Hello Everyone!

In this issue I’ll be walking you through the “‘Retail Apocalypse” that we’re going through, what retailers are doing to quickly adapt to the changing retail landscape, and startups that can help deliver a better customer experience as well as drive sales. I was going to include my thoughts on the future of retail, however it ended up making this issue rather long. So instead, the future of retail will be its own issue in 2018.

Questions I’m going to answer for you:

- How bad of shape is retail in right now?

- What are retailers doing to get customers back into stores?

- Why are retailers jumping into the subscription service business model?

How bad of shape is retail in right now?

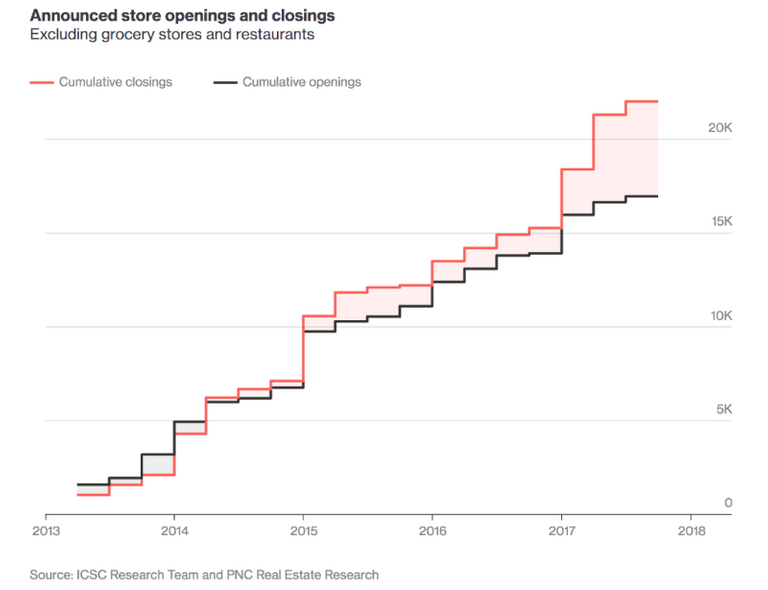

I once tried to karaoke “Come on Eileen” after a few drinks at a bar, and immediately was gonged and told to get off the stage…bad, I know. The current state of retail looks much worse than I did that day. This year alone, nineteen retailers have filed for bankruptcy protection, closing over 5,000 stores and according to RetailDive, twelve others can go bust over the next year.

There are a few reasons why retailers are in this position:

- The rise in online commerce, in other words Amazon.

- The lack of innovation around the in-store and customer experience.

- The change in Millennial and Gen Z shopping behavior.

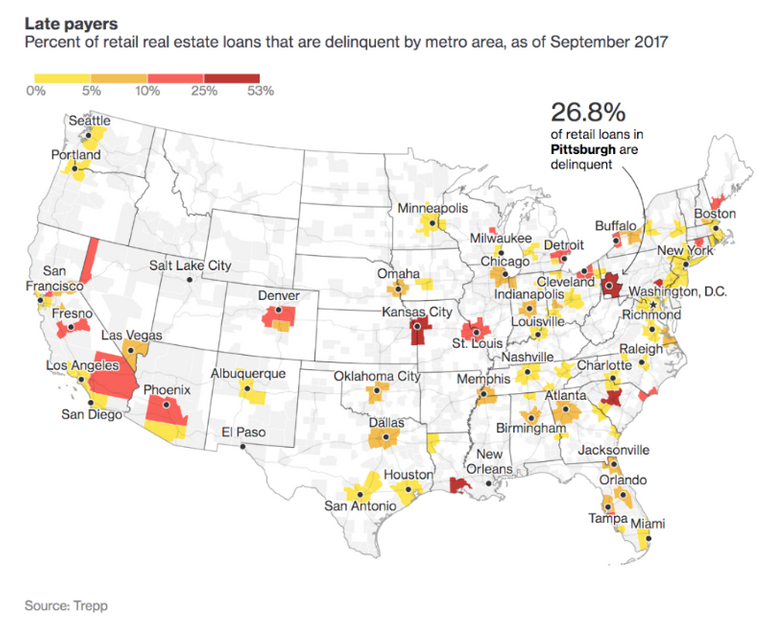

- And most importantly, the fact that retailers have been focused on store expansion, which led to a crazy amount of debt.

