Regulative and legislative bodies round the world have long acknowledged the omnipresence, influence and usage rates of cryptocurrencies, therefore, they cannot sit on the sidelines and see the new financial instruments get easily abused by hackers, fraudsters, and scammers thus rendering the innocent daily users unprotected against the malicious activities. For legislators both developing and developed economies today’s situation on the market of cryptocurrencies or tokenized securities is posing a challenge of constructing relationships between all market participants and privies with the state in the most effective way that would benefit both sides.

ICOs (Initial Coin Offerings) boomed so loud that most of the world’s regulators had time to adapt to the way blockchain-startups raise money publicly and created a rational legal framework for all ICOs operating within their jurisdictions. Although, in practice, those requirements, restrictions and other measures undertaken by legislators were - and are - often simply ignored with the fundraisers getting away with it. Luckily though, the situation is getting better as more and more criminal or securities prosecutions are enacted against fraudsters or even non-compliant tokenized securities issuers, while even the number of sought SEC approvals (so-called, Form D) is increasing month after month.

A good starting point for the research is defining the terms, we’re going to use in the paper. Tokenization of an asset or security is the issuance of an exchange unit in the form of a cryptographic token or a smart-contract (a large number of tokens unified by a common pre-programmed logic and mechanics of interaction) that legally corresponds to a part or a whole of the underlying asset with the respective ownership rights and legal claims arising with the respect to the owner of this token (i. e. keeper of the private key that allows moving the token within the blockchain).

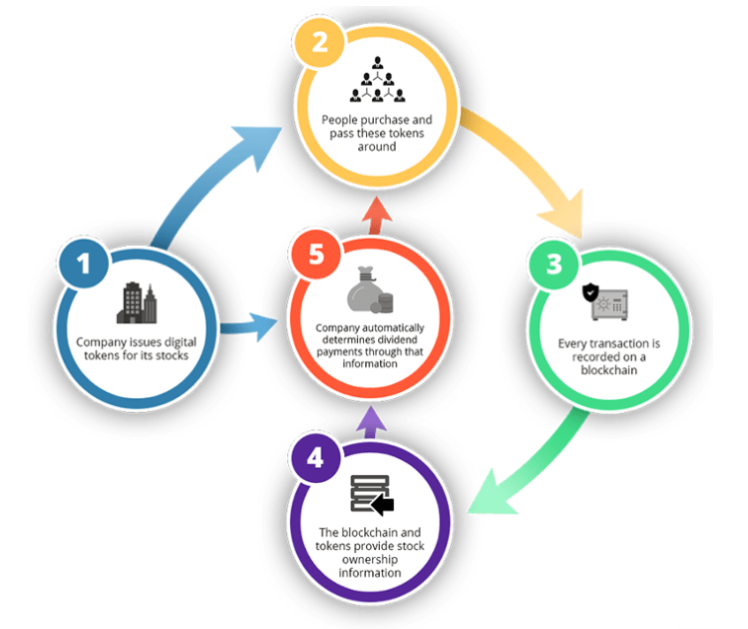

For a clearer understanding of the procedure, let’s look at an example of a truly useful application of tokenization.

- A venture fund invests in a startup at the seed stage;

- It now understands that it has to wait for at least 8-10 years for the ‘exit’ (M&A, re-selling of a share, IPO, etc);

- With the help of legally correct tokenization of securities, it can find a platform where startups’ shares are tokenized routinely and apply for tokenization and market offer of its shares in the startup;

- After the shares are tokenized and the ownership right for the tokens are registered by the issuer, the tokens are offered within the platform either for a set price in cryptocurrency or are put in the open market (exchange);

- The Fund returns some, all or more than the money it invested before and is now able to re-invest it in new promising projects.

One must not confuse the tokenized securities with so-called security tokens which are issued in ICOs. With the former, the noun is ‘security’, whereas with the latter the noun is ‘token’. Security tokens are the tokens issued by the project that bear similar features as shares or obligations do - mainly, dividends distribution. There is a large number of functioning blockchain projects that pay out dividends to their tokens holders. Tokenized securities are the securities that were issued in the real economy in the first place which were later tokenized to add market liquidity.

The main antagonist of security tokens is a ‘utility token’, the token which only allows its holder to access goods or services produced by the issuer. However, according to SEC’s opinion, almost all tokens issued by projects in frameworks of ICOs fall under all necessary characteristics of security tokens and therefore must be registered as such.

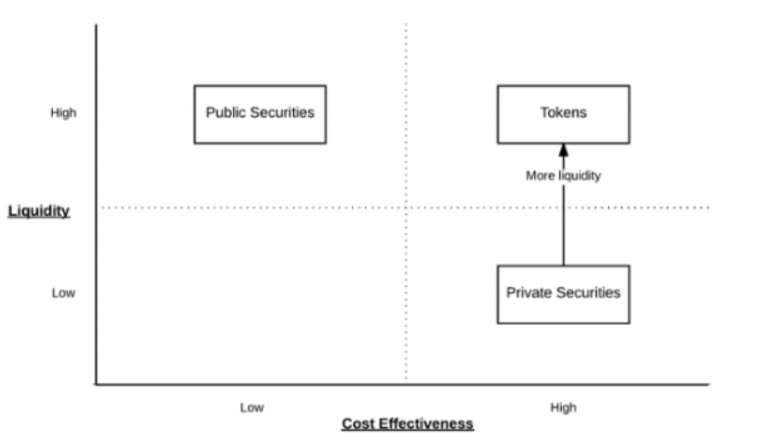

The obvious advantages of tokenized securities versus the traditional securities and the exchange flow are:

- Low costs: issuance of tokens even in the frameworks of popular among blockchain startups Regulation A+ under the Jumpstart Our Business (JOBS) is incomparably faster and cheaper than issuance of shares at IPO, as the one-time costs associated with the IPO tend to average at around $1 mln (not to count marketing and solicitation costs) and from $1 mln to $1.9 each year for being a public company. Any ICO/STO or tokenization costs are nowhere near those figures.

- Transaction speed: buying and selling of tokens among the accredited investors is executed significantly faster than those very processes when speaking of traditional shares through middlemen, such as brokers and registrators. The difference becomes even more striking when we’re speaking about OTC (Over-the-counter) deals.

- Availability for investors from any part of the world: the main incentive driving the tokenized securities issuers is increasing their assets’ liquidity and the fastest possible realization of it in the international market. Cryptocurrencies themselves found such popularity among the millennials, for the most part, thanks to the accessibility and smoothness of both centralized and decentralized trading, which in turn, lowers the entry threshold for individual market participants.

- 24/7 token circulation: one more minor appealing factor for the entities deciding upon tokenizing their securities is the absence of pauses in international trading of tokens.

A number of questions arises out of what was laid out above. Why tokenize securities in the first place? Why not just sell them via private OTC deals? If a security is already tokenized, but the resulting token is not yet sold, does the underlying security cease to exist? Do the platforms where token issuers may rest assured in finding large-scale liquidity already exist? What, apart from securities is worth considering tokenizing? What issues would it tackle? Which regulatory bodies and how they register legal rights for tokenized assets?

What do our subscribers have in mind for the answers to those questions? Please feel free to state your opinion in comments to this article either on Steemit or on Twitter.

your VHCEx team!

would love to see more practical guidance on registering tokenized securities in the US

could you find some?

"Practical" is a true antithesis of tokenization platform, lol

Whenever I see an ICO or platform for "tokenization of land" or some other property, I kinda hand a SCAM tag onto it rightaway

answering to your liquidity question: no, the volume for those securities is still very low, which is why most of those tokens are just shitcoins of the startups no one wants a part of