By Jake Brukhman. (Cross-posted from http://blog.coinfund.io.)

Today, The DAO tokens are trading on exchanges below the value of the Ether that underlies them. This creates more than an 8% spread between DAO tokens and the Ether being held in The DAO’s smart contract. As /u/eeksskee points, out this is quite an opportunity for arbitrage.

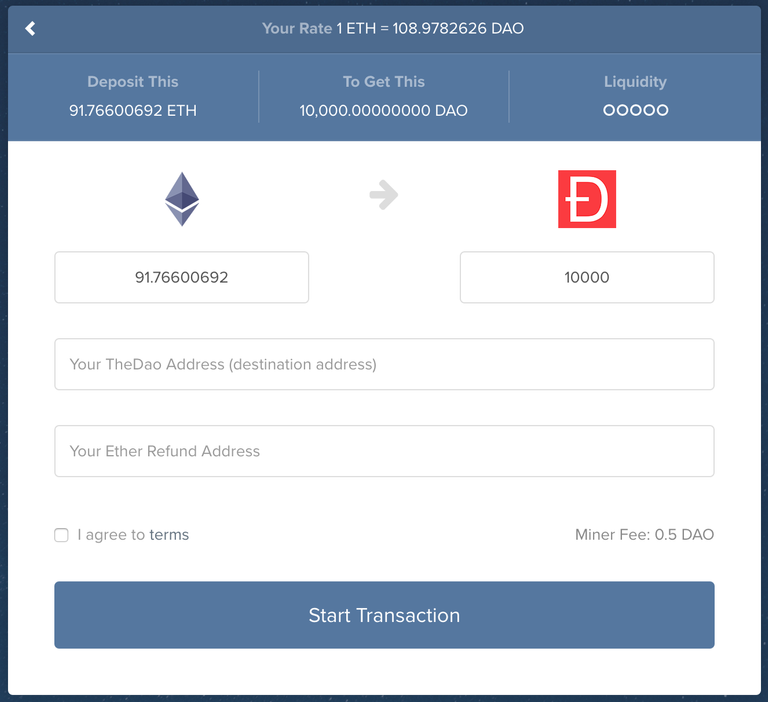

The process is that a trader can head over to ShapeShift and instantaneously purchase, say, 10000 DAO at 91.766 ETH. Then — over the course of 48 days and with significant technical sophistication — they may split from the DAO and recover the underlying funds of 100 ETH, thus generating a near-riskless return.

Interestingly, though this opportunity is now well known, only 47 split proposals have been extended at the time of writing, and it is difficult to tell which are performing arbitrage. Yet, for sophisticated users an 8% spread could be a compelling return level and once the process is proven out (~40 days from now, the first of the split proposals should be completing their Ether recovery phases), we could see a much higher demand for DAO token arbitrage.

This morning the BTC/DAO market on Poloniex alone would have supported approximately $800K in underpriced DAO token liquidity, and if completely arbitraged could theoretically produce a ~$880K outflow from The DAO contract. Today, this represents about 0.5% of The DAO’s holdings.

It seems that as long as holders consider splitting a technologically insurmountable or even just annoyingly complicated obstacle, they will be willing to pay a non-zero spread for Ether recovery. Thus, for the foreseeable future there will be a small but significant economic pressure to cleave off pieces of The DAO for risk-less returns.

By analogy to Stephen Hawking’s black hole mass shedding, would it be fair to call this phenomenon “Jentzsch Radiation”?

This phenomenon should not necessarily concern DAO token holders, but it is an interesting example of markets at work and how latent economic pressures spur market agents into action.

Isn't there a decent risk of the Ether losing value over those 40 days? That's a long time to wait for arbitrage, and the risks might make it no better than speculating directly on Ether or "The DAO" tokens.

Also there is a topic tag of #thedao as well. It seems many Big DAO topics are split between there and #the-dao.

Yes, you are correct. This arbitrage makes sense for long-term long ETH holders.

Will check out the other tag, thanks!

This risk can be hedged by shorting ETH then using a portion of the resulting ETH from splitting to repay the loan. You end up with 8% more ETH than when you started. While ETH may drop in value, as long as ETH has >0 value at the end you come out ahead, not factoring in trading and borrowing costs. (Current ETH loan rates on Poloniex are 0.01% per day so that is fairly low.) Although even then you can short enough ETH to hedge the extra 8% too and lock in a price on the profit.

The other issue is that security problems with The DAO design (both identified and potentially unidentified) mean you can't be completely certain that splitting off to retrieve ETH will work properly.