Fintech is a company that combines a core competency in finance and an integrated technological solution as the core of their business model.

They can take the form of online payment platforms, participatory financing platforms, trading and currency trading, factoring, account aggregator, financial services sales force, savings management, etc.

The French fintech must catch up on the train

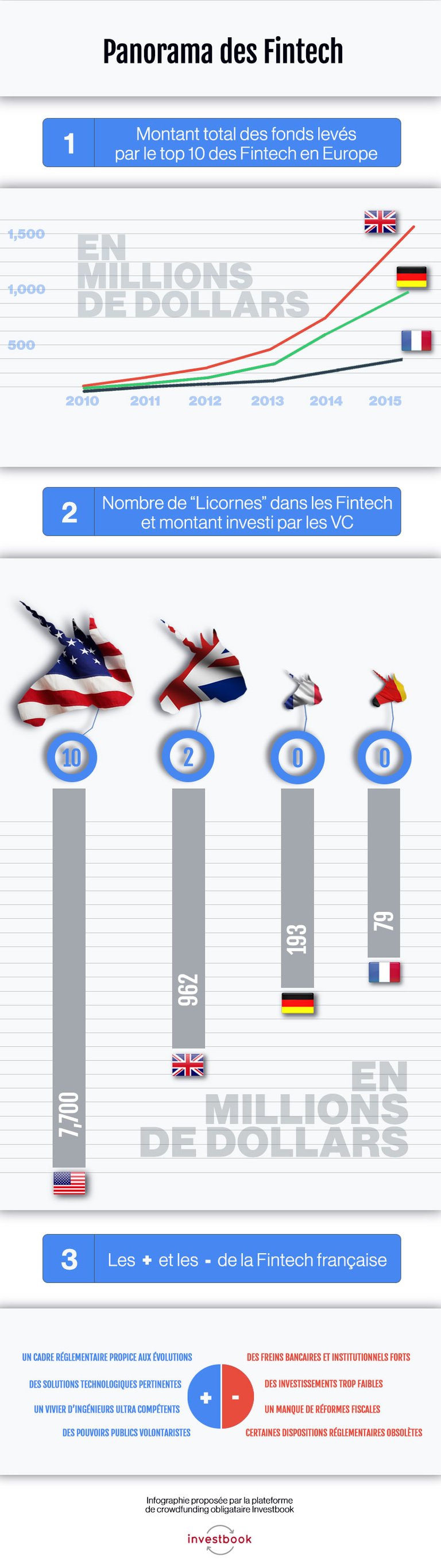

It is noted that the French fintech are lagging behind their European neighbors in terms of raising funds. So it becomes interesting to compare the amounts raised by the top 10 fintech of each country:

The United Kingdom, spearhead of the European fintech

By 2015, the top 10 English fintech have raised almost $ 1.5 billion. The British market is the mastodon of the European fintech. The English fintech knowledge an exponential growth, in the process of fighting the American fintech. London often appears as the world capital of Fintech, as both project promoters and investors are present on the market.

However, the battle is fierce to become the fintech European dolphin of the English. In this game, it seems that the German fintech take over on their French neighbors: the top 10 German fintech have raised 1 billion when the top 10 French fintech have, for their part, raised less than 250 million dollars .

The fintech American undisputed champions of the "Unicorns"

Unicorns are those startups that have a valuation above $ 1 billion on their tenth anniversary.

In the United States, Venture Capital invested more than $ 7 billion in fintech. It is no coincidence that there are ten fintech American companies whose valuation is more than 1 billion dollars. In fact, the world's youngest billionaire entrepreneur, Patrick Collison, 26, is the founder of the US mobile payment platform Stripe.

In the United Kingdom, Venture Capital has invested less than one billion and the Kingdom has 2 unicorns (TransferWise and Funding Circle).

In Germany and France, it is less than $ 193 million and $ 80 million respectively invested by Venture Capital. The two countries have no fintech whose valuation exceeds one billion dollars.

