USD, JPY, CNY, EUR, etc, there are currently 180 currencies across the world that are recognized by the United Nations. When someone is against cryptocurrency, they usually like to argue that why not just use USD (or their respective currency of their nation-state) which is accepted everywhere they spend their money. But why are we using fiat currency in the first place and what is giving it it's value?

How the Modern Fiat Currency Came About:

In order to explain why crypto is better than fiat, we would need to understand where fiat currency comes from. For this explanation I will use USD but the situation is very similar for all fiat currencies. Before 1933, the USD(Federal Reserve Notes) was redeemable into gold. You were able to take your USD to the U.S. Treasury or any of the regional Federal Reserve Banks and you could get your dollar worth of gold back. The US Treasury held the gold reserves that backed the value of the USD in Fort Knox Bullion Depository which give it value. Even though you could not redeem your USD into gold after 1934, the USD was still backed by the gold in Fort Knox until 1971 when President Nixon demonetized the gold. This is when the USD became a fiat currency. Wikipedia defines fiat currency as " a currency without intrinsic value that has been established as money, often by government regulation. Fiat money does not have use value, and has value only because a government maintains its value, or because parties engaging in exchange agree on its value."

But what about cryptocurrency? They don't have any intrinsic value either right? It's just bunch of 0s and 1s on a distributed ledger. Yes and no. Some cryptocurrency like Ethereum or EOS has a use value. You need to have some ethereum to pay for gas fees to process smart contracts that runs Dapps. Some cryptocurrency like Bitcoin is only used as a store or exchange of value. These are backed by nothing but parties engaging in exchange agreeing on it's value. But I still think that Bitcoin is a better store of value than any of the fiat currencies (or cryptocurrencies). I will explain this more in the following paragraphs.

USD and Inflation:

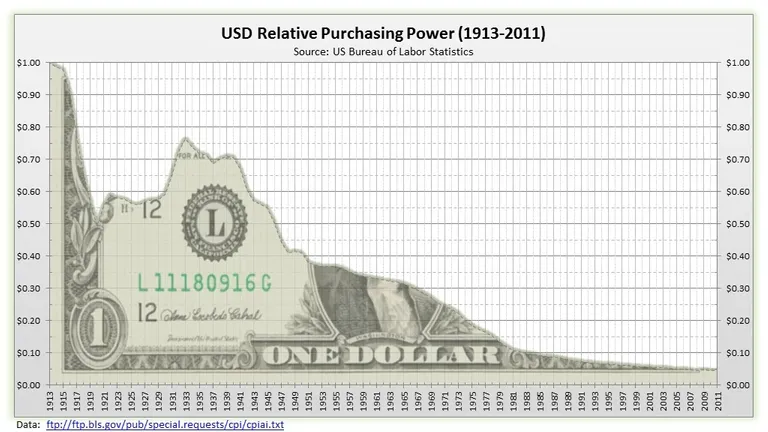

Due to the fiat currency not being backed by anything, the central bank (Federal Reserve bank in the US) can print or inject currency into the economy at will. This was done in a major way during the 2008 financial collapse via Quantitative Easing. Quantitative Easing is when the central bank injects fiat currency in the economy by buying government bonds and other securities. They do this simply by crediting the bank accounts of the entity that sold them the security. Since this increases the amount of money in circulation, it causes inflation and lowers the interest rates. Since the number of dollar in the system keeps increasing, your dollar is worse less as time passes on. It's simple supply and demand. As you can see below, it's astonishing how much value the USD have lost over the years.

Bitcoin - the Deflationary Super Asset:

It's no coincidence that Bitcoin came around during the 2008 financial collapse. The genesis block on the Bitcoin blockchain contained the following message by Satoshi:

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

In my opinion, Bitcoin was created as a tool to go against the fiat currency and the central banks. Total number of Bitcoin that will ever exist is limited to 21 million. Once 21 million Bitcoin is mined, there will be no more Bitcoin created. Which means it's a deflationary currency. As a concept, it's an alternative currency that you can hold that will increase it's purchasing power unlike the fiat currency which will increase it's supply and decrease it's purchasing power. Here is another Satoshi quote that hints at this ideology.

