After breaking below key support, the floor fell out from beneath the entire market. Many issues were literally decimated. Closest to home, BTS, for example, lost a full 27% from the time the network entered unplanned maintenance mode, and STEEM lost almost exactly the same from the same time and in the same period. Those losses, by the way, are for the last 24 hours – they were already down by around 60% and 40%, respectively, from their highs! Crypto carnage that has still to see a capitulation climax!

I’m not too sure about there being a coincidence with the timing of the breaks lower, in fact, on closer inspection, we see that the general market broke lower on increasing volume exactly when BitShares went down. Granted, the market was most likely looking for an “excuse” as it was setup for a breakdown, but the catalyst nonetheless looks to have been BTS. Not good publicity for anyone, and hopefully a full and detailed analysis and explanation will be published shortly in order to begin restoring confidence not only in BTS, but in crypto in general.

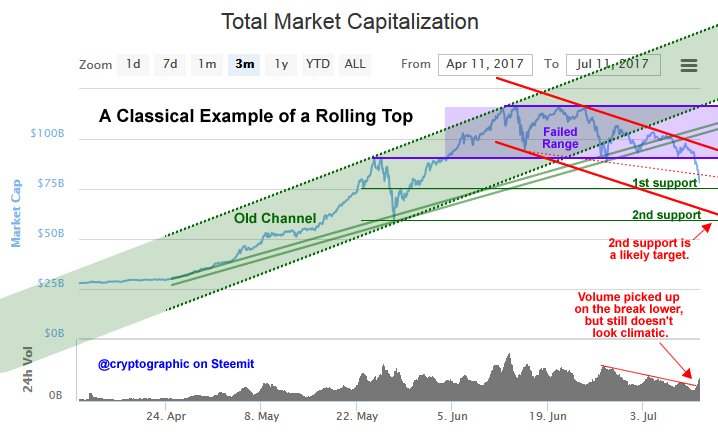

Now, that short aside having been said, let’s get back to the technicals and what the last 24 hours of price action means for all of us. Remember the channel failure I talked about in my post Crypto Channel Failure? Looks like it.? Well, we had our key levels clearly marked out for us, and, with that failure, we were either lightening up positions or getting ready to at a moment’s notice, right? And with the breakdown lower out of the horizontal range we did some hedging/selling, correct? If so, then our losses have been much smaller than most. Like I said in that post, I saw 2 principal outcomes, and the second, that the market would continue rolling over, is what has come to pass. Life’s a bitch sometimes, but if we stay with reasonable expectations and react accordingly, we can make it better. My portfolio is "only" down 11% in the last 24 hours (thanks to a partial hedging with SBD), and less than 24% from its recent all time highs.

Now what? First of all, DON’T SELL! This is where you should be buying, not selling. Secondly, I think we’ve entered into an intermediate term bear market (within a long term bull market, of course, as I’ve said a few times now) and, I for one, will be using bear market rules for the immediate future. What does that mean? Basically, it means selling rallies to raise funds that will later be used to buy back at lower prices, but, most importantly, it means capital preservation because nobody knows just how low things can go. Some issues I follow like LTC, PIVX, GRS, NLG and, believe it or not, STEEM, are still in bullish alignments, intermediate term, but with the general market tanking, caution is still very much advised even with these members of a very select club (BTC is also still technically intact from my point of view, but looking fairly sick and a break below today’s lows would have me put BTC into the intermediate bear category).

The chart below updates and visually illustrates where we’ve been, and where we might be headed. Again, IMVHO, this is not the time to sell, rather it’s the time to buy (or hold tight as the case may be) in order to be able to do some bear market scalping off the violent bounces we are likely to see, and, ultimately, to raise funds to use later when we start seeing intermediate term lows being put in once again.

Please leave your comments, input, questions, etc., below!

I agree that we should see some nice buying opportunities but we need to be careful as the bottom is probably not yet in.

This post received a 2.5% upvote from @randowhale thanks to @cryptographic! For more information, click here!

I agree that we should not panic. Markets are driven by fear and greed. This could represent a buying opportunity.