The most notorious scam artist in recent history is now working with Tether: Bernie Madoff and Associates.

If you have been living under a rock, then you have no idea that Tether has faced a lot of scrutiny recently starting a couple months ago but it intensified recently. So here is a little background on all of this.

What is Tether?

Tether is a crypto currency that was created to be tied to the dollar so that 1 Tether always equaled $1 USD, hence the name “Tether”. They began by selling Tethers directly for cash money, but this soon changed when their banking partner, Wells Fargo cut ties with them. Which is interesting since Wells Fargo is notorious in the crypto community for being anti-crypto. In many cases, Wells Fargo closed accounts of clients who bought Bitcoin from places like Coinbase.

Tether claims that each Tether is backed by a US dollar in their banks so that each dollar in reserve always equals the amount of Tether in circulation. This can protect an inverstor’s funds from the volatile price swings of other coins.

— For example, say an investor expects a price drop in BTC and lets say their investment totals $1000 at the moment. This investor could move this over to Tether and receive 1000 Tether in return. Once BTC correction ends, the investor can exchange those 1,000 Tether for $1000 worth of BTC. This protects the value of your investment from price swings.—

Originally, you could only purchase Tether directly from them in exchange for fiat currency, but this has changed to where many coins and exchanges have Tether pairings for most coins. This allows you to buy and sell Tether without going through Tether and their website.

The Issues and Accusations Against Tether

As stated above, Tether is meant to be directly tied to $1 USD which means that each Tether is backed a dollar in their reserve bank accounts. But one of the main issues occur here since Tether no longer has a partnership with a bank which used to be Wells Fargo. So where are they putting their money? Tether has not officially stated where their funds are held, which leads to speculation that they do not hold $1 USD for every Tether they issued.

This speculation is also coming from the fact that Tether used to require fiat currency for their coins. That scenario would allow for confidence that Tether is holding an equal number of Tether and USD since they receive USD for their coins directly. The current system allows for trading directly from BTC (or many other coins) directly into Tether. But how is Tether backing that up with USD in their reserves? Are they holding the BTC gained from trades and then selling it back? Are they selling that BTC for fiat currency right on the spot?

It’s unclear how they are managing to back up their currency since they are not disclosing much besides the fact that they back their Tether with USD. But again, Tether only makes the situation more intense by issuing even more Tether and adding to the circulation. How did they do this if every Tether is backed by a dollar? Are they just printing money freely at their own pleasure?

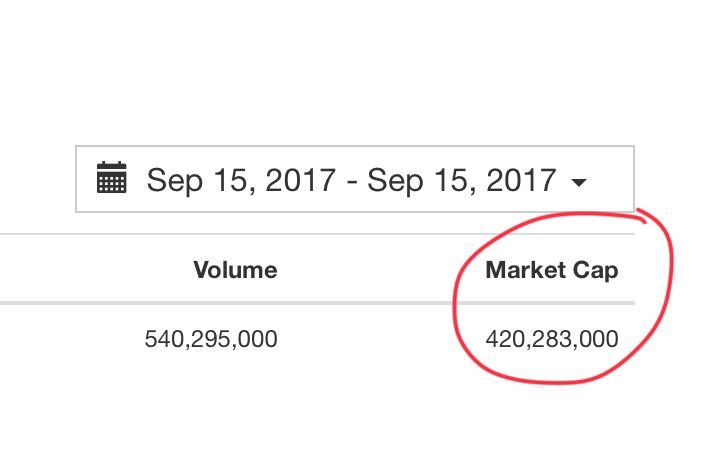

This is what I believe has ultimately led to another dissolved relationship, this time between Tether and their accounting firm Friedman LLP. This created even more speculation with Tether since people began to suggest that Tether was not being truthful with their funds and the firm did not want to handle this type of situation. But its notable to mention that Friedman LLP did compile a source that showed that Tether was holding 443 million dollars in bank accounts on September 15. This does correspond to Tether holding $1 for every coin they have in circulation since on that day their market cap was up to about 420,000,000. This lends some credibility to Tether, but it still raises questions on why the accounting firm would cut ties with them... Perhaps Tether no longer holds the amount of currency in their banks that is equal to the amount of Tether issued.

