Decades back, the only way to do transactions was by going through the bank. You had to wait in line, fill out checks, and do a lot of boring stuff. But times have changed with the advent of the Automated Teller Machines (ATMs).

ATMs have become an indispensable part of our banking infrastructure. But how well do we understand the workings of these machines that dispense cash at the push of a button? In this article, we will delve into the evolution, technology, security, and global usage trends of ATMs.

The Evolution of ATMs: A Brief Historical Overview

The world’s first ATM was installed in 1967 at a Barclays branch in Enfield, London. This revolutionary machine was developed by John Shepherd-Barron. When Barclays tested the first ATM, direct cash withdrawals were limited to £10 per transaction which was equivalent to around $140 today.

Initially, ATMs faced skepticism and were seen as a threat to bank tellers' jobs. However, within a few years, ATM technology had improved and banks realized the vast potential advantages of automated cash distribution services. Chemical Bank installed the first ATM in the US in 1969 at Rockville Center, New York.

It was a tremendous success as customers embraced the convenience and novelty of self-service banking. By 1971, there were just a few hundred ATMs globally. However, technological improvements in security, electronic fund transfers, and networking accelerated ATM growth through the 1970s and 80s.

The introduction of interbank networks like STAR, NYCE, and PULSE allowed ATMs to connect to multiple banks over shared data switches. This meant customers could access their accounts from any affiliated ATM, not just their own bank's machines. The number of ATMs in the US swelled to over 100,000 by the 1990s.

As per ATM Industry Association statistics, today there are over 3.5 million ATMs deployed worldwide as of 2019. Developing economies like China, India, and Brazil are rapidly deploying ATMs to improve financial access. The average number of ATM withdrawals per month per cardholder has grown from around 4 in the 1990s to over 8 currently. The ATM has well and truly gone mainstream.

In Pennsylvania alone, the presence of Bitcoin ATMs has become notable, with numerous machines offering easy access to the cryptocurrency. This trend is reflective of the broader adoption of Bitcoin ATMs worldwide, as digital currencies continue to shape the landscape of financial transactions.

For those looking to buy Bitcoin or find where to purchase it locally, searching for “Bitcoin withdrawal ATM near me” and Bitcoin ATM locators can help. Websites and apps allow searching for nearby crypto ATMs by location, beginning to replace traditional cash ATMs.

The Inner Workings: From Card Insertion to Cash Dispensation

While an ATM might seem simple from a customer’s perspective, the mechanics behind it are highly complex. Here’s what happens when you walk up and use an ATM:

Card Reading and PIN Verification

The first step is card insertion into the ATM card reader slot and entering your unique Personal Identification Number (PIN) on the keypad. The card can either have a magnetic stripe or an EMV chip. EMV chip cards have reduced global card fraud by over 80% as of 2020 compared to traditional magnetic stripe cards.

The embedded microchip provides enhanced encryption and security. Your PIN is encrypted before transmission to the bank to prevent any security breaches. The ATM will retain your card during the transaction if the machine is designed for card retention as an added security measure.

Communication with Bank Networks

Once the ATM reads your card, it connects to an ATM network—like NYCE, PULSE, STAR, or Maestro—that interfaces with your bank using secure data lines. In the US alone, major ATM networks process billions of ATM transactions every year.

When you insert or tap your card, the ATM network routes your request to your bank. Your bank verifies the validity of your card, whether your account is active, account balance availability, and other security details related to your account.

For example, in bustling cities like Philadelphia, Pennsylvania, this intricate communication system ensures seamless ATM transactions, contributing to the convenience of millions of users.

Cash Disbursement

Upon successful verification, your bank approves the transaction amount requested by you. The ATM then dispenses cash from its built-in currency cassettes. The average global ATM holds around 2000-2500 bills of various denominations from $1 to $100.

ATMs utilize advanced sensors including optical, magnetic, and mechanical fit recognition systems to identify each bill and authenticate security features. These features ensure it dispenses the correct denomination. Counting errors by ATMs are extremely rare, occurring in only 1 in 10,000 transactions.

Imagine you're in a busy city like Pittsburgh, PA. If you don't have enough money in your account, or there's a problem, the ATM will tell you it can't give you cash and give your card back. These newer ATMs also let you stop the transaction if needed, making things go smoothly and quickly.

Integration of Modern Technology

Beyond replicating basic bank teller functions, modern ATMs also allow customers an enhanced user experience through the integration of the latest technological innovations:

Touchscreen interfaces: Over 50% of ATMs will offer touchscreen capabilities by 2021 compared to just button-based interfaces in older machines. Touchscreens provide more intuitive and user-friendly navigation of ATM functions.

