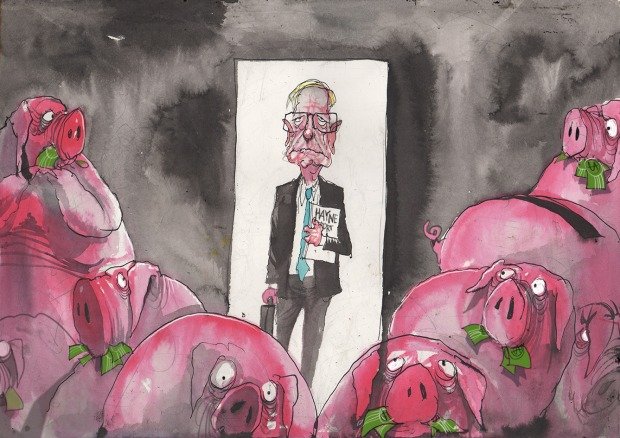

As a result of political pressure from The Greens, Nationals, and Labour, The Royal Comission into Misconduct in the Banking, Superannuation and Financial Services Industry was announced by the Turnbull Government on November 30, 2017. It was constituted only fourteen days later, with Justice Kenneth Hayne appointed as the sole commissioner.

Source: https://www.afr.com

Prior to the comission, there was already a culture of scepticism towards banks, specifically the 'Big 4' - Westpac, NAB, ANZ, and Commenwealth Bank - perhaps as a result of these banks charging hard working Aussies unfair fees and high interest rates. NAB being made to refund AU$67 million to their ill-informed MLC customers as a consequence for charging hidden fees, for instance, was only a taste of the corruption and misconduct that goes on in banking and superannuation sectors.

Profit Before People

Legislation is already in place to ensure banks lend money responsibly to potential clients. Before agreeing to cough up money, banks are suppose to confirm their client's incomes and living expenses. Hence, ensuring they aren't giving out mortgages or loans to people who cannot afford repayments... at least in theory.

Instead of following responsible lending guidelines, Hayne has uncovered that NAB, CBA, ANZ, and Westpac cease to confirm their borrowers' expenses 'more often than not'. Such a toxic culture of lending money has occurred for two main reasons. First, mortgages and loans create profits. Home loans were worth a staggering $1.6 trillion at the end of 2017, which is a substantial market for banks to get their hands on. Second are the incentives are commissions that banks offer to their staff. Such incentives have resulted in lenders cutting corners during the responsible lending process in an attempt to earn that sweet, sweet bonus.

Earlier in September, Westpac agreed to pay regulatory body, ASIC, $35 million dollars after accepting that their automated lending system breached responsible lending laws. Such a huge sum, the largest civil penalty ever awarded in-fact, was followed by Westpac establishing stricter lending criteria. Such a court case could be a hint of the many to come.

While Hayne doesn't recommend the legislation of more laws, he has hinted that there will be many more civil disputes to come.

'Passing a new law to say "don't do that again", would add an extra layer of legal complexity to an already complex regulatory regime. What would that gain?' Haynes wrote in his executive summary.

If lending entities face further legal ramifications for irresponsible lending due to the commission's findings, consumers will see even more restricted lending criteria. This may not be preferable for some younger Australians who already struggle to enter the competitive housing market.

At the lowest of lows

The banks don't just keep profits in mind while lending to customers. They think about their bonuses when attacking our hardworking farmers, or Indigenous Australians, too.

Watch: An emotional Westpac customer testify at the royal commission.

As a candid, intimidating Hayne grilled bank officials and staff in the witness box, he also took the opportunity to hear stories from victimised farmers. The result wasn't a pretty picture.

It was uncovered that ANZ don't hesitate to foreclose farms despite farmers offering negotiations, or in some astonishing cases being six months ahead in repayments. Instead, it was revealed that ANZ attack farmers with an unparalleled haste. For example, if a farmer was about to harvest a valuable crop that would otherwise lead to more loan payments, ANZ didn't hesitate to swoop in and take the farmland - along with a crop worth millions that they'd than sell. Moreover, there were stories told of ANZ threatening to make bankruptcy proceedings to farmers who had already had their land, livestock, and homes taken away by the banks. These threats went on for nearly four years, until they were dropped only a month before the royal comission hearings commenced.

In rural Northern Territory, there is an even more grotesque picture. It was revealed that the Aboriginal Community Benefit Fund (ACBF), a funeral plan provider that markets itself towards indigenous Australians in rural communities, was also targeting minors and misleading customers. This 'predatory' behaviour, as Haynes described it, has resulted in over a third of the fund's clientele being under the age of eighteen, despite claims that it doesn't target minors. Such unethical behaviour has made Haynes question if it should be legal to sell funeral insurance to minors.

Not Just The Banks

Disclaimer: Image for illustrative purposes only. Choosi are in no way associated with the examples above or below, nor is this a product endorsement. Source: Google.

Insurance and Superannuation companies were also revealed by the commission to be just as bad, if not worse than the banks. It was made apparent that insurance companies have no issues charging people who have been left homeless insurance fees, nor any remorse for charging deceased estates insurance and account fees.

Calm Before The Storm

The The Royal Comission into Misconduct in the Banking, Superannuation and Financial Services Industry's final findings will be delivered in November this year. The stones upturned by Haynes so far don't paint the end result in a positive light. Thus far, it is apparent that there is undoubtedly a negative culture of greed amongst out banking and insurance sectors in Australia. One can only hope that the publicity these ongoing issues have received will change banking culture in the future, and perhaps more importantly, bring justice for those who have been ill-informed, victimised, and ripped-off by the banking and insurance sectors in Australia.

For now, I can't help but ask myself two core questions: Will I ever own a house with increasing prices and even stricter lending criteria in the future? And which bank can be trusted? If not the big four, are the smaller ones like ING or Bankwest trustworthy? There is certainly a fog of uncertainty around our financial sectors that only further legal amendments will make clear.

If you've read this far, please let me know. I know this post is rather long-winded and perhaps dry to some people. It is an important issue that impacts us nonetheless. Please upvote, comment, and consider following me for more content. Thanks!

Sources

http://www.abc.net.au/news/2018-07-03/bank-royal-commission-funeral-insurance/9936696

We've known the bankers were scum for a long time now but it's good to see the indisputable proof coming to light.

Nice write-up. I see a few slaps on the wrist, a few scapegoats thrown under the bus and some tighter lending conditions in the short term before business as usual returns.

This is why we need crypto tech to succeed. Big centralised institutions invite big corruption. We need to put them out of business with decentralised and transparent alternatives that are competitive.

Notice how the worst corruption is in the most heavily regulated industries?

People assume corruption attracts regulation; but it's actually the opposite.

Regulation leads to something called, 'Regulatory capture' and gives the monolithic multinationals a clear playing field, without losing customers to hungry, young, innovative startups.

I wrote a piece on this two years ago which funnily enough identifies banking and insurance specifically.

Love a long post!

I've owned a couple of houses, and honestly I just can't see how it's financially better... even though interest rates are fairly low, you can still very easily end up paying double than the value of the house over 30 years. There's also rates, repairs, and I dunno, it just feels like you get hit with so many different bills during the purchasing stage and for the life of that investment. It honestly feels like anyone making money off people buying homes are the real people who are better off.

I've definitely had better luck with Bank of Melbourne/St George and ING, I had no idea ANZ was so awful! Jerks.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by jordan.white306 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.