Do you know why cash is referred to as the most liquid asset?

Because the fiat market is always able to easily absorb large amount of transactions, without the price of the fiat currency reducing drastically. If anyone decides to make a transaction of $20 million today, the cost of that transaction and value of that same fiat currency is already known and other procedures can be taken to control volatility. It differs in the case of cryptocurrencies, sending the same amount with most of these cryptocurrencies may cause an effect on the value of that coin.

But What Is Liquidity About?

The word liquidity simply refers to how the buying and selling of an asset is allowed in the market at a stable or given price. When large orders are placed on an asset with low liquidity, the market tends to be very volatile, resulting to the change in price of that coin, but in a very high liquidity, there is a less volatile market, as prices do not fluctuate, leaving a conducive market for traders and investors.

In order for significant amount to be transferred into or out of an exchange, the challenges facing liquidity must be tackled, as the amount of some cryptocurrencies in some exchanges tend to run out, and traders are forced to complete a single transaction in a number of times than expected.

Trade.io is solving this problems with a trading platform the has a very large liquidity, also allowing their users to benefit from the liquidity pool.

The Trade.io exchange has brushed up a lot of unique ways to maintain liquidity on the exchange platform. They have a lot of promising investors, traders and partnership with tangible financial institutions. The trading and investments on the platform will be mostly done by highly reliable participants that will maintain the high liquidity of the exchange.

Furthermore, since the platform will be housing tokenization of different project and also listing of these coins on the Trade.io exchange, there will be extensive research on these projects that will be listed, so they can be good and likewise attractive to invite more traders and investors to the platform. The platform has expertise that will be able to run effective research and evaluate all the coins and their future before being added to the exchange.

How Will Users Benefit From The Liquidity Pool?

Trade.io has great plans in creating a sustainable liquidity in the platform and also a liquidity pool for it's participants to benefit from it, rewarding all Trade tokens (TIO) holders. The liquidity pool is also advantageous to the TIO token because it creates high demand for the token and also reduces dumping.

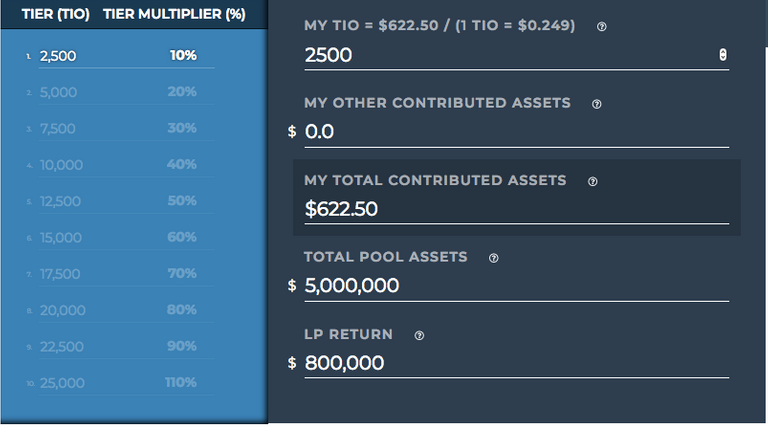

The liquidity pool will be made up of members that hold a minimum amount of 2,500 TIO tokens, and also a membership fee, which might reduce overtime. Members can also participate in the liquidity pool with other cryptocurrencies, but lower reward is generated as to using the Trade.io tokens. Every participant will receive their daily reward in proportion to the result of their share in the liquidity pool.

All profit differs according to the amount of TIO invested into the liquidity pool, to acquire more profit, a participant will be required to buy more than 2,500 Trade.io tokens (TIO). The platform rewards are distributed according to the table below, with an additional 10% profit for participants with more than 2,500 TIO.

The Trade.io Ways Of Increasing The Liquidity Pool's Income:

- Spreads

- Commissions

- Aggregation

- Risk positions

- Margin Interest

- Transaction & Placement Fees

Spreads represent the difference between the purchase and sale price of the exchange platform, 50% of the profit made from the transaction spreads will be moved to the liquidity pool, hereby sustaining the profit of participants. The platform also make some funds from commissions, this charges will also be moved to the liquidity pool.

The Trade.io platform combine unmatched orders of little amount into one large order before they are passed back into the liquidity pool, this maximizes the value of every transaction without regards to the size while increasing the liquidity pool. Many brokers tend to hedge trade risk for customers in order to make profit, Trade.io is using complex proprietary algorithms and expertise to manage risk

The Trade.io platform posses an e-wallet that enables their users to take credit in a secured manner, the credit collection works i a peer2peer manner, 50% of fees generated from this lending program is issued to the liquidity pool. As investment banking will be among the features of Trade.io, there will be a fee on transaction and placement of company tokens. These companies will also keep their assets locked down in order to receive Trade tokens, hereby increasing the value of the Trade Token.

Conclusion:

Trade.io is creating a seamless and conducive exchange for traders with the aim of keeping a high liquidity exchange and also a rewarding liquidity pool, this will be attractive to experienced and less experienced traders/investors. The ways of increasing the liquidity pool are so unique and transparent, hereby making the exchange sustainable.

For more information and updates, visit the following Trade.io links:

Website: https://www.trade.io/

Twitter: https://twitter.com/TradeToken

Facebook: https://facebook.com/trade.io

Telegram: https://t.me/TradeToken

Medium: https://medium.com/@trade.io

LinkedIn: https://www.linkedin.com/company/11296933/

BitcoinTalk: https://bitcointalk.org/index.php?topic=2367245

Thank you.

Sounds interesting...

Hi @xpency!

Your post was upvoted by utopian.io in cooperation with oracle-d - supporting knowledge, innovation and technological advancement on the Steem Blockchain.

Contribute to Open Source with utopian.io

Learn how to contribute on our website and join the new open source economy.

Want to chat? Join the Utopian Community on Discord https://discord.gg/h52nFrV