Financials are uncomfortable with high debt and even more to finance the Time Warner acquisition. Add in rising interest rates and we will want to see more earnings growth for the dividend to be safe.

That said, the Time Warner court decision has the potential to change industry dynamics as it allows a new class of vertical competitor to compete in the advertising markets with Facebook and Google.

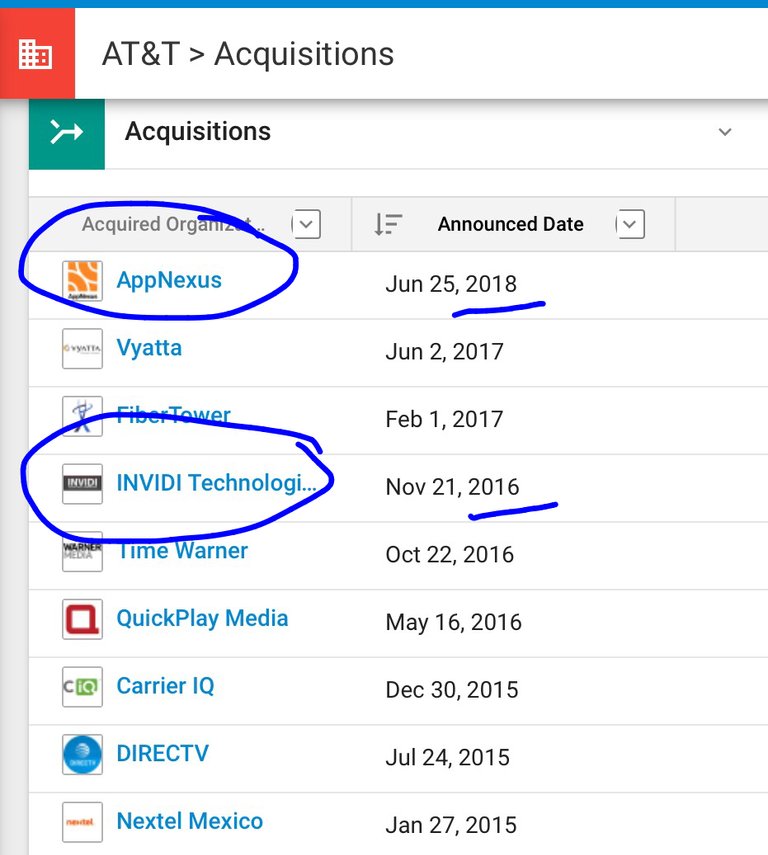

AT&T are positioning themselves for this. They have the customers. They now have the content once Time Warner closes. And they bought two ad serving platforms one of which closed in the last month.

That is why I am buying next week when markets open. The new stream of earnings will protect the dividend

I totally agree with you, the amount of debt is concerning. Another thing to look at is that mergers are often not that successfull and easy as people think. It is hard to integrate companies and company culture. I think the merger might be more costly and the share price will suffer in the short run. I want to pick up the AT&T stock as well, but I'll wait a little longer for the share price to fall further.