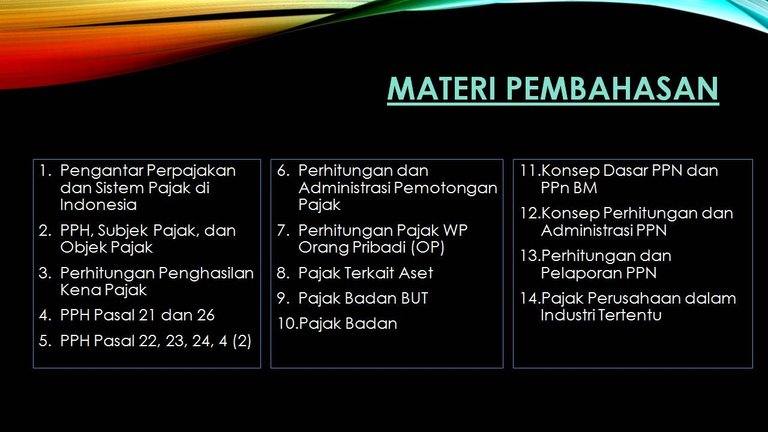

The subject of taxation taught to students for one semester is as follows:

Introducing taxes early becomes a bit of an answer to the low tax awareness in Indonesian society today. Tax which is basically a binding obligation to every citizen and has been legalized by the 1945 Constitution (UUD) was not fully obeyed by the public. As a result the very important tax role in development is not fully met.

Most people know the tax is only the obligation to pay to the government property / assets owned, without understanding the basics and intent and purpose of tax payments. This ignorance makes many people ignore and do not fulfill the obligation to pay taxes, which in turn leads them to have to deal with the law.

What is taxes, how tax laws and other things that are taxing are important. In addition to personal awareness, tax learning also provides many benefits to you because by learning tax then you will understand what is the true meaning of taxes, legal basis, tax functions, sanctions for offenders and all related to taxation. The benefits that can be derived from tax learning as follows:

It is expected that the teaching of taxation, so that students can calculate, manage and report the tax debt and to help others who need understanding of taxation.

It can help to provide an understanding of the applicable tax obligations in Indonesia and how to fulfill those obligations. In order not to break the tax law in Indonesia.

20 free ripples, bitcoin, etc plus 6% daily interests

Mannabase Universal Basic Income for Lifehttps://walletcoin.money/?a=jk 10 free coins daily free https://www.mannabase.com/?ref=efa053bae1