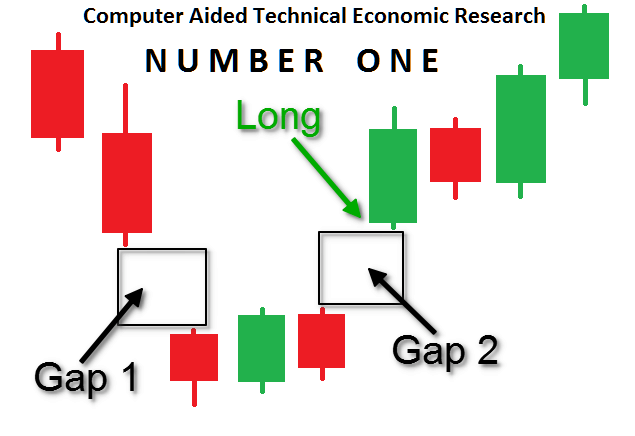

I did a major research on technical analysis about 25 years ago. It ended up in writing a paper called "Computer Aided Technical Economic Research", a term I coined because I was the first one to do this kind of work. Please refer to my article https://steemit.com/cryptocurrency/@bubke/computer-aided-technical-economic-research to know more about it.

Today, as promised, I will submit some results of that research. In fact I will talk about the unbeatable number one that came out of my research, the island bottom reversal formation. It is a signal that doesn’t occur many times but it is total bingo when it does. I will not post my results except for this one so be the lucky one to read about it. I think today is a very good time to learn about this indicator as I expect this signal to come around the 1st of August.

The most amazing fact about the research on this formation, is that I just took the general guidelines as you find them in books and on the internet, didn’t play around with any parameters, the results were astonishing…

In 100% of the occurrences of this signal (I hope you read that again, 100%!!!), an 8% upward movement happened within 40 days. That was the absolute minimum upward movement!!! I hear you saying 8% only? Well, in a world of buying/selling RIGHTS (think options, futures, Augur in these days I guess) or buying/selling short (please just google these terms, this post is not about that), you can easily double your money with a correct 8% prediction. And…that was the minimum!

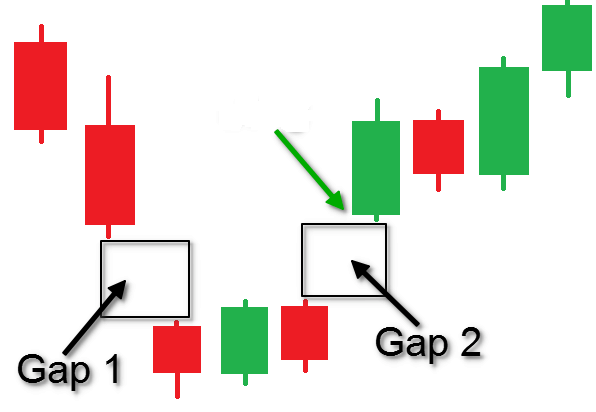

So let’s get on with it, what is this island bottom reversal?

To understand this, I will first speak about the concept of a gap in a candlestick chart. A gap is strictly an area where no trading happened. In a downward trend, a gap occurs when the lowest price of any moment is higher than the highest price of the next moment. All depending where the gap manifests itself, there are 4-5 different kind of gaps. An interesting one is the breakaway gap but in this post, we will look at the exhaustion gap.

What is an Exhaustion Gap?

An exhaustion gap is associated with a rapid straight up or down trend. When it is formed with heavy volume (no of transactions occurring), there is a good chance that the market is exhausted and that the current trend is finishing. Careful, it is not a strong signal to indicate a reversal, it just signals a possible ending of an up- or downtrend. Bitcoin had one in his last decline and 1st of August will be very interesting to watch for this again.

It is a perfect moment to look technically at a chart as it might be the frontrunner of a reversal. The formation I am talking about today is just that, it is the combination of an exhaustion gap followed by a breakaway gap.

What is a Breakaway Gap?

A breakaway gap occurs when the price is breaking out of a price range in which the market has traded for some period of time. To break out of these areas requires market enthusiasm which translates into many more buyers than sellers for upside breakouts or more sellers than buyers for downside breakouts.

Volume will (should!!!) pick up significantly, for not only the increased enthusiasm, but many are holding positions on the wrong side of the breakout and need to cover or sell them. It is better if the volume does not happen until the gap occurs. This means that the new change in market direction has a chance of continuing.

Ok, you made it so far, let’s finish it off.

What is an island bottom reversal?

An island bottom reversal is an exhaustion gap followed by a breakaway gap. As you can see in the picture, a little island is formed in the candle chart.

In my research which was some with 10 years of historical data, this is the strongest signal I ever encountered, there is no better moment to buy than after gap 2 and you will have to be fast. It doesn’t occur a lot but go for it when you see it.

In the cryptocurrency market place, there is no closing and opening price. Most graph websites, e.g. poloniex, allow you to play with the timing of your candles, put them to 24hr to reflect my research but I would definitely look for it with 6 or 12hr candles as well. Never forget to watch the volume, gaps have to go hand in hand with a higher volume.

Good luck and Congratulations!

First, to finish reading the whole article :-) Secondly because you will find my research results nowhere else as here on Steemit and you just picked the lucky post out. I might do 1 or 2 more but that will be it, I prefer to curate articles instead of writing them but I still miss a bit of better content, please do something about it and let me know, I will follow you gladly.

And here goes my classic ending. The best way to make money in life is to just do what you like and the money will follow. I am doing something I like today. I am here, you are here, we both write some stuff, we can say what we like, we can help each other, we can promote good content, we are getting a bit of compensation for it. We are actually using something which is already based on this most amazing blockchain technology, we are ready to say f@@# you to FB and the likes. Let’s start this revolution here and now!

I really start liking you ecotrain guys more and more!

Now there seems to be another trader in there and he seems to carry the black flag as well. Or is it more yellow-black?

Anyway, I feel like the bear who found the honey pot :-)

So much diversity and knowledge in the train, so many good articles already in one week.

If there is anything I ´ve been doing continuously since childhood, it´s reading and I know, here I am on the right train and the right track.

Why not also post this kind of topics under the ecotrain umbrella?

I think it would enrich and empower.

mm m good idea likedeeler

bub? maybe repost just with ecotrain tag

Come on, where is the ECO inside of this? :-) This is 100% VIP fun :-) I am not building out a blog or something but honestly, seriously, you found the honey pot :-)

MMM< interesting!

did u look at the crypto chart history yet for any gaps and similar comparisions?

That is your task, try to find me 1 example where the reversal didn't happen :-) As I said, it is a rare signal but it is very, very strong, it HAS to be in your arsenal. The bitcoin graph showed the 1st part of it when it went below 2000, this 1st part deserves already attention. The more classic signals get more power after that. In case of bitcoin, it broke out of a triangle and went back to current levels. Thanks for your upvote :-)

Thanks Bub

f@@# you FB and the likes.

Welcome to the revolution .....!!!

How rare is rare? And how fast is fast?

Congratulations @bubke! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP