Technical Analysis:

Trend Overview:

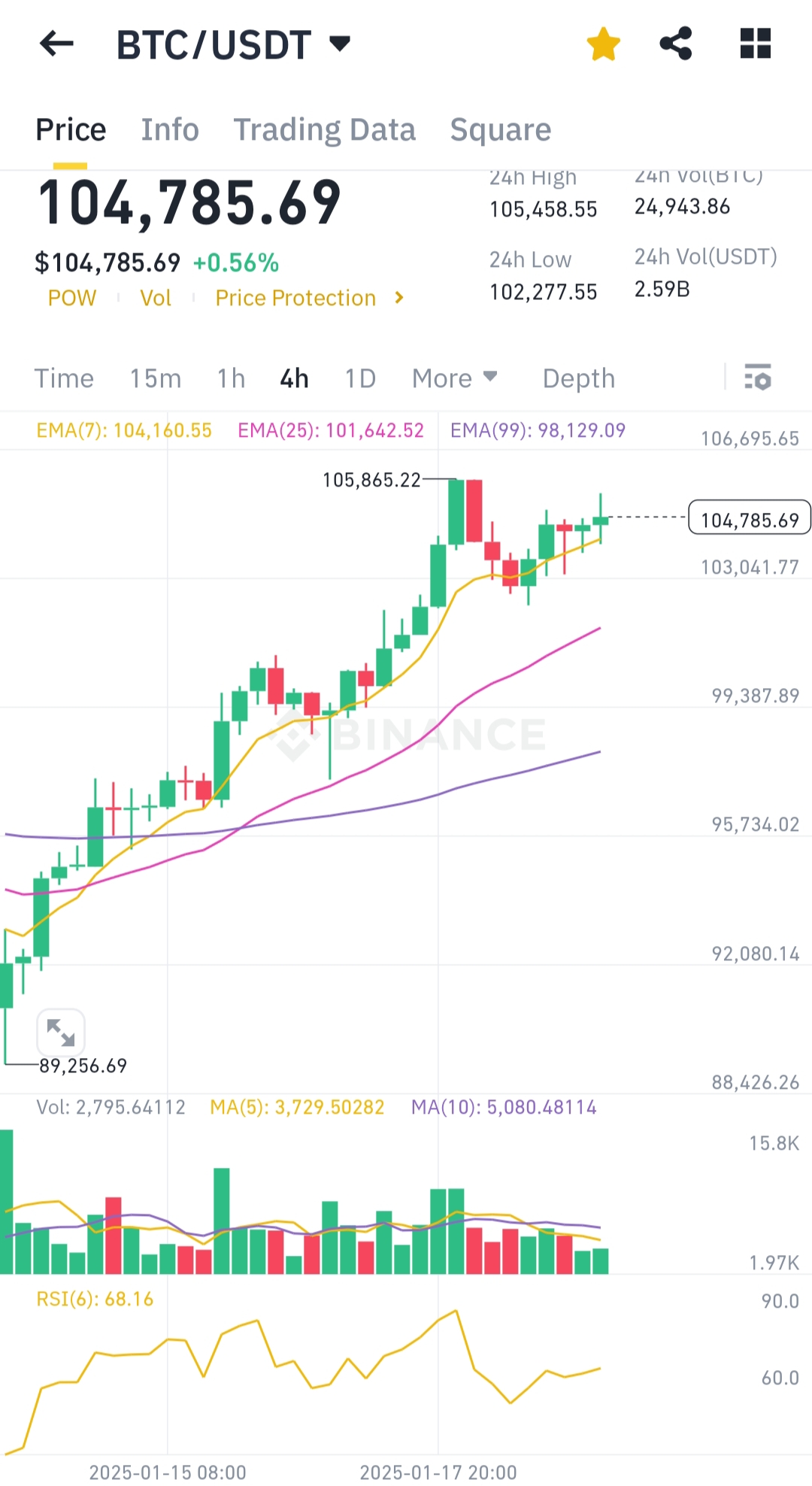

- Bitcoin is in a clear uptrend, as evidenced by the higher highs and higher lows on the 4-hour chart.

- The price is trading above the EMA (7), EMA (25), and EMA (99), indicating strong bullish momentum.

- The 24-hour high of $105,458 and low of $102,277 show an active trading range with potential for breakout.

Key Indicators:

- RSI (6): Currently at 68.16, nearing overbought levels but not yet signaling exhaustion. It implies continued upward momentum.

- Volume: Slightly declining, suggesting that further bullish action may require a surge in volume to break the $106,000 resistance.

- Moving Averages (MA5 & MA10): The MA (5) and MA (10) on volume indicate steady accumulation with room for increased buying pressure.

Support and Resistance Levels:

- Immediate support is near $104,160 (EMA 7) and $103,041 (recent consolidation zone).

- Key resistance lies at $105,865 (recent high) and $106,695 (psychological resistance).

Potential Impact of Trump's Inauguration:

With Donald Trump's inauguration happening within 24 hours, markets might react to his policies and statements, potentially injecting volatility. Historically, major political events can drive speculative buying in Bitcoin due to its status as a decentralized asset.

Conclusion:

Bitcoin maintains bullish momentum and is poised to test higher resistance levels. Watch for increased volume and potential reactions to Trump's inauguration, which could catalyze a significant price pump. Stay alert for a breakout beyond $106,000.