Binance is a centralized digital cryptocurrency exchange with its own token. It’s based in China, so you may not have heard much about it if you live in the west.

At first glance, the website for binance is a bit messy. This is a token with similar goals to BitShares - you could go as far as call it “the BitShares of the west” - but in terms of website quality, it’s way inferior.

This could be partially due to the language barrier - perhaps there are non-english pages I’m missing, which could look better. But at least on the english side, it’s not so good.

Compare the Binance and BitShares websites for comparisons’ sake: https://bitshares.org/ vs. https://www.binance.com/

About This Series + Disclaimer

This post is part of a new series where I investigate each of the top 50 coins by marketcap (based on coinmarketcap.com's rankings on October 11, 2017). My goal is to help steem’s userbase become the most knowledgable blockchain community in the world.

Disclaimer: I am not an investment expert and will not be providing investment advice. I will teach you about the top 50 coins, and you can do what you want with that info.

Who Created Binance?

Binance's CEO & founder is ChangPeng Zhao.

ChangPeng Zhao

You can watch an interview here:

Mr. Zhao gives a good impression in this interview. He seems knowledgeable and well connected in China’s cryptocurrency industry, referencing a long friendship with Bobby Lee, “well before he was involved in cryptocurrency.”

Mr. Zhao seems to be a capable CEO for a digital crypto exchange. But I will admit that Binance is more talk than action so far... they talk about building a decentralized exchange powered by the BNB token, but so far they only have a centralized exchange.

The real winning scenario for Binance is to become a new competitor to BitShares, a decentralized exchange that anybody can use to trade altcoins with the fewest possible steps. This is a tall order and I don’t see a ton of evidence about their progress in building it.

BNB Token Use Cases

There are three ways that you can use BNB tokens: one you can use now, one which happens automatically, and one which will start happening in the future.

(1) If you have BnB token and you trade via Binance, you don’t pay the commission fee via the token you are trading - you pay in Binance coins instead, at a 50% discount.

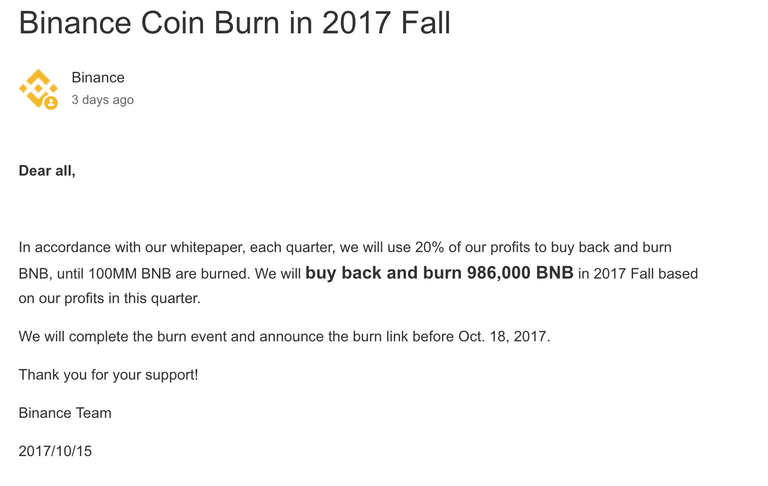

(2) Binance uses 20% of profits to buy back BNB tokens and burn them. This functions essentially as a dividend for BNB token-holders (by reducing the circulation of BNB tokens.)

(3) Using BNB as “gas” for the future decentralized exchange. This is not currently possible since the decentralized exchange has not been built yet.

The China ICO Ban

How badly was Binance’s exchange affected by the recent ban of ICO tokens in China?

gavel // source: pixabay.com

Based on the company’s own response, it is not a huge hit. They claim that 81% of their transaction volume occurs between entities residing outside of China: https://support.binance.com/hc/en-us/articles/115001414292

It could have more broad implications for Binance’s goal of building a decentralized exchange. Considering that the entire team is based in China, they have significant regulatory hurdles to overcome.

On the plus side - if Binance succeeds in launching a decentralized exchange that stays in good graces with the law, they could aim to become the primary exchange in China.

There has been no more information regarding the decentralized exchange and/or regulations. We do have some signs that the business is running as usual. Mainly, there’s a post from four days ago that says the latest BNB token burn is occurring on schedule:

Market History

How has the BNB token performed so far?

The token is too young and centralized for me to have much of an opinion. Buying in right now represents an investment in the idea that Binance will become a more popular exchange around the world.

I suspect that their main utility is to become a stable decentralized exchange that can survive within China’s regulatory structure… but we are a long, long way from that. Right now Binance is more of a standard cryptocurrency exchange with a token attached.

This seems like a speculative investment right now. You could make money on it, but it’s too early to tell if they will succeed.

Final Thoughts

I’m not very excited about Binance. What I am seeing right now is a subpar exchange with a lot of promises for the future.

The company seems trustworthy. CEO ChangPeng Zhao appears to be experienced and capable of running Binance for the foreseeable future… but I don’t see a killer app here, a reason for the exchange (or the token) to thrive in the long-term.

Will Binance exist somewhere in the middle of the long-tail of decent digital tokens 5-10 years from now? Maybe. It could find a niche in the Chinese market in particular. It’s just not a very exciting token right now.

With so many big bets on huge ideas, Binance could become a stable token in a volatile world. Or it could fade away over time. Hard to say.

What do you think? Do you have any experience with Binance or any other insights to offer?

p.s. - these posts are now labeled with the "token-investigation" tag for easier browsing - thanks to @staticinstance for the idea.

I think Binance looks better than Bitshares website visually at least so I have to disagree with you on that.

Also I love that Binance is the ONLY exchange so far to give their NEO holders the GAS they earn by holding NEO.

There are some downsides to the exchange, like not being able to buy smaller fractions of many coins. I think they said their reason for doing this is so people can't under cut other peoples bids by only 1 or 10 satoshi to become the new lowest bidder by a margin that is less than a hundredth of a penny.

I like bitshares/openledger but I have to admit that Binance seems to be trucking along and doing big things to grow their exchange, where I just unfortunately (as an OBITS holder) don't see the same growth in openledger/bitshares.

Fair enough about the websites... I am open to dispute :-)

Binance does seem to be doing a good job of growing so far like you said. I just hope they are able to build a good decentralized exchange, as of September 2017 it seems like they had barely started, with Zhao saying things like: "we have yet to decide on the architecture for the exchange"

This is a cool series. Since you're early in it, can I suggest an addition? A major consideration for network tokens are the economic and technical specs.

Economically there is coin supply, emission schedule and rate, historical token emission or creation (ICO/founders/premine/etc). More technically there is its code heritage, consensus model, and block or transaction confirmation time.

Thanks @pfunk. Yeah I can include that info in future posts, you are right... coin supply / emission, consensus model, block time, all very important to keep an eye on. I'll start putting that stuff in.

Nice tag choice! Thanks for the shoutout! :)

Hey I am robot everyday i will upvote you and comments you so now follow me and upvotes my all posts,,,,

Thank You so much