-Pennsylvania-18_Jun_1764%20(1).jpg)

Early American currency went through several stages of development in colonial and post-Revolutionary history of the United States. Because few coins were minted in the thirteen colonies that became the United States in 1776, foreign coins like the Spanish dollar were widely circulated. Colonial governments sometimes issued paper money to facilitate economic activities. The British Parliament passed Currency Acts in 1751, 1764, and 1773 that regulated colonial paper money.

During the American Revolution, the colonies became independent states; freed from British monetary regulations, they issued paper money to pay for military expenses. The Continental Congress also issued paper money during the Revolution, known as Continental currency, to fund the war effort. Both state and Continental currency depreciated rapidly, becoming practically worthless by the end of the war. This depreciation was caused by the government having to over-print in order to meet the demands of war.

Colonial currency

There were three general types of money in the colonies of British America: specie (coins), paper money and commodity money. Commodity money was used when cash (coins and paper money) was scarce. Commodities such as tobacco, beaver skins, and wampum served as money at various times and places.

Cash in the colonies was denominated in pounds, shillings, and pence. The value varied from colony to colony; a Massachusetts pound, for example, was not equivalent to a Pennsylvania pound. All colonial pounds were of less value than the British pound sterling.The coins in circulation in the colonies were most often of Spanish and Portuguese origin. The prevalence of the Spanish dollar in the colonies led to the money of the United States being denominated in dollars rather than pounds.

One by one, colonies began to issue their own paper money to serve as a convenient medium of exchange. In 1690, the Province of Massachusetts Bay created "the first authorized paper money issued by any government in the Western World." This paper money was issued to pay for a military expedition during King William's War. Other colonies followed the example of Massachusetts Bay by issuing their own paper currency in subsequent military conflicts.

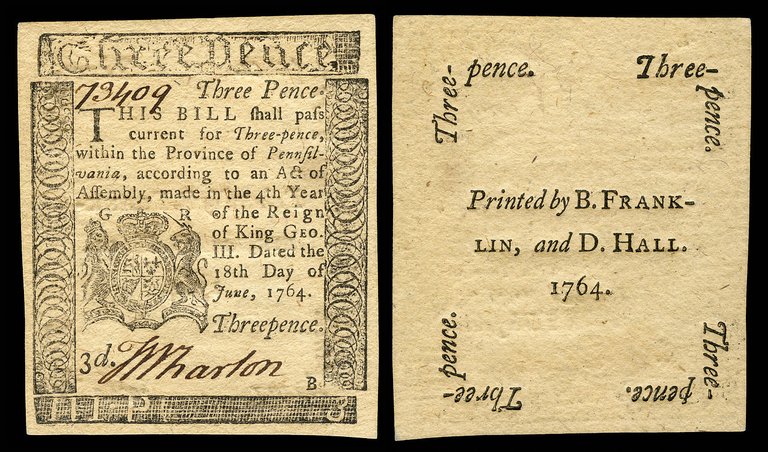

The paper bills issued by the colonies were known as "bills of credit." Bills of credit were usually fiat money: they could not be exchanged for a fixed amount of gold or silver coins upon demand. Bills of credit were usually issued by colonial governments to pay debts. The governments would then retire the currency by accepting the bills for payment of taxes. When colonial governments issued too many bills of credit or failed to tax them out of circulation, inflation resulted. This happened especially in New England and the southern colonies, which, unlike the Middle Colonies, were frequently at war.Pennsylvania, however, was responsible in not issuing too much currency and it remains a prime example in history as a successful government-managed monetary system. Pennsylvania's paper currency, secured by land, was said to have generally maintained its value against gold from 1723 until the Revolution broke out in 1775.

This depreciation of colonial currency was harmful to creditors in Great Britain when colonists paid their debts with money that had lost value. The British Parliament passed several Currency Acts to regulate the paper money issued by the colonies. The Currency Act of 1751 restricted the emission of paper money in New England. It allowed the existing bills to be used as legal tender for public debts (i.e. paying taxes), but disallowed their use for private debts (e.g. for paying merchants).[5] In 1776, British (Scot) economist Adam Smith criticized colonial bills of credit in his most famous work, The Wealth of Nations.

Another Currency Act, in 1764, extended the restrictions to the colonies south of New England. Unlike the earlier act, this act did not prohibit the colonies in question from issuing paper money but it forbade them to designate their currency as legal tender for public or private debts. That prohibition created tension between the colonies and the mother country and has sometimes been seen as a contributing factor in the coming of the American Revolution. After much lobbying, Parliament amended the act in 1773, permitting the colonies to issue paper currency as legal tender for public debts. Shortly thereafter, some colonies once again began issuing paper money. When the American Revolutionary War began in 1775, all of the rebel colonies, soon to be independent states, issued paper money to pay for military expenses.

Continental currency

Continental One Third Dollar Note (obverse)

A fifty-five dollar Continental issued in 1779.

After the American Revolutionary War began in 1775, the Continental Congress began issuing paper money known as Continental currency, or Continentals. Continental currency was denominated in dollars from $ 1⁄6 to $80, including many odd denominations in between. During the Revolution, Congress issued $241,552,780 in Continental currency.

Continental currency depreciated badly during the war, giving rise to the famous phrase "not worth a continental". A primary problem was that monetary policy was not coordinated between Congress and the states, which continued to issue bills of credit. "Some think that the rebel bills depreciated because people lost confidence in them or because they were not backed by tangible assets," writes financial historian Robert E. Wright. "Not so. There were simply too many of them."Congress and the states lacked the will or the means to retire the bills from circulation through taxation or the sale of bonds.

Another problem was that the British successfully waged economic warfare by counterfeiting Continentals on a large scale. Benjamin Franklin later wrote:

The artists they employed performed so well that immense quantities of these counterfeits which issued from the British government in New York, were circulated among the inhabitants of all the states, before the fraud was detected. This operated significantly in depreciating the whole mass.

By the end of 1778, Continentals retained from 1⁄5 to 1⁄7 of their face value. By 1780, the bills were worth 1⁄40 of their face value. Congress attempted to reform the currency by removing the old bills from circulation and issuing new ones, without success. By May 1781, Continentals had become so worthless that they ceased to circulate as money. Franklin noted that the depreciation of the currency had, in effect, acted as a tax to pay for the war.

For this reason, some Quakers, whose pacifism did not permit them to pay war taxes, also refused to use Continentals, and at least one Yearly Meeting formally forbade its members to use the notes. In the 1790s, after the ratification of the United States Constitution, Continentals could be exchanged for treasury bonds at 1% of face value.

After the collapse of Continental currency, Congress appointed Robert Morris to be Superintendent of Finance of the United States. Morris advocated the creation of the first financial institution chartered by the United States, the Bank of North America, in 1782. The bank was funded in part by specie loaned to the United States by France. Morris helped finance the final stages of the war by issuing notes in his name, backed by his own money. The Bank of North America also issued notes convertible into specie. Morris also presided over the creation of the first mint operated by the U.S. government, which struck the first coins of the United States, the Nova Constellatio patterns of 1783.

The painful experience of the runaway inflation and collapse of the Continental dollar prompted the delegates to the Constitutional Convention to include the gold and silver clause into the United States Constitution so that the individual states could not issue bills of credit or "make any Thing but gold and silver Coin a Tender in Payment of Debts." This restriction of bills of credit was extended to the Federal government, as the power to "emit bills" from the Articles of Confederation was abolished, leaving Congress with the power "to borrow money on credit.".