The company about which anybody never heard, go for an IPO every day. Still, before the issue of shares in free circulation, the company has earned the reputation of multiple years of successful work, and now they spend IPO in the first days of its existence, and instead of obtaining financing through the sale of shares, building a distributed network and sell the tokens.

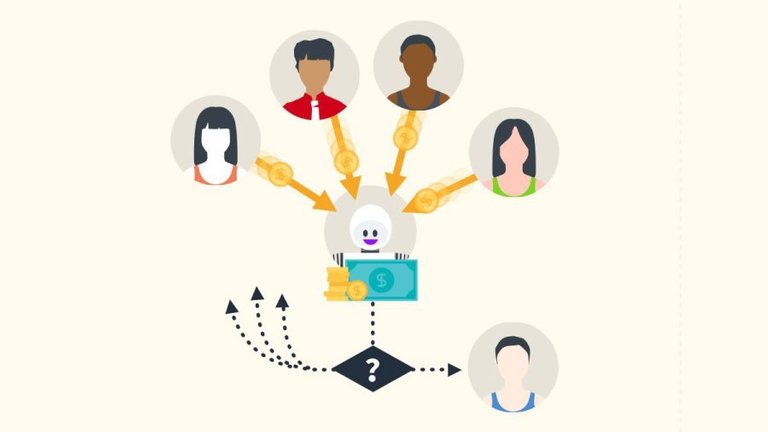

Fred Aram (Fred Ehrsam, founder of Coinbase, called this scheme a "Decentralized business model". To a new model not applicable a well-established investment guidelines. What can we learn from companies who have embarked on the path of development?

Digital tokens.

Pre-sale mechanism token depends on the token. We can distinguish three kinds of tokens:

Custom tokens

Tokens-stock

Credit tokens

Tokens application or tokens.

Tokens applications or Appcoins is a digital currency, giving access to services that provides distributed network. Analogue applynow – badge to visit the attraction.

For example, the network Ethereum to build the necessary ether (ETH). In a distributed storage network Sia files, to write files to the network required Cialini (SC). In Emercoin (EMC) tokens are required to pay for decentralized network services.

Tokens-tokens can be earned by creating value in the corresponding network. In networks of Bitcoin, Ethereum, or Sia can engage in mining, and the network Steemit tokens can be earned by mining, and still publishing the content in demand.

Since the tokens-the tokens recorded in the blockchain, they can be freely bought and sold for any cryptocurrency or Fiat currency.

Tokens-stock.

The tokens-the shares are used to Fund the development and construction of the network. To access the services of the company they are not needed. In fact, they can be considered as crypto-equity.

In exchange for investments, holders of tokens-shares receive dividends in the form of a percentage of the income or part of the commissions for transactions in the network. For example, in case of network Sia, 3.9% of the income for the storage of information shall be paid to the holders Siafund – tokens-share network.

In many cases tokens are shares are shares in the organizations like DAO. In these structures the code produces tokens, collects the money raised from the sale of tokens, and contracts with companies involved in developments.

In addition to remuneration, the holders of tokens-DAO shares also vote on the investment proposals of the companies. The number of votes in proportion to the tokens package. Example: Digix – the DAO, built on the Ethereum platform and engaged in the transfer of different assets in digital form. Holders of tokens Digix DGD get:

1. Remuneration – the portion of the commissions from transactions on the network Digix Network Gold

2. The right to make business proposals and vote on existing proposals Digix DAO.

Credit tokens.

Credit tokens can be considered as a short-term loan network, in exchange for interest income from the loan amount.

One of the first networks that use tokens became the network Steemit. Credit tokens are called Steem Dollar (SD). The main cryptocurrency of the network, Steem, it can be mined with a mining. SD you can buy for Steem. They are also traded on exchanges, their owners receive a fixed income of 10% per annum, payable in SD.

In the economy of the system Steemit SD play an important role. This investment in the network with sufficient liquidity, they are easy to sell on the exchange. An alternative is to use Steem Power – tokens, generating profit of 100% per annum, but cannot be sold within two years.

Networks exist with different combinations of tokens:

Only tokens-tokens – Bitcoin, Ethereum

Only tokens-stock – Golem, SingularDTV

Tokens tokens and tokens-shares – Sia, Digix

All three types of token – Steemit

The combination depends on the dynamics and Economics of a particular network.

Pre-sales (ICO, Crowdsale).

Method pre-sale is determined by the type token.

Pre-sale tokens.

The sequence of actions in the pre-sale of tokens-tokens are usually as follows:

The publication of the description of the network and plans for further development (White paper)

The announcement of predstoyaschey ICO and publish the source code to generate the first token.

Network deployment and generation of tokens-tokens with the help of mining. There is a possibility of part of the tokens for the founders, as remuneration for the idea and development of the network.