And just like a shopaholic that opened an unnecessary number of lines of credit, most retailers have done the same and do not have the funds to pay the debt. There are billions in borrowings on their balance sheet and sustaining that load has hit a breaking point. In fact, one retail consultant in a Bloomberg Businessweek feature stated that,

"Terry Lundgren's 2005 decision to double Macy's size with the purchase of May Department Stores, was one of the top 5 worst decisions in retail history."

This led to Macy’s losing $11 billion in value in 3 years. To further emphasize Terry's decision, there are more than 660 Macy's stores in America, but according to Macy’s CFO Karen Hoguet, only 245 would be "critical" assets if the company were to start over today.

What are retailers doing to get consumers back into stores?

There are a few positives caused by the drastic shift in retail. One being that it’s forcing retailers to quickly experiment to understand in-store customer behavior and how it’s changing across different age groups. Retailers are experimenting by:

- Testing different concept stores to attract and increase customer footfall.

- Improving the in-store experience so customers want and not need to return.

- Becoming more open to partnerships and collaborations with other retailers to reach an entire new audience, even within its own category!

CONCEPT STORES

My god, it only took fifty-one years but it finally happened…we can now literally have breakfast at Tiffany's. In November at their NYC flagship store, Tiffany & Co. opened a cafe area where consumers can order breakfast while being immersed in its famed robin egg blue trademark color.

While this may seem like a pure PR stunt, I believe this is a step towards getting more people into their stores. This may not turn to immediate sales but it will begin to put Tiffany & Co. top of mind with customers that continuously go for breakfast. This experiment is quite timely. Though sales recently surged 15% and third quarter profits beat Wall Street’s expectations, US sales only rose 1%. The bulk of its third quarter sales primarily came from China followed by Europe.

American Eagle Outfitters on the other hand is doing something a bit more extreme. The retailer is alleviating a chore that no college student likes to do, let alone pay for it. They transformed their NY Union Square store into a new concept store called AE Studio. The new space which is conveniently located next to NYU and features a wall of washers and dryers where students can do their laundry for free! In addition to free laundry, AE Studio is providing:

- An area where students can lounge with their friends.

- Studio bar and seating area for studying which provides a great view of Union Square.

- An in-store “Maker’s Shop” that will allow consumers to personalize their jeans.

IN-STORE EXPERIENCES

Retailers are also putting a heavy emphasis on consumer data (see my last newsletter on The Importance of Audience Data). More specifically in the ability to capture and sync consumer data across different devices in order to provide a VIP experience when consumers walk into the store. I will be going more in-depth about the in-store VIP experience trend in a later newsletter.

Beyond data, retailers are beginning to add in-store experiences ranging from Brooks Brothers serving Stumptown Coffee in its Red Fleece concept store to Nike partnering with Foot Locker to re-open Sneakeasy - a one-of-a-kind sneaker shopping experience that combines the secretive nature of a speakeasy with purchasing exclusive Nike sneaker releases.

PARTNERSHIPS & COLLABORATIONS

As they say, “If you can’t beat them…forge a partnership with a company that can ultimately wipe you off the retail map.”

Calvin Klein has partnered with Amazon Fashion to open holiday pop-up shops in New York City and Los Angeles. In addition, Calvin Klein will have an online brand store on Amazon.com. Of course the pop-up shops will have the usual celebrity attraction but what’s really interesting is the fitting room and payment experience. The fitting rooms will have Amazon Echos allowing shoppers to ask Alexa questions about the Calvin Klein products as well as control lighting (because outfits look different in certain lighting) and play music. Moreover, shoppers will be able to purchase items in-store in the traditional way or can make purchases by scanning a bar code in the Amazon app and have their items delivered to their home. Both experiences aren’t new per se, however this is an example of a legacy brand learning how to integrate new technology and deliver an enhanced experience to customers with an established leader in the space.

