Index - https://steemit.com/tax/@alhofmeister/tax-blog-index

Introduction

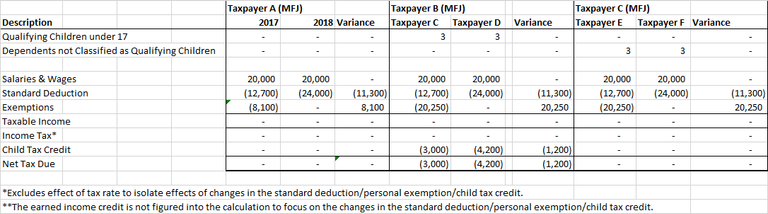

Over the next couple of articles, I hope to explore the impact of the of the new tax bill with a focus on the changes to the standard deduction, exemptions & the child tax credit. The purpose is to demonstrate the tax implications of the new bill on families of varying size and income. To increase the visibility of the impact, I will be ignoring the effects of the earned income tax credit, the change in tax rates (using 2017 rates), and measuring the impact on taxpayers filing married filing jointly.

Calculation

Conclusion

As shown above, taxpayers with qualifying children will benefit from the changes to the tax code. Taxpayers with dependents that aren't qualifying children and without dependents, however, will pay the same in taxes under the new tax plan.

Taxpayers with qualifying children will benefit from the increase in the refundable portion of the child tax credit. As none of the taxpayers make income in excess of the standard deduction (and personal exemptions in 2017), they will not be effected by the changes in the standard deduction/personal exemption.

Disclaimer

Any accounting, business or tax advice contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor is it sufficient to avoid tax-related penalties.

@OriginalWorks

@OriginalWorks

I really appreciate this post. Very easy to follow and you did a fantastic job explaining the tax bill. Looking forward to more content like this! Keep it up!

So the lower income and middle tax brackets in your examples are pretty much the same.

Good observation! Taxpayers with qualifying children benefit more from the tax cuts if they're in the middle income category based on the facts and circumstances as presented. What I'm missing in the calculation (to try and focus on the specific items detailed in the problem) is the earned income credit which could potentially compensate for the difference in tax benefit. I plan to write up a summary analysis tonight that compares the different situations.

Thanks!