The ICO is selling tokens-tokens to everyone.

Work to create the network effects to build applications and network support. The growth of the network increases the demand for tokens, which leads to an increase in the value of user tokens.

This scheme is called the business model Nakamoto. Satoshi received a reward not for pre-mining (premin), but because he was the founder of the network, and for some time remained virtually the only generator of bitcoins.

Network Steemit when you create did not follow the business model of Nakamoto. The company wrote the code to launch a distributed network Steemit, published it and have reserved 80% of the cryptocurrency Steem generated pre-mining. Of these, the company plans to keep 20%, sell 20% to ensure financing of the project and the remaining 40% to pay for new users for the published content.

The Ethereum model is slightly different: In the pre-sales to customers, was transferred to private keys as tokens of access to the future network. The Ethereum raised over $ 18 million in bitcoins that were generated 60 million tokens of the ether. Of these, 12 million of esters (20%) were reserved for the development team. After the launch of the Ethereum network and start mining customers receive your broadcast.

Pre-sale tokens-stock.

Sequence of actions:

The publication of the description of the network and plans for further development (White paper)

Create a smart contract with some token shares reserved for the founders of the network.

The establishment of the company-provider, which will develop the network for a fee.

Advertising and promotion of the upcoming ICO and selling tokens-stock to everyone. From the proceeds of the payment provider.

The expansion of the network, the collection and distribution of remuneration for network use.

Regulation of pre-sales tokens.

The legislative framework that manages the production and sale of crypto-tokens is determined by the jurisdiction in which the events occur. In countries such as Singapore or Switzerland, cryptocurrencies in General are not considered as securities or legal tender.

In the United States to define the asset as securities used test Howie ( Howey test). The instrument is a security if:

There are investments of cash or other tangible assets

The funds are invested in a common enterprise

Expected profit

Profit is the result of the actions of a third party

For public sale of securities to U.S. citizens need a permit SEC.

According to some experts, the issue of tokens-tokens and token actions fall under the definition of securities issuance. However, the token is much wider than the existing definition of traditional securities.

Currently, the SEC is developing a number of refinements to the legislation, which will allow you to adjust the blockchain as a transfer agent. But the impact of such regulation on the issue of token it is difficult to assess.

Adaptation of tokens to the existing legal space.

The authors see four different approaches to conducting legal pre-sale token.

A Swiss GmbH (LTD) and the Stiftung (Foundation).

Pre-sale of ether was carried out by the Ethereum Foundation, a non-profit organization registered in Switzerland. The only declared objective of the Fund is to manage the proceeds from the sale of air and development of the Ethereum ecosystem. In order that U.S. citizens could buy ether without the permission of the SEC, the Fund had pre-sale of ether (ETH) as the sale of "cryptohippie" required to run applications developed on the platform Ethereum.

Programming coding was conducted by Ethereum Switzerland GmbH, based in Switzerland.

Singapore company DAO.

In the case of Digix, a smart contract for DigixDAO was written DigixGlobal - a company registered in Singapore. This company has worked under contract with DigixDAO and received payment for the development of a network Digix.

The tokens-the shares are analogues of shares in DigixDAO. The financial Commission of Singapore does not consider tokens as securities, however, the legal sale of tokens to the citizens of the United States depends on the decision of the SEC according to the test Howie.

CODE - conditional decentralization.

The third experimental approach uses Singular-DTV – based on the blockchain Studio entertainment. CODE – the abbreviation, the combination of two elements:

CO (Central Organized) – the control component in the form of a Swiss GmbH

DE (Decentralized Entity) is a decentralized ecosystem based on the Ethereum network.

GmbH is responsible for the expenditure of ether, collected during the pre-sale of tokens via DE. The aim of the project is the creation of media projects revenue collection from them. It is assumed that the model CODE meets regulatory and tax laws, protecting the owners from possible tokens of responsibility.

An independent company.

Issue token and network support occur regardless of the Creator of the system. Tokens are issued by a computer algorithm, which lacks a public key for receiving the proceeds. The Creator of this system gets its share of tokens from mining because it is the first miner in the finished network. This approach applies the network Steemit and its Creator company Delaware C Corp.

These methods build new companies is only the first attempt to write a new model in the existing legislation. As new projects, lawyers and regulators are included in the crypto space, and will establish new rules of the game.

Things are moving quickly.

For more than forty projects using a business model based on tokens, preparing for pre-sales, or even held her.

Nice article. Same mindset here. It's facinating how people invest 10's of millions of dollars in "just an idea". I was wondering if anyone of you uses: https://www.coincheckup.com They give great insights in the team, the product, advisors, community, the business and the business model and other techincal insights. For example: https://www.coincheckup.com/coins/Emercoin#analysis To see the: Emercoin Analysis