Most Q&As work with the audience asking questions and an expert giving answers. Today we are going to be flipping that around and I am going to ask YOU questions. Because I’m new to crypto and seriously don’t know. I’m crowdsourcing part of my crypto education!

Have you invested in lending platforms like BitConnect and Davor? If you feel comfortable sharing your experience, I would love to hear about it. Please tell me about it in the comments below.

If you have or haven’t invested, are you planning to invest in another lending site that’s still operating? Why or why not?

Now with the questions out of the way I am going to explain to the best of my knowledge how lending platforms (specifically BitConnect) works. If I’ve gotten any of the points wrong, please feel free to correct me. The internet ain’t NEVER shy about correcting people! Don’t disappoint me!

How it Works, As Far As I Can Tell…

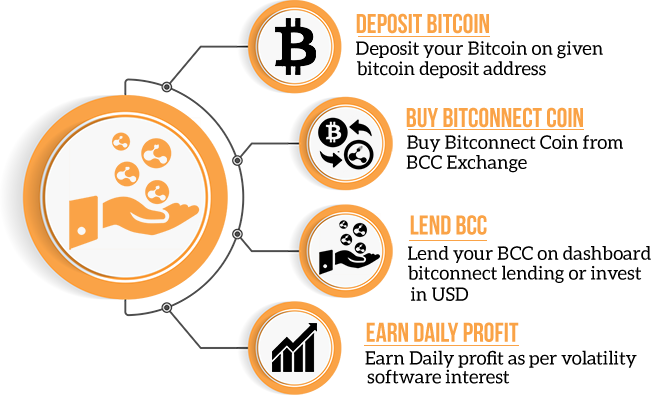

One of the first topics that I stumbled upon in my first days researching crypto currency is BitConnect. To my understanding this is how BitConnect used to work:

- Use Bitcoin to buy BitConnect Coin (BCC)

- Deposit BCC with BitConnect as a loan and they’ll use a bot to make profitable trades with the borrowed coin.

- Interest is paid out, with additional bonus rates paid depending on amount lending (more money loaned = more interest paid).

- BitConnect holds your loaned coin for a set period of time (more coin loaned = shorter holding time), but pays out interest daily.

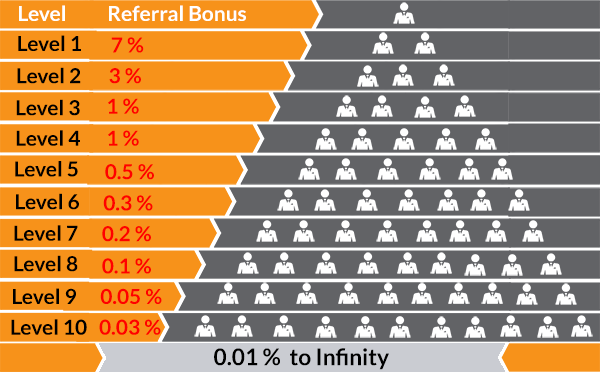

- Referrals: on top of being paid interest, BitConnect also pays referral bonuses. When signing up for BitConnect, a user receives a link that can be shared, and the user gets a bonus not just for the person they referred, but also for the people their referrals referred, as well as their referrals, and so on.

On the surface, it seems to work similarly to how fiat banking institutions work: a person deposits currency into a financial instrument (i.e., savings account, certificate of deposit, etc.), and the bank uses that money for lending purposes, such as personal loans, mortgages, auto loans, business loans, etc. The bank charges customers interest on the loans, and the bank pays interest to the owners of savings instrument.

The interest to be earned by an individual in this instance is fairly low, especially compared to the returns advertised by BitConnect (averaging 1% per day, most days). BitConnect is not the only player in crypto trading platforms. Davor is another platform that has pretty much the same structure.

Potential Problems, As Far As I See It…

Unsustainable?

Like I said before, I’m new to cryptocurrency so I am by no means an expert. I’m also not a financial expert of any capacity. But I wonder how a platform like this can be sustainable during massive dips (or plunges) in cryptocurrency values. Cryptocurrency is still an incredibly volatile product, and it’s great and exciting when you’ve invested before a big upturn, but what happens when it goes the opposite way? Bitcoin, for example, is at around $9300 USD/BTC at the time of this post when only a couple months it ago it was close to $20,000. How does the bot continue to make money when the value of cryptocurrency is sure to go down thanks to it’s inherent volatile nature?

Ponzi scheme?

Again, I’m new to cryptocurrency so I am by no means an expert. I’m also not a financial expert of any capacity, but I am a student of history, and the promises of big returns are usually a red flag of an unsustainable system. If you take Bernie Madoff, for example, he was promising big returns and consistently paid those returns to investors when there should have been some periods of low or no returns. In his case, he was using money from new investors to pay older investors, and falsifying documents to hide this fact. I wonder if that isn’t the same with BitConnect, since one of the chief complaints among BitConnect opponents is that the company offers no proof that the payouts are actually from returns on trades, and not newer signees.

Pyramid Scheme?

Even if all of my other concerns are unjustified, my major concern is with the referral bonus program. I’m not even going to go into any great detail about here, just want to show you this:

This chart is not made by people who think BitConnect is a scam. It was shared by BITCONNECT ITSELF. They are literally showing potential investors a pyramid.

Like my mama always said…If it looks like a pyramid scheme, walks like a pyramid scheme, and quacks like a pyramid scheme, it’s probably a pyramid scheme.

Also, it looks as though this isn’t the first iteration of a trading platform that has went down in flames. And now Davor is facing the same Cease and Desist challenges from Texas that BitConnect did. They had a contest of sorts where the winner wins $1 million, but it looks like that probably isn’t going to end up getting paid out to anyone.

Personally, I’m staying away from anything that might resemble these types of lending programs. It could be profitable to get in as an early adopter, earn a bunch of money, and get out before the last shoe drops, but it’s impossible for a typical investor to know when the fall is going to happen.

Being profitable from joining early is just a myth, just because bitconnect could survive before first capital release most ponzi schemes fall apart way earlier.

How many people do you know that got rich investing in ponzi schemes.

Honestly. what the fuck lol.