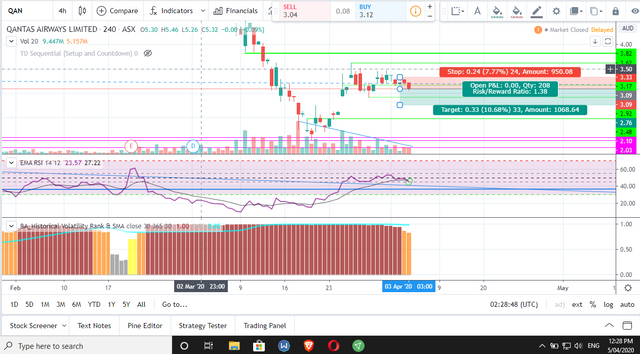

Trade went the other direction.

first thing i notice, that could have given me a early signal the trade was going to go the other direction would be the next 4hr candle of volume showing green and larger than the two previous volume candles.

also noting the wick on the same "next" 4hr price candle, a wick is like a mini support or resistance zone . rsi regaining the ema is also a sign of strength.

volatility still contracting, price moving upwards, volume not as neat trend down - no bearish divergence.

Hypothetically if I had not switched to bullish or closed trade instantly with the green volume, wicking candle and gained ema, I would have been stopped out of my trade at the higher level stoploss which is not ideal. a positive pnl more and more difficult to attain long term so minimization of loss is key, closing a trade first sign of weakness is aggressive loss prevention.

Identifying real weakness is the hard part.

to re-enter a short hoping that there is only one drive to the upside when the rsi enters the overbought?. The trend is your friend, but the micro 4hr rally, floating slowly up? or the greater bear market trend?

I do however think that the re entry on overbought may not be the best edge theory and I would like to develop -re entry skillset. Past trades have been re-entered 3 or more times with tight stoploss before having that trade go into profit.

Even if this has played out with larger wins, truly identifying resistance, failed drives into new support seem to me to be where the nuance lies in capturing a very nice entry point

I have heard being fluid in your bias' and direction is essential to good trading. with a 4hr trend up, the short being faded on low volume, loss of ema on rsi then regain, a higher low, I would almost think that auto go long in that moment may have been the best option to trade.

Please comment and critique!