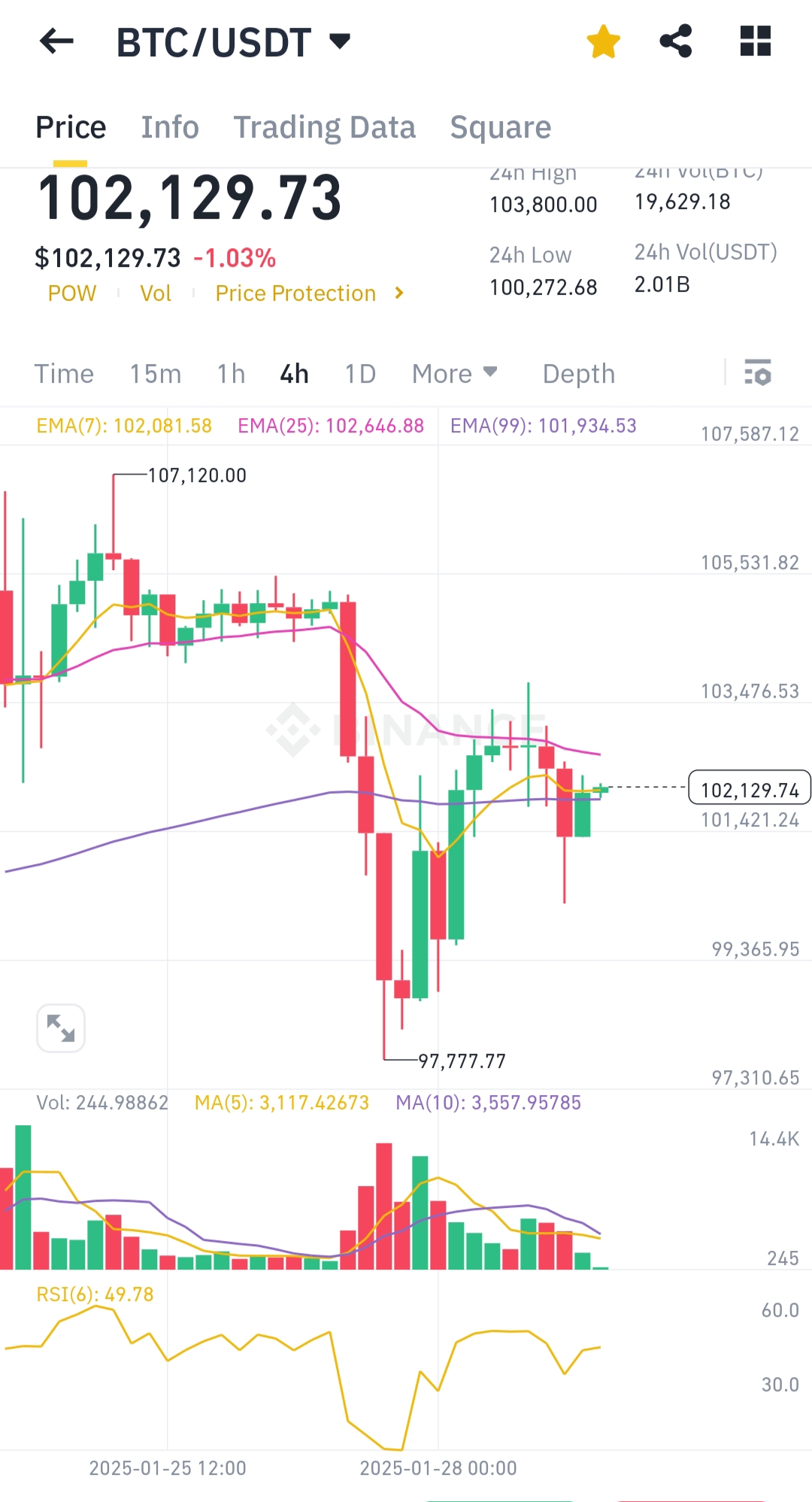

Technical Analysis:

- Price Action: Bitcoin is trading at $102,129.73, showing a minor decline of -1.03%. Recent support was observed at $97,777.77, while resistance is near $107,120.

- EMA Indicators:

- EMA(7): $102,081.58 (short-term).

- EMA(25): $102,646.88 (mid-term).

- EMA(99): $101,934.53 (long-term).

The price is oscillating near the EMA(99), indicating indecision, with potential for consolidation before a breakout.

- Volume: Declining volume suggests weakening momentum, which may lead to a sideways trend in the short term.

- RSI(6): Currently at 49.78, signaling neutral momentum and no clear overbought or oversold conditions.

Recovery After Chinese New Year:

Historically, Bitcoin has often shown signs of recovery and bullish momentum approximately 2-4 weeks after Chinese New Year due to increased market activity and renewed liquidity.

Conclusion:

Bitcoin is in a consolidation phase, and key levels ($97,777 and $107,120) will determine its next move. Watch for post-CNY sentiment shifts to potentially fuel recovery.