The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.

Although mining gets a bad rep for it's energy use, I think it is part of what gives Bitcoin it's worth. The price of energy it takes to mine a Bitcoin will be the bottom line price of Bitcoin. Satoshi described this in the following quote.

It's the same situation as gold and gold mining. The marginal cost of gold mining tends to stay near the price of gold. Gold mining is a waste, but that waste is far less than the utility of having gold available as a medium of exchange.

I think the case will be the same for Bitcoin. The utility of the exchanges made possible by Bitcoin will far exceed the cost of electricity used. Therefore, not having Bitcoin would be the net waste.

Due to halvening, this will almost guarantee that Bitcoin will only go up in it's value until all 21 million Bitcoin is mined.

Beauty of Truly Decentralized Currency:

Have you heard of the saying "Money makes the world go around"? Money has been used as a way to control the public. The ones who control the monetary supply of the world has the power to control many aspects of society. This is true with politic, business, communication, etc. By controlling how and who we can and cannot send our money to, they can effectively censor us or make our lives difficult. For example, for decades, international money transfer was only for the rich with the funds and connections, making it very difficult to start an international business.

Even recently, it cost my family member ¥7500JPY (About $70USD) in bank fees to wire me some money from Japan. This is not true with a decentralized crypto currency. Since all transfers are decentralized and done by network of miners or nodes that ultimately gets a say in how much they want to charge for the transfers (Charge too much and they risk people moving to a different blockchain for their transfer needs), it is a fair market price. Also, because there are no central figure, no one have to worry about having their transfers censored. This is giving freedom with money back into the hands of the people.

What the Future without Crypto Holds for Fiat - Negative Interest Rates:

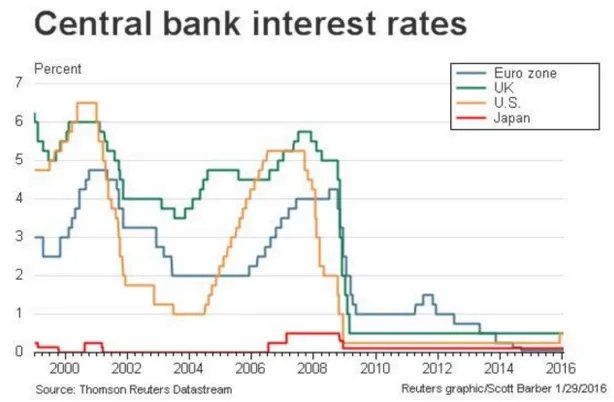

Negative interest rates seemed very real around 2014-2016 with it getting implemented by European Central Bank in 2014 and by Bank of Japan in 2016. Negative Interest Rates Policy (NIRP) is when the lender pays the borrower interest instead of the usual borrower paying the lender interest. So, for example Joe borrows $200,000 from the bank at -2% interest to buy a house. Instead of paying the bank interest with his mortgage payments, Joe will get paid $4000/year from the bank. This is great for people borrowing money but it's a disaster for savers and pretty much makes fiat useless as a "store of value". Why would you hold your fiat in your bank if you have to pay the bank to hold it on top of it losing value to inflation?

NIRP was becoming very real up until 2017 but I think the rise of crypto around that time put an end to it. If fiat in the bank becomes useless as a "store of value", you can just "be your own bank" using crypto. This is probably part of the reason why crypto had a huge bull run in 2017. If crypto somehow becomes illegal or difficult to use due to government regulations, I bet the central banks will be back at it trying to implement NIRP in order to keep the general public borrowing money to consume shit they don't need, contributing to inflation and the GDP.

Conclusion:

So, what did you guys think? I think the world without crypto will be very dark and gloomy with the select few elites controlling the society via their fiat currency and I reflected that in this article. I think crypto needs to be the future so we can have complete control of our own finances. Let me know what you think in the comment below! :)

Congratulations @fortunish! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!