The world is in panic mode, stocks are falling, the financial reset is said to be apon us. This is an obvious red flag to be aware of when playing with stock for profit, some companies will survive the turmoil and where these companies can crawl through the cracks of repression is where there is a once in a lifetime opportunity to secure the bag.

The Covid has made international travel near impossible, large scale redundancy and unemployment has destroyed many industries (my own being one of the first to go) with the air travel industry also being one of the more obviously heavier hit targets.

So why do I think Qantas Airlines will survive?

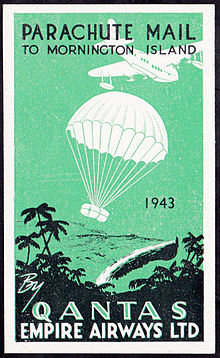

Qantas is an Australian icon founded in 1920, steeped in history from assisting in the world wars to working alongside Australian Government to deliver mail. In 2020 it is seen to be the leading airlines and a preferred choice for business' with an affinity to Australian culture, tho the company is now majority owned by international interests it is and always will be an Australian owned company with our government never too far away if things go sour.

With a most recent low in price in 2011 at around 0.90c, and a recent drop in price in 2020 (8 dollars dropped to 3 dollars) there are some interesting points of value to be aware of.

The image above is the monthly chart showing some continuing pressure to the downside, while the opportunity to find value is great, the risk to reward though may be skewed as this worldwide pandemic we are currently involved in is proving to be highly disruptive.

But like I said. Qantas is like the currently enforced social distancing and home isolation policy . Not going anywhere anytime soon.

The image above shows a more magnified look to the drop to the downside, using the TD Sequential indicator along side the relative strength index. These indicators show the movements to the downside as the market flows and is currently having a go at gaining some new momentum to the upside. The upside momentum is something to be careful with as it may be too soon to climb out of any Covid induced industrial disaster but the next few days should show some more information as to the next push of direction hopefully, even with the potential to break out of any negative pricing that is currently happening the bigger picture and the social climate point to a difficult next period.

The world is only in its first few weeks of really dealing with this pandemic, this pandemic and its resonance could last months but once the world is back on its feet again people will feel more comfortable traveling for leisure, and money will hopefully flow back into these industries that have been left anemic, I do think first we need to push and pull to find out what price valuation is strongest before deciding where we are going to end up.

If I was buying stock would I jump into buying Qantas right now? I don't think so. The opportunity to wait and watch is available and probably the safest option right now, but considering the points of value that can be identified and the financial climate, Qantas looks like a good pick for future prosperity.

images sourced from wikipedia including - https://commons.wikimedia.org/wiki/User:RuthAS

Oh, and please be aware these opinions are just the ramblings of an at home chart analyst and in no way financial advice!