Moving on, it’s safe to say that Lord & Taylor has seen better days. The oldest company in North America, recently announced that it was selling their famed New York flagship store to WeWork. The exact details are still being worked out however the press has stated that Lord & Taylor will likely rent one or two floors from WeWork, and the rest of the building will be turned into WeWork’s global headquarters and shared office space. This might look like a sad ending at first glance but this plus the recent partnership with Walmart is what Lord & Taylor needed to do in order to shed debt, be in very close proximity of constant foot traffic and provide consumers with a better online experience via the Walmart partnership.

Sneaker culture might be in its peak right now. In fact, According to SportsOneSource, the international sneaker market has grown by more than 40% since 2004, to an estimated $55 billion. Today’s sneaker craze is one of the reasons why Lululemon partnered with Athletic Propulsion Labs to debut its first-ever sneaker line for men and women. Sneaker collaborations aren’t new, for example J.Crew has its signature sneakers made by New Balance, but as the athleisure space becomes more competitive, this is a way for Lululemon to dive into a growing sneaker market that has seen a 5% year-over-year growth rate in the US. More importantly, this collaboration is a good attempt by Lululemon to pull away from new comers such as Outdoor Voices, Human Performance Engineering (HPE), Yogasmoga, and the mass merchants such as Gap's Athleta, Uniqlo and Target.

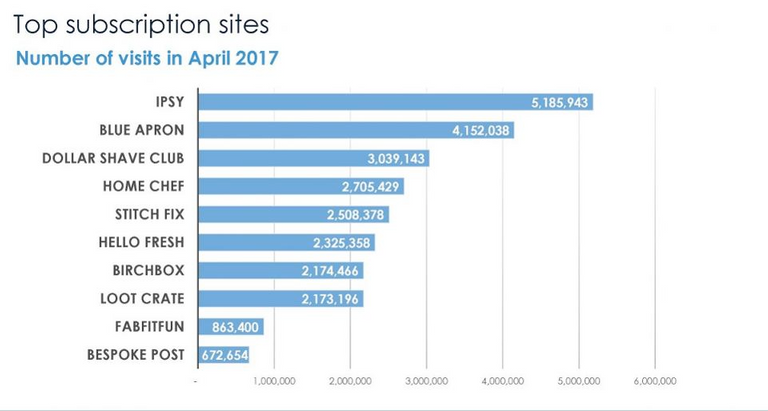

Why are retailers jumping into a subscription service business model?

Today, most brands have adopted a subscription service model via acquisition. Two prime examples are Unilever-Dollar Shave Club and Petco-PupBox, but others have begun to create this in-house. One notable brand is Under Armour. Consumers have to option to receive boxes of UA gear tailored to their preferences. When customers sign-up, they enter their gender, fitness goals, work, lifestyle, activities, style preferences and size. Customers have one-week to decide what to keep and send back. Similar to Stitch Fix, customers get a 20% discount if they keep everything that was sent. According to a Forbes article back in August,

“in the month of April 2017, subscription company websites had about 37 million visitors. Since 2014, that number has grown by over 800%.”

Besides the fact that 41 percent of revenue in retail businesses in the US comes from repeat customers, below are additional benefits why retailers are adding a subscription service offering:

The lifetime value of a regular customer is much higher than the value of a customer who makes an expensive one-time purchase.

- Subscription-based model makes it easier to forecast sales.

- Social shareability and unboxing videos has become a trend that retailers can’t ignore.

- The convenience factor adds enough value to make the recurring charge part of the customer’s spending norm.

A word of caution though. Adding a subscription service offering isn’t a sure thing. While Dollar Shave Club started this boom back in 2012, their sales have flat-lined and customer retention has become a major concern according to an analysis by 1010data. The barrier to entry is very low for subscription services so customer churn, number of competitors and money needed to continuously acquire new customers are huge pitfalls.

Looking ahead

For retailers, the name of the game is to survive and thrive. It's great to see retailers experimenting with new concept stores and tactics but they have to ask themselves if they're rolling out these experiments for buzz and PR purposes only, or are they experimenting to answer and/or solve an actual business challenge. Retailers that identify a core challenge, big or small, and then experiment based on that challenge will be better off than retailers that roll out an experiment first and then try to find insights to justify the roll out.

Partners corner

Tulip

- Overview: Tulip deploys tablets to store associates in brick and mortar locations to enable them to instantly access customer and product information, brand content, limited time offers, inventory checks, and CRM data to provide consumers with white glove service.

- Why you should care: They are able to aggregate customer data across different touch points (apps, site, social, wearables, etc.) into a customer profile and make this information accessible through a mobile app on the tablet.

- Additional Details: Clients include Saks Fifth Avenue, Coach, Frank + Oak, and Bonobos.

- Competitors: Red Ant, Newstore, Mad Mobile

Focal Systems / Standard Cognition

- Overview: At a high level both Focal Systems and Standard Cognition are using computer vision and machine learning to provide retailers with inventory and shelf analytics. However, they differ in two ways - user experience and data capture - and are relevant to different types of retailers.

- Why you should care: Focal Systems captures data through a tablet-like device attached to shopping carts and focuses on out-of-stocks detection and indoor location (store navigation & in-store advertising). Standard Cognition on the other hand, captures data through a set of cameras within the retail space but focus on vision-based checkout, similar to Amazon Go.

- Competitors: Amazon Go, Radar

Deliv

- Overview: is a last-mile delivery platform that offers retailers a crowdsourced same-day delivery service.

- Why you should care: Deliv enables any retailer, large or small, to compete with Amazon’s same-day delivery offering.

- Additional Information: They are working with over 4,000 e-commerce companies, local businesses and retailers such as Best Buy, Bloomingdales, BloomThat, Fry’s Electronics, K&L Wine Merchants, Office Depot, PetSmart, Macy’s and Plated.

- Competitors: Homer Logistics, Postmates, Uber Rush

About Me 👋🏾:

My name is Angel Mendoza and I'm the Partnerships Director for the IPG Media Lab - a specialized group dedicated to bringing innovation to brand clients across Mediabrands. With the Lab, I'm tasked with understanding how new technology trends will impact media consumption and consumer behavior, as well as evaluating startups for client test pilots. In addition, I provide clients with actionable insights to help navigate the evolving media landscape in the form of editorials and through the IPG Media Lab’s podcast called Floor 9.

If you would like to follow me, you can sign-up to his bi-weekly newsletter at QuickRead.Tech

Nice post! But I don't know if you you've fully captured the full extent of how retail is being disrupted. I've seen statistics saying that, in fact, more than 300 retailers have filed for bankruptcy this year. This could ultimately decimate shopping malls (which are also in a bad state), since smaller stores can reduce or get out of their leases when an anchor store closes. Retailers are also being squeezed by brands, such as Canada Goose, growing their direct-to-consumer sales channels, thereby becoming less reliant on retail partners. And there's also the emerging business of stuff—like clothes—as a service, which further undermines the need for retail stores. I don't study this as closely as you, but my read of the situation is that:

My two cents.

Thanks for the kind words!

You’re right, I didn’t touch on all the shifts that are happening in retail, specifically around the malls, online commerce, and the concept of death in the middle - where today as a brick-n-mortar retailer you’re options are really only providing a one-of-kind experience (such as Apple) or sell merchandise at very low cost (such as Marshall’s).

Also, I think it’s more wholesalers that are feeling the impact of brands going consumer direct. However, the shift in cutting out the middleman is a shift that’s already been happening across several industries. Think Dell in their prime.

You brought up a very good point with Amazon. Amazon is basically a blackbox with merchants, meaning that they pass along very little information/demographics on who are buying your products. So when talking to clients, the conversation focuses on how can we work with partners that act as a middle layer to capture 1st party audience data (to begin to segment and use for targeting & retargeting) even if the sale and fulfillment is done by Amazon or other big box retailers.

Love the feedback and sorry this was a bit delayed.

No worries! Appreciate the reply. Amazing to me that, more than 20 years after the web's mainstream deployment, people still buy as much as they do offline at all.

Congratulations @angeljasonm! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @angeljasonm! You received a personal award!

Click here to view your Board of Honor

Do not miss the last post from @steemitboard:

Congratulations @angeljasonm! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!