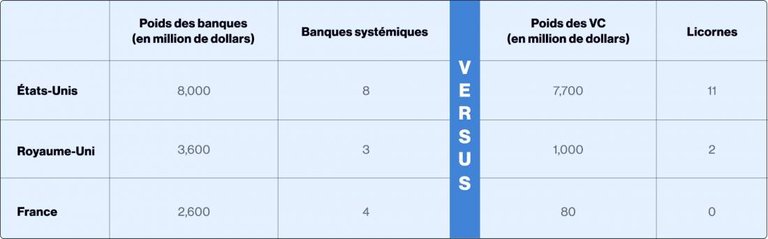

It is then interesting to compare the weight of fintechs in the traditional financial landscape. By 2015 in the United States, banks have lent more than $ 8 billion to the corporate private sector and there are at least 8 systemic banks (vs. $ 7.7 billion injected by Venture Capital for 11 Unicorns).

It is almost 4 billion dollars in the United Kingdom for 3 systemic banks and 2.6 billion in France for 4 systemic banks:

What advantages for French fintech?

We note that the disproportion between the weight of fintech in France and that of traditional banking players is abysmal, and that the mutation of the French financial landscape has not yet begun.

But what are the strengths of fintech in France and why these startups are still only start-ups? Why are they so marginalized and still so weakly implanted in the traditional financial landscape?

The main strengths of fintech are their added value in terms of speed of execution and ease of use. All this for a measured cost and an increasingly customer-oriented service offering a simple, efficient and pragmatic service.

But fintech in France lacked means. Their commercial scope is still weak, when traditional actors occupy the field of advertising, communication and media coverage. As a result, fintech can not compete for the time being, often limited to early adopter customers or to a segment of the population that is over-informed about new technologies and new consumption patterns, or a population that crosses the market Not and turns to the fintech by exasperation of the classical actors who no longer offer offers corresponding to their expectations and their way of life.

Fintech in France therefore has many arguments to make: a pool of highly competent engineers, relevant technological solutions and meeting the needs, whether for individuals or companies, a regulatory framework conducive to developments, such as Including the end of the banking monopoly introduced at the end of 2014, when crowdfunding platforms were able to offer loans to companies or individuals. To all this, we can add voluntarist public authorities, who want to make France a leading country of fintech. However, the institutional and banking constraints are strong, fiscal and market-specific reforms are still non-existent and some regulatory provisions are still obsolete for the new trades of fintech. All these elements make France a mastodon that is difficult to move, slow in its mutation and its propensity to accept change, when the United States and the United Kingdom are already 3 years ahead of us.

So fintech and banking actors build partnerships, but at a level that is still too timid. The French financial institutions' own being to get into the car when the train has already passed, while the Anglo-Saxons do not hesitate to jump on the train before it even started.

In the French financial landscape, the weight of classical Fintech will increase without a doubt, but at a slow pace, as certain actors realize that their traditional activity no longer offers growth, or that it is declining. It is then that many historical actors will think about accelerating the timid partnerships they have already committed, but without being mistaken, by taking some time to decide strategic orientations and integrations. Meanwhile, will the American and British players of fintech and the classic bank have already optimized their relationship? By avoiding past mistakes, reorientations with agility and speed, they will not have merged, with a maturity that will allow them to attack the European market in a calm manner like Google, Amazon, Facebook & Co , And other giants so powerful that any initiative to compete with them would be a failure announced? It is no longer a question of "too big to fail" but of "speed to lead".

Finally, here is a computer graphic that will summarize the discrepancies between the fintech countries quoted in the article:

To be honest I

m having a great startup idea I want to share with you guys, beacuse anyway, I wont be able to do it on my own. I had a plan to build and Crypto Currency Derivatives exchange platform, where people can trade options, swaps, futures based on the underlying derivative. I think its a natural step in evolution of the cryptocurrencies marker. Please share ypur thought on this, the future is now :)Nice idea hope that a whale show your post

Thanks, I`ve made a separate post about it just a while ago. Maybe someone wi UPWHALE this :) https://steemit.com/cryptocurrencies/@bolgan/cryptocurrency-based-derivatives-exchange-platform

How many such derivatives exist now? Algorithmic trading would be nxt step.

Useful compare of countries.

Unicorns everywhere