As of many among us declared Bitcoin a dead crytocurrency this week, due to a massive dive in value in cryptocurrency market. As the panic spreads out and Bitcoin falls to round about $9,000, others followed bigger drops.

Crypto market was in a phase of deterioration since Bitcoin hit the $20,000 mark. Whereas, Red days across the Cryto Market took a decisive turn and the chart turned green for all the major coins.

As we all know whenever bitcoin is rising, many other coins also follows bitcoin the rises. But as we saw in last week that Bitcoin led every other coin to the way in loss of value.

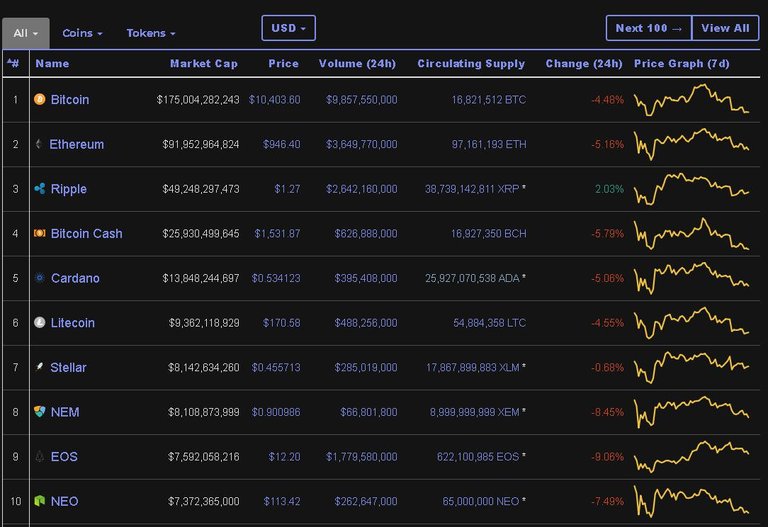

Digital currency Investors were left nowhere to flee as TOP 10 cryptos fell harder than Bitcoin. Market dropped to $400 bln from $700 bln, thus facing Huge outflow of money from the crytocurrency market.

Looking back to the history of Bitcoin, this swing in Bitcoin Value ( dropping from $14,000 to under $10,000) is normal and most likely expected.

Bitcoin faces three similar drops in 2017, and after each drop its Price went up from the previous one.

Bitcoin’s price is taking back and forth turns from quite some time now. Couple of days back crypto market look a lot more positive as red numbers are turning into green numbers and BTC price reaches to $12,000 above. Whereas while writing this BTC Price dropped less then 10,500. Still a long way to travel but Green Charts are always good after such a massive dive.

The reason behind such a massive crash in Crypto Currency Market leads us to the confusion that has been circulating Crypto Market for the last one week that Korea Plans to ban Crytocurrencies.

Question still remains the same. Will BTC ever rise again or will it fall to its worse?

i hope red days will be green very soon and the crypto market will up again

Yess bro. Hope is still alive

I think unless all the big fishes get into Cryptos , it will never reach its true potential

yes right. and the big fishes are the investors

Hope red light will off soon.

I think it will go up again and by the end of 2018 it will hit 25K mark.