Just one nugget from this unreal awesome paper by Mauboussin. He's from another planet.

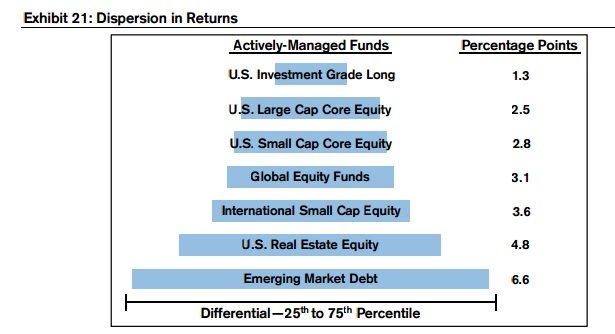

Exhibit 21 shows the dispersion between first and third quartile managers over the past five years for seven asset classes. The dispersion for emerging market debt funds is much larger than that for U.S. investment grade debt funds, and international small capitalization funds have greater dispersion than do U.S. large capitalization funds.

Where there's a larger dispersion, there are more opportunities for us (as active investors) to find abnormal returns (abnormal means; more returns / less risk in some combination). The table suggests it could be interesting to become an expert in emerging market debt or U.S. Real Estate equity. U.S. Real Estate Equity is one category that I did not expect to show such a large dispersion. Future cash flows don't seem to hard to figure out with tenants on lease... The gap between International and U.S. small cap is also quite large.