randomise the supplying of Social Security numbers, primarily removing one in all the tools in our arsenal to try to to some identity checking.”

Making it Easier for Crooks

Conroy, too, aforesaid that the increasing variety of economic establishments that are permitting members and customers to register electronically is creating it easier for crooks.

“We recently free a report that shows that the account application fraud rate is eight times higher with digital channels as a result of it's most easier to commit fraud this fashion,” she said.

Conroy aforesaid there's no solution for FIs to use in defensive against this sort of fraud. She aforesaid there are new scores being developed by the credit bureaus that facilitate assess the legitimacy of the identity provided by a replacement member and client.

Those new scores contemplate factors like however long the ID has been breathing, however long the e-mail address with the account has been functioning, if the identity was else for the primary time as a certified user of a mastercard, and also the sort and frequency of activity related to the ID.

“For example, did this person have AN abnormal rate of going out and obtaining a bunch of credit relationships at the identical time,” Conroy aforesaid.

Solutions obtainable, But…

Conroy noted that a lot of vendors are giving solutions to assist monetary establishments verify the identities of latest accounts, however advised that CUs search for a resource that doesn't need victimisation multiple vendors.

“That will be cumbersome and tough to manage, stitching along all of those completely different risk scores,” Conroy aforesaid. “We are seeing the emergence of identity authentication hubs which will be used for brand spanking new account onboarding.”

If the depository financial institution believes it's going to have noticed an artificial ID among its new accounts, Conroy aforesaid it ought to follow fastidiously developed procedures for remediating the potential downside.

“Remember, these are sometimes fastidiously nurtured artificial IDs,” Conroy aforesaid. “The dangerous guys will pass most of the quality authentication tools.

‘Be Careful’

She aforesaid that some FIs can begin to look at the activity on the account, closely observance to work out if the individual is behaving as a typical new client. Conroy aforesaid that others can begin asking the person for copies of utility bills and a lot of.

“But take care,” she cautioned. “You don’t need to lose a decent, legitimate member. If the person doesn't adjust to your requests, that’s not a transparent indication this can be an artificial ID or simply someone WHO doesn't need to leap through all those hoops.”

The recently passed economic process, regulative Relief and client Protection Act ought to offer FIs some help in fighting artificial IDs. below Section 215 of the new law, the Social Security Administration can must offer monetary establishments with AN electronic system to test the name and date of birth connected to a given Social Security variety. Results ought to be obtainable in twenty four hours.

“The devil are within the details here,” aforesaid Conroy. “How this can all take place, the timeframe…The Social Security Administration still needs to build the