2017 has been a wild year for cryptocurrency. According to coinmarketcap.com, the total market cap has gone from about $18 billion on January 1 to close to $600 billion at the time of this writing. This has resulted in some massive gains for both the HODLers and Traders alike.

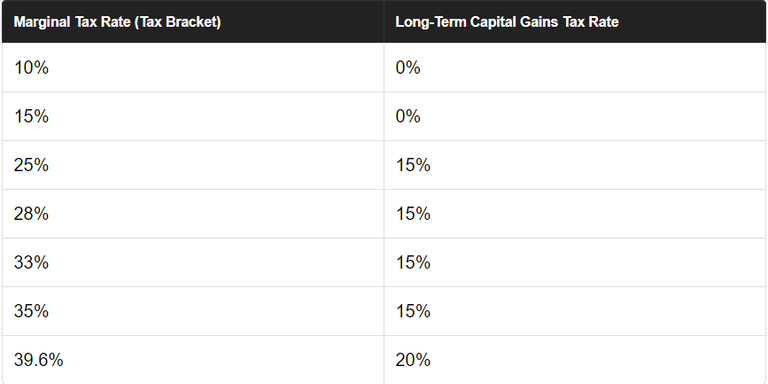

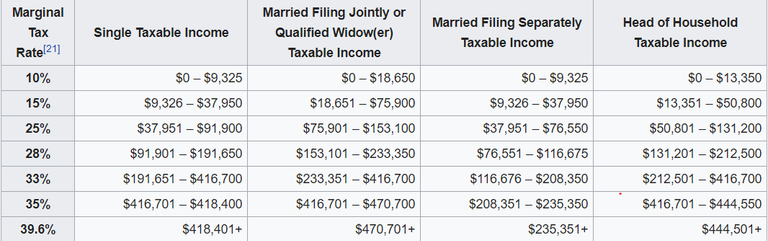

For the majority of investors, cryptocurrency sales and trades will result in either a capital gain or loss. We know by now that short-term (held less than one year) capital gains are taxed as ordinary income, while long-term capital gains are taxed at a more favorable rate determined by your tax bracket. Lets take a look at these tax brackets and what your long term capital gains rates would be. The following tables were taken from Wikipedia and the Motley Fool.

https://www.fool.com/retirement/2016/12/16/capital-gains-tax-rate-for-2017.aspx

Looking at the table above, it is quite possible to pay a 0% Federal tax rate on your crypto sales. For those sitting on large, unrealized, long term capital gains and looking to cash out, it is advisable to see your position on the tax bracket. At minimum, you will want to cash out to the point that you are still in the 15% bracket.

Source: https://en.wikipedia.org/wiki/Capital_gains_tax_in_the_United_States

HODLers

Let’s go over an example of someone sitting on $1 million worth of bitcoin they bought in 2015. They haven’t sold a single satoshi since purchasing and all the gain is still unrealized. With their new wealth, they quit their job to go travel and had no other income in 2017. Looking at the tables above, their first $37,950 in long term capital gains will not be taxed. Even better, they can still apply their standard deduction ($6,350) and personal exemption ($4,050) to offset more income, resulting in a total of $48,350 of gains at a 0% tax rate. For the next $376,400 (the personal exemption gets phased out at these levels) of long term capital gain, the tax rate will be at 15%.

Lets use the same $1 million for someone who earns $100,000 per year. They are in the 28% tax bracket and therefor their long term capital gains are already taxed at a 15% rate. Considering no other income and the basic standard deduction and personal exemption, they will have their next $324,750 at the 15% rate. Though there is no way to pay a 0% capital gains rate as in the first example, it may be worth saving the 5%.

It is also important to note the Net Investment Income Tax, which tacks on an additional 3.8% to certain investment income, such as capital gains. This begins at $200,000 for Single tax filers and $250,000 for Married Filing Joint tax filers. More information can be found here.

Traders

Even for those more on the trader side with short term capital gains rather than long term capital gains, it is important to see the other aspects of your personal income. Short term gains can be used to offset long term capital losses, if there are any. It also may make sense to realize gains and pay lesser taxes on income this year if you feel like you will have a much higher earning year in 2018. Additionally, if you are now swimming in crypto riches and will take 2018 off from work, it can be better to hold off on realizing some gains in 2017 so you can realize them in a lower marginal rate year like 2018.

In Conclusion

It is incredibly important to be aware of your current realize and unrealized gains, as well as to be aware of the tax treatment of both short term and long term gains. This awareness can help you plan for maximum tax savings for both the rest of 2017 and ensuing years as well.

The Crypto CPAs is the premiere tax accounting firm for cryptocurrency investors and is available to help you strategize and file your tax return. Please see our website, www.cryptocpas.com , to schedule a complimentary 15-minute strategy session.

tax is theft. end of story

Congratulations @cryptocpas! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP