In general I appreciate the MIT Technology Review and their articles, but when it comes to Bitcoin, they just seem to miss the mark! They're back again writing on the topic, this time to make Bitcoin "irrelevant". No reason for why we ought to destroy Bitcoin is presented, but it is explored in three scenarios, which again, show serious lack of understanding of the technology.

Fedcoin

These scenarios make much ado about the network effects of Bitcoin and discuss how they could be undermined with a competitor because while Bitcoins themselves cannot be copied, the idea can be. The first scenario introduces an idea that has already been explored by a number of countries - most recently Venezuela's Petro - to have a central bank develop and release a crytpocurrency. This, the author claims would give the central bank power to tax it at will, see all transactions, exert monetary controls, and implement monetary policy, all of which are true. Moreover, the author argues, having a trusted, centralized authority could improve efficiencies by reducing confirmation times. I don't dispute this either. What I do dispute is that any current Bitcoin user would prefer this system of the current system.

Bitcoin isn't simply about having secure transactions or anonymous transactions (more on that later) but about being able to control one's finances in a way that the current system does not afford. Contrary to the implications of the author, enabling greater control to the central banks of the world to enact monetary controls is not a benefit to the people, but only enriches and empowers those who are well connected. To think that central bank usage of cryptocurrency (or Fedcoin in this case) would undermine Bitcoin is laughable. Bitcoin exists precisely because of the way central banks have behaved in the past. Rather than undermining crypto, I actually encourage central banks to explore blockchain technologies, because it would be a spectacle to show how the market and the miners are more capable of securing one's assets and more reliable than any government agency could be.

Facecoin

I don't think the author is aware of Steemit, because she posits a social network based on building likes and reputation in return for cryptocurrency. Regardless, the major development of this scenario is to see Facebook step into the game by offering Bitcoin wallets tied into their network that serve as a hard-fork of the main Bitcoin blockchain. Their clever marketing and sleek designs would get everyone to forget about the current cryptoverse and turn their hashing power over to the internet giant for additional rewards. The endgame for Facebook in this scenario? Take over Bitcoin, redistribute the wealth, or do whatever they see fit with it.

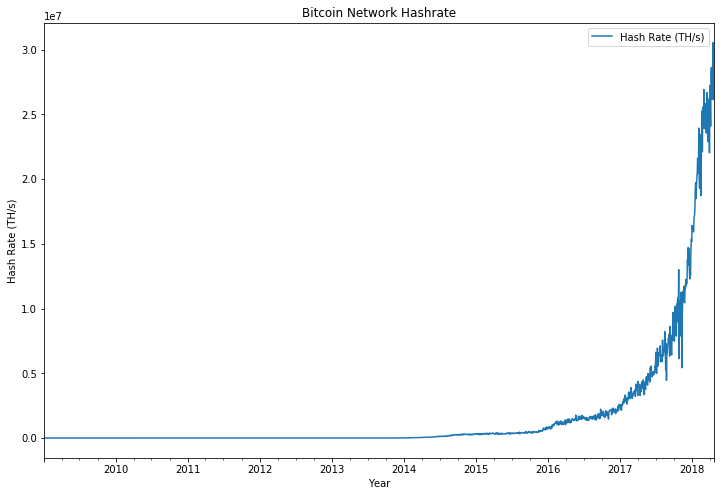

Again, I'm dubious of such a scenario. First, let's just look at the hard numbers. According to Forbes, the Bitcoin network contains more computational power than the top 500 supercomputers combined. Check the date on that article too, that was 5 years ago. If you didn't know, the network has only increased its hash rate by 1.5 million times since then, so good luck getting enough users to trust a Facebook led hard fork with spare power on their machines to compete with this, let alone getting the miners to change their investment strategy because of a snazzy new Facebook-branded wallet.

Let's assume that Facebook overcomes this hurdle and gets people to switch. That big Bitcoin weakness that the author identified (i.e. anyone can make their own crypto) means that users would likely opt out of the network and move to alternatives. So, your move Facebook.

Everythingcoin

In this final scenario, the author envisions everyone from Toyota to Whole Foods, Coca-Cola and basically every country and commercial entity creating their own tokens to pay for products. This would create a massive barter network and then Bitcoin would be undermined!

This scenario is probably the most improbable. Sure, every person under the sun could go about creating their own blockchain and issuing their own crytpo currency, but why would any of these things have any value? Moreover, why would anyone prefer to move to a convoluted barter system? Money works because it obviates the coincidence of wants which means that you don't need to barter because money serves as a consistent, widely accepted medium of exchange. If I want a car and the seller of the car wants new shoes, a new laptop, groceries, etc., I don't have to go out and acquire these things in exchange for the car, I can use money instead. Even if this scenario is an "incredibly efficient barter system" it doesn't outperform money.

So no, Bitcoin is not in trouble and not about the be toppled, undermined, or made irrelevant by any of these scenarios. That MIT would continue to run this type of material shows yet again that the editors of this paper don't understand the technology that they're criticizing.