Digital integration: Around 40% of US ATMs allow cardless cash withdrawals by simply scanning a QR code from your banking app. This tight digital and physical integration provides added convenience.

As ATMs transformed from isolated cash dispensers into interconnected banking hubs, technology played a pivotal role in enhancing utility, security, and convenience for millions worldwide. This technological revolution isn't limited to banking; it extends to various aspects of life, even impacting iconic locations like Pennsylvania's Liberty Bell.

Here, modern technology, including digital guides and interactive displays, enriches the visitor experience, paralleling the evolution of ATMs. Technology consistently reshapes and enhances our interactions with the world.

The Safety and Security Protocols

While mechanical errors or counting inaccuracies in ATMs are increasingly rare, external threats such as fraud, vandalism, and theft persist. Let's examine some of the robust security measures surrounding ATMs to counter these risks:

Hardware Security

Thanks to anti-skimming technology that prevents card cloning, skimming fraud was reduced by 10% globally in 2019. However, threats like shimming and card trapping still persist. Continuous hardware innovations are crucial.

Software Security

In the world of ATMs, approximately 15% of global machines still rely on outdated software, which presents a significant security risk. To safeguard against hacking and data theft, regular software updates and robust data encryption measures are imperative. Even in remote Pennsylvania locations, such as Scranton, ensuring that ATMs receive these essential updates remains crucial to maintaining the security of financial transactions.

Physical Security

ATMs in convenience stores, which are not operated by banks, face a risk of vandalism that's over three times higher than bank-operated ATMs. Robust physical security protocols including surveillance, alarms, location selection, and timely maintenance help mitigate risks.

Global ATM Usage Trends

ATM usage and features vary across the world based on region-specific needs and banking behaviors. For instance, while over 80% of ATMs in the US are free to use for customers of affiliated banks, countries like the UK charge rent for even basic transactions.

Developing economies are rapidly expanding ATM fleets to improve access to banking. Biometric ATMs are gaining popularity in Asian markets. Understanding global trends provides insights into the future of ATM banking worldwide.

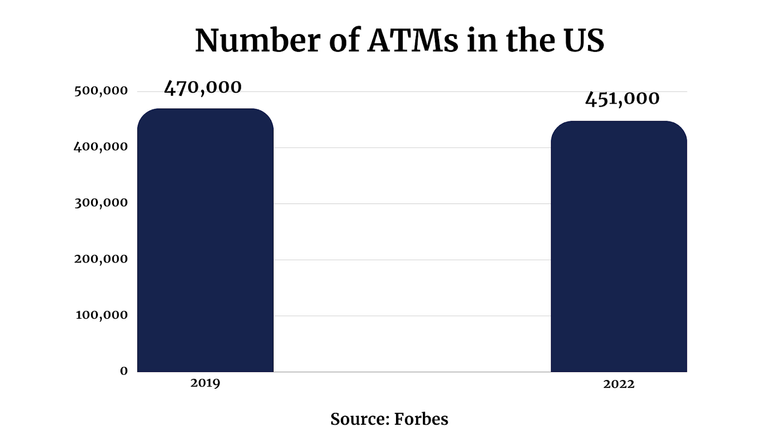

However, the number of ATMs in the US has declined over the past few years. The below chart shows the number of ATMs in the US in 2019 - 2022.

However, it's worth noting that the number of ATMs in the United States has been declining in recent years. This change is mostly attributed to the emergence of Crypto ATMs, a trend that has impacted the U.S. more than other regions. Interestingly, this trend extends to well-established financial centers like Pennsylvania, where the interest in and trust of digital currencies are on the rise.

In summary, while the fundamental purpose of ATMs remains the same, these achines are continually evolving in terms of technology, security, convenience, and utility on a global scale. From their humble beginnings as mechanical cash dispensers, ATMs have now evolved to offer swift, smart, and secure banking solutions for billions of people worldwide.

Conclusion

ATMs have come a long way from the first cash-dispensing machines. As banking evolves from physical to digital realms, ATMs continue bridging the gap between cash and electronic transactions by merging technology, security, and accessibility. So the next time a child asks you about ATMs, don't be caught off guard; share with them the story of Automated Teller Machines.

Frequently Asked Questions about ATMs

How do ATMs detect fake currency?

ATMs use UV light, magnets, patterns, and micro-printing to check each bill is real. This makes counterfeiting nearly impossible.

Why do some ATMs keep your card while others don't?

Some ATMs keep cards briefly to finalize transactions. But most now let you remove cards quickly for convenience.

Do bank ATMs have better security than standalone ATMs?

Bank ATMs have better security, like upgraded software and anti-skimming devices. Standalone ATMs are more prone to tampering.