So Who Is Working With Tether Now?

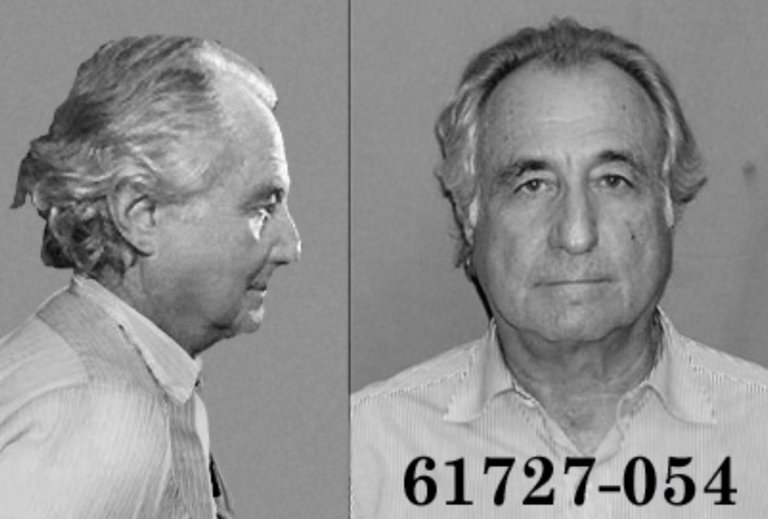

Tether has confirmed that they are working with “Madoff and Associates”, but it is still unclear who exactly this involves. They have made a point to say they wouldn’t be working with Bernie Madoff himself, but with associates of his. But “associates” isn’t defined here and makes the whole situation sound fishy to me.

In short, Bernie Madoff scammed investors out of money by using a Ponzi scheme essentially. He was not holding enough funds to pay back investors even though he was required to. That is the very short story and explanation since the long version requires explanation of stocks and investing in general.

Would you consider it a coincidence that Madoff was not holding enough funds to pay back investors and it just so happens that Tether is being accused of the same thing? Perhaps they are looking for advice on how to get out of the situation clean. Or perhaps they are genuinely just looking for their auditing service to provide truthful results. But it seems to me that Madoff’s associates working on auditing Tether is very suspicious, especially since Tether is in the same place Madoff was before he was arrested and sentenced to 150 years in prison.

I’m not accusing Tether of wrong doing at all, but it just seems like their is the huge coincidence in this situation and their explanation was basically that Tether “believes Madoff and Assocaiets need a second chance, and if Tether ever happened to be in that situation that others would give them a chance as well”.... make of that what you wish, but it appears to me they are trying to cover their a##.

Invest wisely and store your funds in Tether at your own risk.

This post has received a 8.74% UpGoat from @shares. Send at least 0.1 SBD to @shares with a post link in the memo field.

10 SP, 50 SP, 100 SP, 500 SP, 1000 SP, 5000 SP.To support our daily curation initiative, please donate 1 SBD or delegate Steem Power (SP) to @shares by clicking one fo the following links:

Support my owner. Please vote @Yehey as Witness - simply click and vote.

Your article is featured in @Shares UpGoat Project Daily Curation for additional mention and exposure to the world.

This post has received a 100% https://UpGoat.com sponsored by @yehey.

Send at least 0.01 SBD to @shares with a post link in the memo field. To support our daily curation initiative, please delegate Steem Power (SP) to @shares.

Lovely.

@Acknowledgement

“Madoff and Associates” sounds like some kind of bad guy comic series.

It does lol

Or like some kind of evil club or something

@originalworks @steem-untalented

Your post has been resteemed👍

This post has received gratitude of 0.73 % from @appreciator thanks to: @ginquitti.

This post has received a 1.71 % upvote from @boomerang thanks to: @ginquitti

I don't understand why anyone would convert their crypto to a crypto tied to the price of fiat rather than just selling crypto for fiat, or gold, or whatever.

The only plausible reason I can think of would be to try to avoid paying taxes on the crypto you sold. I can absolutely believe that Madoff is looking for a crypto-like tax shelter without the crypto price variance.

Good luck. The IRS will subpoena Tether for customer records just like they've subpoenaed Coinbase and others. This definitely smells like a scam to me.