Tie noted in a now-expelled post on its site that almost $31 million worth of tokens were stolen from the treasury in which it put away its dollar-pegged digital money.

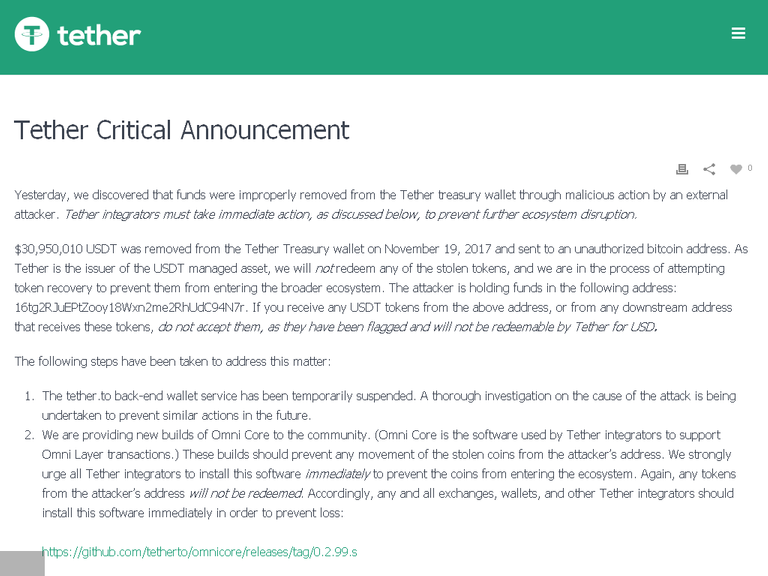

The organization said that it won't reclaim any of the stolen tokens, and will endeavor to keep them from entering different trades.

While Tether has possessed the capacity to recognize the address in which the programmer is holding those stolen reserves, it hasn't yet seen how the assault occurred. Thusly, it's briefly suspending its backend wallet benefit for accomplices, and is refreshing its Omni Core programming customer to keep the missing tokens from being utilized as a part of any exchanges.

The organization, which offers digital currency tokens esteemed at US$1 each, has just been under investigation for purportedly being possessed and worked by similar individuals who run Bitfinex, a British Virgin Islands-based Bitcoin trade that has been hacked before.

It'll be fascinating to perceive how the digital currency group responds to this news as more points of interest become exposed. We're watching out for this, so stay tuned for additional as it happens.

In a post on the undertaking's site (which has since been removed), Tether faulted a "vindictive activity by an outside aggressor" for the robbery of $30,950,010 USDT yesterday. Initially propelled as Realcoin and later rebranded, Tether intends to fill in as an intermediary for the US dollar that can be sent between trades including Bitfinex, Poloniex and different markets.

Accordingly, Tether said it would move quickly to guarantee these trades don't exchange or generally bring the stolen subsidizes once more into the digital money economy.

Prominently, the organization said that it is discharging another variant of the Omni Core programming customer (which Tether keeps running over) in an offer to viably bolt up the tokens it affirms were stolen. Should hubs in the system embrace the product, it would viably boycott the stolen address, sanctioning a crisis fork to contain the assets.

Delegates from the Omni Core programming venture said they would try to discharge new programming in the coming days that will enable Tether to recover the stolen tokens.

Spectators online recognized the move before today, feeding hypothesis about the idea of the stop.

The declaration comes in the midst of a time of developing exchange – and debate – around Tether.

Under investigation has been the vague connection amongst Tether and the agitated British Virgin Islands-based bitcoin trade Bitfinex – and long-standing charges the trade has been utilizing the advantage for participate in misrepresentation and market control. Confusing issues is that the two organizations are said to share a typical proprietorship, however points of interest stay cloudy with regards to the correct idea of the association.

In that capacity, the present hack claims are probably going to additionally drive the discussion, which started following Bifinex's hack last August, in which it lost more than $70 million in client reserves.

Following the news, different trades that offer request book exchanging on Tether have found a way to solidify exchanging, with China-based Huobi and OKCoin declaring the move not long after the post.

Emergency Fork

Trades Suspend USDT Transactions After $30 Million Tether Treasury Wallet Hack The organization records its subsequent stages to manage the issue and approaches Tether integrators to help its activities to forestall facilitate biological system interruption. These incorporate briefly suspending the tether.to back-end wallet benefit, opening an examination to discover the reason for the assault to avert comparable activities later on and do a crisis hard fork.

The group clarifies that they are giving new forms of Omni Core, the product utilized by Tether integrators to help exchanges, that ought to keep any development of the stolen coins from the aggressor's address. This will cause an agreement change to at present running customers, "implying that it is successfully a brief hard fork."

Follow us and please Upvote!!

usdt is back :