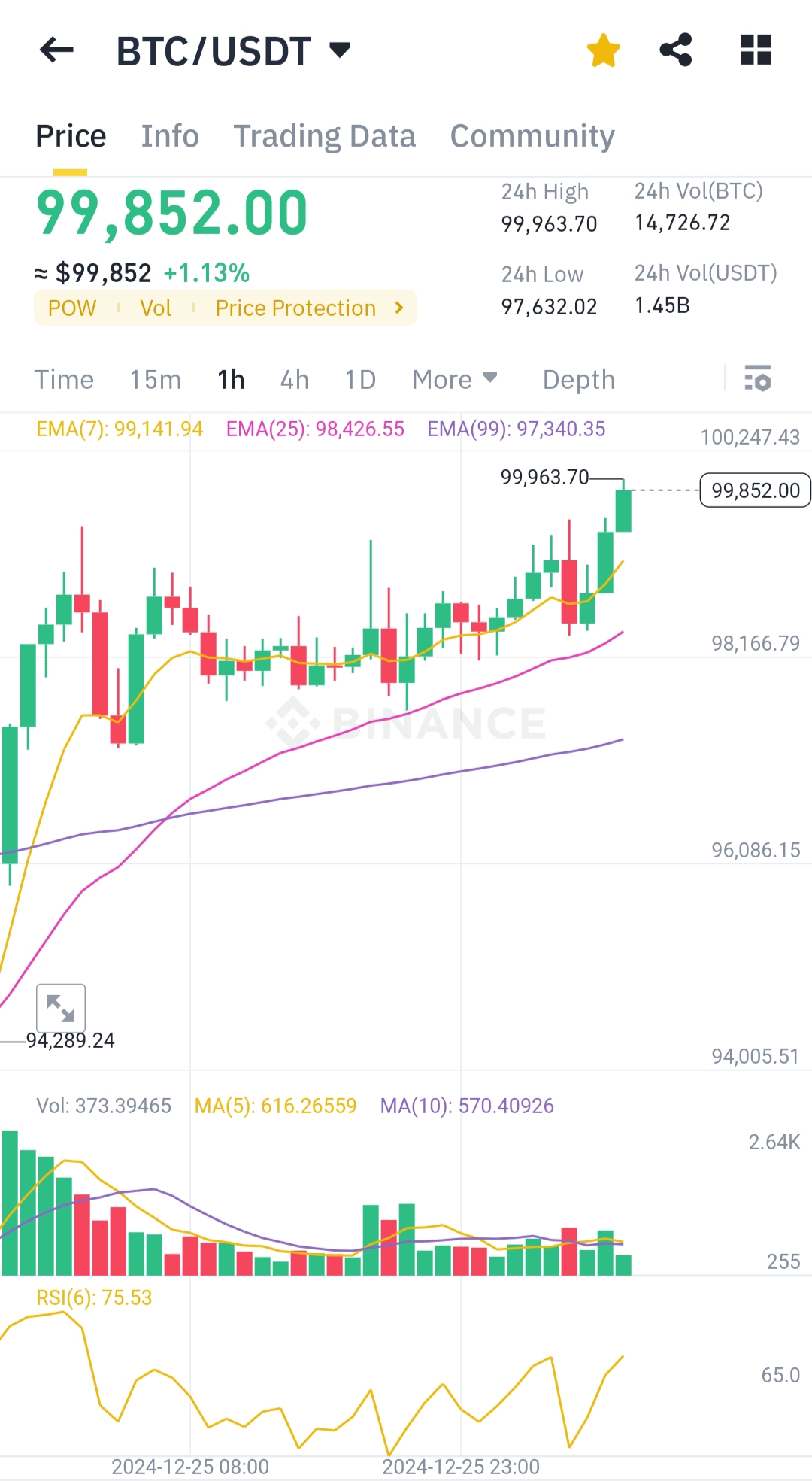

Yesterday there is a small pump in Bitcoin price and it is now almost back to $100,000. Is this the Santa rally we are waiting for? here is a detailed technical analysis for Bitcoin.

Technical Analysis

Current Price:

Bitcoin is trading at $99,852, which is close to the 24-hour high of $99,963.70. This indicates strong bullish momentum.Exponential Moving Averages (EMA):

- EMA(7): $99,141.94 (Yellow Line)

The short-term EMA is below the current price, confirming a bullish trend. - EMA(25): $98,426.55 (Pink Line)

The medium-term EMA is also below the current price, supporting bullish sentiment. - EMA(99): $97,340.35 (Purple Line)

The long-term EMA is acting as a strong support zone, showing the overall trend is upward.

The alignment of these EMAs in ascending order (short-term > medium-term > long-term) is a classic sign of bullish momentum.

- EMA(7): $99,141.94 (Yellow Line)

RSI (Relative Strength Index):

- The RSI value is 75.53, which is in the overbought territory (above 70). This suggests Bitcoin may experience some profit-taking or a minor pullback in the short term. However, overbought conditions in strong uptrends often persist.

Volume Analysis:

- The volume bars show a recent increase in green bars, reflecting higher buying pressure. This supports the upward movement.

Support and Resistance Levels:

- Immediate Support: $98,166.79 (near recent consolidation).

- Key Resistance: $100,247.43 (psychological level and recent high).

A breakout above $100,247 could push Bitcoin into uncharted territory, potentially attracting more momentum buyers.

Christmas Rally Context

The "Christmas rally" or "Santa Claus rally" refers to the tendency of financial markets, including cryptocurrencies, to experience a surge during the last week of December and early January. Reasons include:

- Optimistic investor sentiment heading into the new year.

- Reduced trading activity, leading to lower liquidity and exaggerated price movements.

- Year-end tax considerations influencing investor behavior.

Bitcoin seems to be benefiting from such a rally, as evidenced by its strong upward movement during this period.

You received an upvote of 15% from Precious the Silver Mermaid!

Thank you for contributing more great content to the #SilverGoldStackers tag.

You have created a Precious Gem!