Hello again friendly and knowledgeable Steemit community, this is Part 2, of Coinjar experience from a novice. There is a Part 1, here: https://steemit.com/teamaustralia/@truthdoesntpay/coinjar-experience-from-a-novice-part-1-setting-up-account-and-coinjar-swipe

Just a short one today. Australia-based, for those international readers.

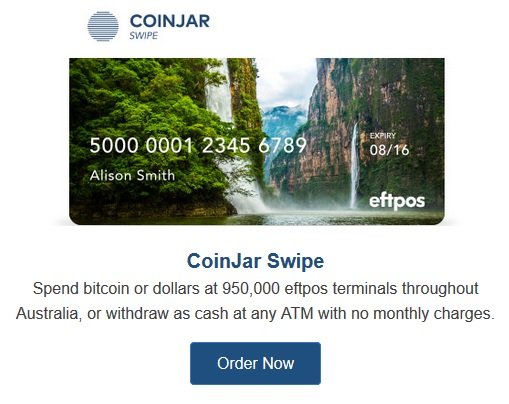

Today I successfully used the CoinJar Swipe EFTPOS card for the first time - to purchase groceries. You select 'Savings' at check-out, and enter your PIN that was mailed to you with the card. Earned 5 CoinJar Rewards points from the transaction, which I can see when I log in to the website. Sure enough, the transaction and updated balance is recorded once you log in at Coinjar.com, or by checking at an ATM (if it's not a rediATM you can avoid the $2.00 fee).

As Part 1 explains, the value on the card is stored in AUD, or your local currency, not BTC, so to actually benefit from increased purchasing power you need to first exchange AUD for BTC when BTC is trading low, and then top up the card when the value of BTC rises (more than the transaction fee of a flat 1% according to the website: www.coinjar.com.au). Then the value on the card is locked at a higher value of AUD than you started off with - spendable wherever there is EFTPOS immediately, or even withdrawn in cash at an ATM.

Comments welcome, stay tuned for Part 3 when I work out how to use the Hedge account, hopefully with a real life example.

Quick follow up re Coinjar rewards points, if anyone is considering using their service:

You earn 500 CoinJar Rewards points per every Bitcoin traded, so if you trade 0.5 BTC that would earn you 250 points.

You earn 5 Coinjar Rewards points for every purchase you make with the Coinjar Swipe card, regardless of the transaction amount.

I might make Part 3 into a successful example of buying BTC low and then loading up the card when it is trading high.

I surmise that the way to profit from BTC price movements is to use the above strategy in a bull market, and use the hedge account in a bear market - one would buy high, then hedge to avoid losses down the track. Actually being able to predict a bear market in BTC is of course very tricky, and might not happen for a long time, if ever (?)