Do you give any credence to this I saw yesterday on Zerohedge that, “not everyone is convinced [...] that The Fed is done,” and that “The Fed's dot-plots are vastly out of line with what is priced into the market”?

Fed is caught between the need to pause or lower rates because of the global slowdown caused by the rising rates and the short-dollar vortex which is causing a spiraling up demand for dollars and dollar denominated investments such as USA stocks, and the surge in inflation caused by the stimulus to the USA economy by that influx of demand for dollars (and the resultant strong dollar making imports cheaper). So because we are about to see Europe and Japan fall over the economic cliff by 2020 in a severe recession, the Fed is going to have to ease (perhaps at most to just below 2%) but they will eventually have to reverse course and start raising again. As Armstrong recently wrote, from 2020 to 2024 will be global stagflation. There’s an elaboration about the cause of this coming stagflation at the bottom of my blog Countries Vulnerable to Economic Devastation Soon.

So we have a choppy pause in interest rate increases and perhaps slight easing into 2020, and then after that rising rates again because of short-dollar vortex causing massive inflation in the USA. The rest of the world will be in a serious recession, especially Europe is going to be sliding into the economic abyss. Appears the UK refuses to break free and will choose to go down into the abyss with the rest of Europe.

Yeah, I was reading about this. Seems encouraging. Hope it turns out that way.

I don’t know if you had seen the further edits I made to my prior post (the one you replied to) such as quoted below:

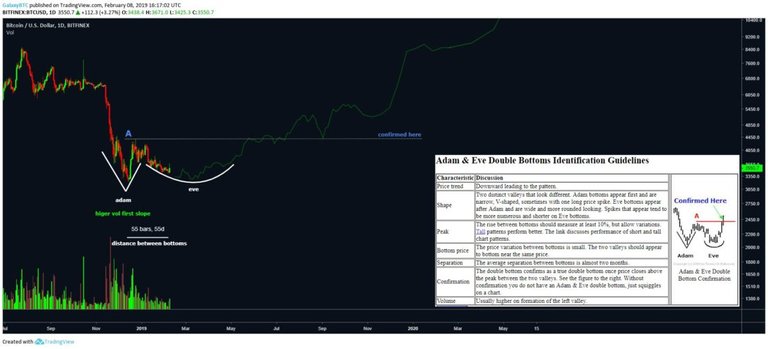

EDIT#4: Price breakout to the upside of the downward channels and bullish wedges is very likely imminent tomorrow Feb. 8. Volume has also shrunk to the lowest in years, so any burst in volume can lead to a spike up.

Well that ended up being exactly what happened and the market was shocked:

So that’s bullish flag breakout from bullish declining wedge, but as has occurred several times already, it’s like to be bull trap topping as I previously stated, “between $4800 and $5400, before retesting the [~$3000] bottom again before the potential summer lift-off at a year before the halving.”

Note that the downward mathematical slope of each of the bearish wedges depicted above is reducing (i.e. the slope is less steeply downward) going forward in time. The latest instance is nearly horizontal. This IMO indicates the bottom is ~$3000. This is likely the last downward bearish wedge of this crypto winter.

A bull flag often marks the pause at the halfway point of the up move, so that projects to ~$4250 where there’s considerable congestion:

So it’s likely to get choppy and stalled for a while in that congestion zone before making the move to the topping. Yet some will paint a bullish scenario like the following which can provide the bullishness demand to form the trap to make that final push to ~$5000 before the retest of the ~$3000 bottom:

P.S. The SEC is warming to a Bitcoin ETF with two commissioners now in favor.

Would be curious of new timing for ETF to watch. Good post.

Thanks for the reply.

Still unsure if we will or not. Nothing is certain. Complete chaos. Our govt is not fit for purpose. I'm hoping the UK can launch the lifeboat in time. All our mainstream media propaganda rejects "no deal" (the real Brexit), insisting it should be off the table, as the sky will fall in if we go ahead. Aagh!

Yes. I've been keeping an eye on that bullish declining wedge for some time - waiting.

It will be interesting to watch.

Are you active anywhere else? need to know where to look if you stop posting here.