Innovation- Whether you are a journalist, a professor, a businessman, a broadcaster or a student, this is the word that is making its way into every conversation, discussion and presentation today. In fact, it has increasingly become the basis of every new idea, proposition or expression.

But why do we love innovation?

Maybe because we simply love the sound of this word or perhaps, because we are actually living in an era in which technology is flourishing and it seems fair to say that we are amazed by the pace of its development. Therefore, not using this word has simply become impossible.

And that is not all: within the technological landscape, thousands of innovators and FinTech start-ups are emerging with the ultimate aim of facilitating our lives. Because after all, we all love the easy stuff.

Indeed, the marketplace is becoming extremely sophisticated, and keeping up with the rapidly changing consumer demand is not an easy job. As Tom Freston once said:

‘Innovation is taking two things that already exist

and putting them in a new way.’

To some extent, this statement can be attributed to the ability of innovators to identify a certain problem, the so-called customer pain, and to imagine the possible ways to solve it through the use of technology, so as to generate a brand-new product to ease customers’ lives.

Problem and Solution

An example of this is the cross-border money transactions, which usually make us incur in long waiting times, displeasing exchange and transaction’s fees imposed by traditional banks.

High transaction costs represent one major problem for consumers across Europe. Yet, banks, playing the middle-person role, continue to charge ‘unreasonable’ fees, as in some instances, at the end of the year those contribute towards up to 10% of their entire profit.

The technology innovation in this case is embodied by the FinTech pioneer TransferWise, which allows user to send money to 46 countries worldwide, charging an upfront exchange fee ranging between 0.35 and 1%.

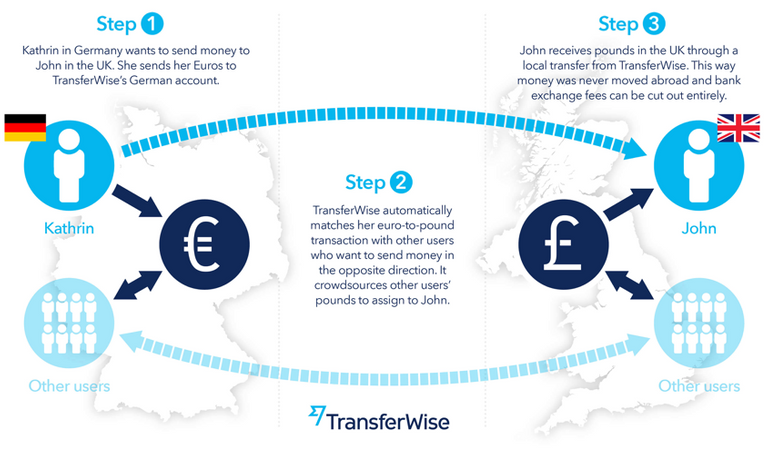

The company is able to maintain low transaction costs by holding bank accounts into each country it operates in the respective local currency. By doing so, it matches local and international transactions in a way that money never actually crosses borders, thereby avoiding the exposure to bank exchange fees.

How TransferWise works:

UK Market

Within the payment landscape, consumers are increasingly changing their habits, and people just don’t want to carry cash every time. Also in this case technology is helping in keeping them satisfied.

According to a research carried out by Euromonitor International, the UK is one of the most digitally advanced market worldwide, with a high smartphone penetration rate (estimated at 168% per household in 2017), paving the way for consumers to look for alternative payment methods.

We are now living in an extremely hectic environment, in which we all tend to prefer what is easy, quick and convenient. Contactless payments are mainstream in the UK, accounting roughly 38% of all card purchases.

Owing to the introduction of mobile payment solutions, we, as consumers, are starting to realise the comfort of using our smartphone for just about anything we need, without the hassle of carrying cash or cards everywhere.

Problem and Solution

In this regard, an example of innovation comes from the subscription economy, in which again, the UK is at the top of the list, with 9 out of 10 Brits preferring subscriptions over the ‘one-off’ payments.

The problem here is that despite the wide adoption of the subscription model, many local shops, sole traders and SMEs, lacking an efficient online portal, risk to be overshadowed by the industry’s giants and thereby jeopardise customers’ relations.

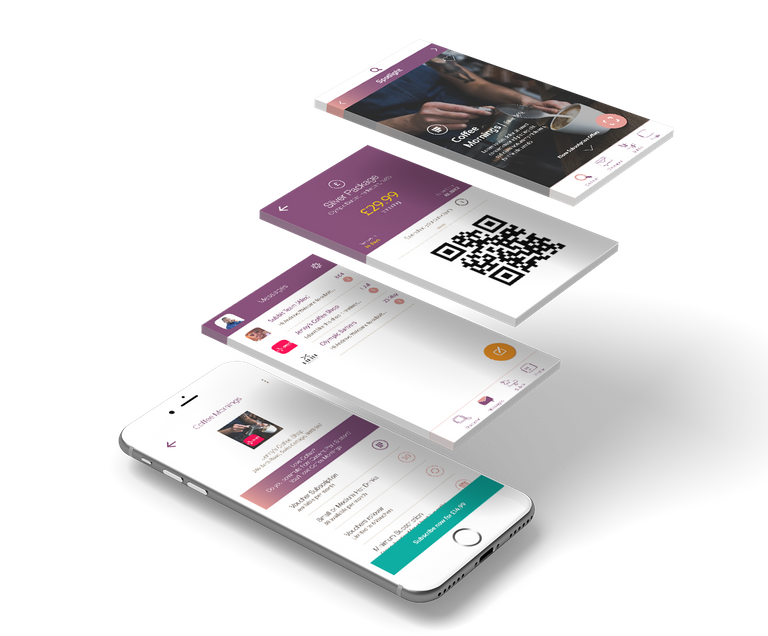

The new London based FinTech start-up, SUBBIT, provides a simple solution that accommodates both vendors and consumers’ needs. Through an extremely intuitive dual mobile app, high street businesses can now convert any product and service into a subscription package, leading to a predictable revenue stream and improved customer loyalty.

While, for us, as consumers with a few taps on our smartphone we can easily pay for just about anything with a monthly subscription, gaining the access to premium products and services at a better price.

Just imagine all the things we use and consume on a regular basis with a ‘one-off’ payment method: coffee, haircut, beauty treatments, workout sessions etc.

Thanks to Subbit’s subscription platform, we can now manage all our recurrent purchases in once and in the meantime access special offers and discounts.

An insight into Subbit's app

Additional innovation is given in terms of payment method. Subbit, provides the possibility to pay via fiat currency (i.e. credit/debit card, Apple Pay, Google Pay) but also all the major cryptocurrencies in the market (i.e. Bitcoin and Ethereum) along with the company’s SBT utility token, whose use, enables the access to additional benefits for both the vendor and consumer.

By talking about these great ideas there is a quote by the American industrialist, Jean Paul Getty, that comes in my mind and I want to share it with you:

‘True innovation is coming up with a product

that the customer didn’t even know they needed.’

And this for me is the reason why we love innovation.

If you are interested and would like to know more about SUBBIT, feel free to check out our website or our whitepaper.

Source

Plagiarism is the copying & pasting of others work without giving credit to the original author or artist. Plagiarized posts are considered spam.

Spam is discouraged by the community, and may result in action from the cheetah bot.

More information and tips on sharing content.

If you believe this comment is in error, please contact us in #disputes on Discord

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://medium.com/subbit/innovation-why-do-we-love-it-97a296ccbcd3