On Friday 4th August 2017 the macroeconomic fundamental good news for the US economy helped the US Dollar make a strong rally and appreciate against its major counterparts, as there was a stronger than expected higher reading for the Non-farm payrolls at 209k, higher than the expectation of 180k.

The US unemployment reading was unchanged at 4.3% and Average Hourly Earnings on a yearly basis increased to 2.5% from 2.4%, while the deficit for the Trade Balance was lower than the expectation as well. These positive economic news helped the US Dollar make a strong trend and appreciate, and in the new week starting today the forex market will focus on these economic news to decide if this US Dollar strength is sustainable or it was only temporary.These are the most important economic news for Monday 7th August 2017:

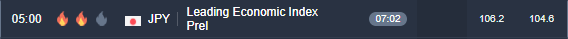

Japan Leading Index and Coincident Index (July)

Time: 05:00 GMT

Both these Indexes reflect current and future state of the economy, taking into consideration several economic indicators such as industrial production, retail sales, consumption and higher or rising readings reflect a better outlook for the Japanese economy and are supportive for the Yen. The expectations for both of these indexes are to rise, the Leading Index to 106.2 from 104.6, and the Coincident Index to 117.2 from 115.8.

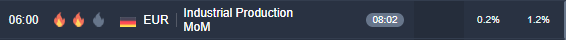

German Industrial Production (June)

Time: 06:00 GMT

The yearly reading for the German Industrial activity is expected to show a lower reading of 3.7% compared to the previous reading of 5.0%. Any higher than expected or rising Industrial Production reflects economic expansion of the German economy and is supportive for the Euro.

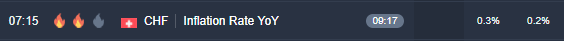

Switzerland Consumer Price Index (July)

Time: 07:15 GMT

On a yearly basis this measure of inflation is expected to show an increase to 0.3% up from the previous reading of 0.2%. Any higher than expected or significant rising reading will reflect inflationary pressures, being positive for the Swiss Franc as the Swiss National Bank may have to raise the interest rates to manage inflation.

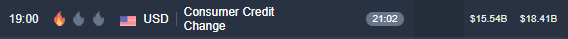

US Consumer Credit (June)

Time: 19:00

Higher or rising readings for Consumer Credit reflect higher consumer spending and confidence, which are positive for the economic growth of the US economy and the US Dollar.

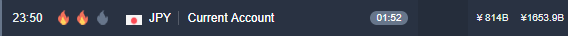

Japan Trade Balance (June)

Time: 23:50 GMT

The Trade Balance is a very important economic figure, with a surplus showing capital flowing into the Japanese economy with more exports than imports, being supportive for the Yen which should appreciate in the long-term. The expectation is for a large increase of the surplus to Yen 549.0 billion up from the previous reading of Yen 115.1 billion.

Nice post

thank you so much

Hi

hello bro

Hi! I am chandan kumar i have upvote and follwed u now u upvote my post and follow for good team work earning

Thanks, and I already do it :-)

i am upvoted and reply your post plz visit me

upvoted,reply,follow and resteem when you work in steemit thanks alot,

i am 226

Thanks, and I already do it :-)

Thanks, and I already do it :-)