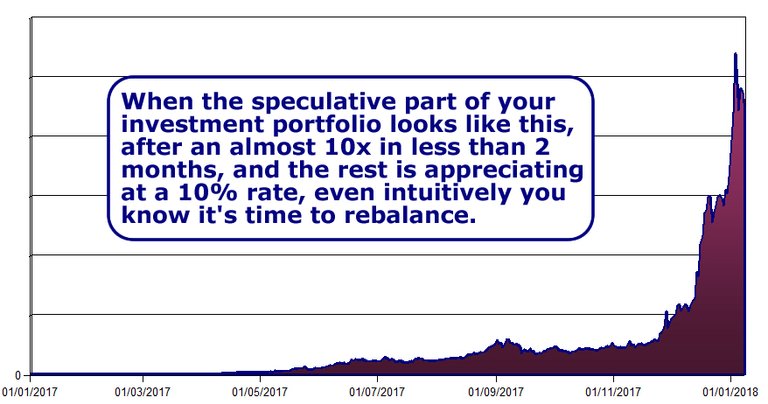

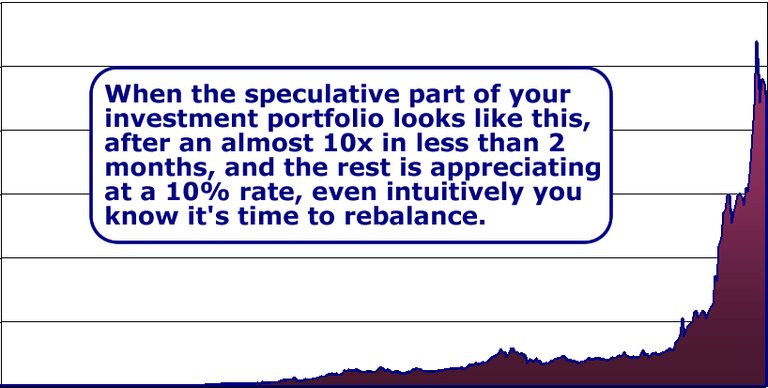

When the speculative part of your investment portfolio moons, you really have no choice but to rebalance your entire investment portfolio, that is if you are following best practice portfolio management concepts. See my Buy Low, Sell High post for more on that.

Being that my crypto investments are inarguably speculative, and since the speculative part of a balanced portfolio shouldn’t exceed 10-15% of the total portfolio, in the last couple of days I’ve had to completely rebalance my total investment portfolio. This required making difficult decisions, the first of which had to due with how much STEEM and BTS I was willing to part with. In the final analysis, the answer was “as little as possible”. That meant complete liquidation of some of my holdings.

this interview a few days ago, I also believe that POW is on its way out, so I cashed out of SYS (although they do have a planned conversion to a masternode type PoS, but it seems to be taking more time than initially thought), GRS, NLG and DGB. I also sold everything but a handful of ADA, in this case because I think it’s getting pricy.Basically my portfolio management criteria obligated me to sell around half of my total crypto, and since I wanted to hang on to as much STEEM and BTS as possible, I had no other choice but to let go of all of the older, crypto 1.0 holdings. Like @stan said in

In the end, I’ve brought my total investment portfolio more or less in line, but in doing so I've taken my crypto portfolio down to a very low level of diversification with STEEM, BTS, BitUSD, some SBD, and that handful of ADA. This could be viewed as a rather risky portfolio given the lack of diversification, but it just may be the case that STEEM and BTS move completely out of the speculative category altogether in 2018, in essence becoming members of the “growth” part of my total portfolio, leaving the speculative phase behind. Suffice it to say that I’m very positive on the future of both STEEM and BTS, and while I would not be initiating new positions at these levels, I’m not willing to sell them either.

Remember, the idea is to buy low and sell high, and especially so when it comes to speculative investments where buying high often means losing it all.

Hope everyone else is happily rebalancing as well. There are lots of profits to lock in. Remember, nobody ever went broke taking profits.

Yesterday I had a chance to read about DPoS, PoS and PoW. STEEM, BTS belongs to DPoS and build by Graphene's blockchain framework. Graphene is the fastest and the real time blockchain technology so far! Actually this is the future. I am not going to sell my BTS, STEEM to anyone! It will be precious in future, that's how I feel it!

@cryptographic,

One more thing! I wish to hear your review about EOS too! Coz I want to hear from genius like you do!

Cheers~

EOS is still very much in development. It's similar to ADA in that sense. I'll be looking at dip buying on intermediate term pullbacks in both, if we get them, and, if not, no big deal.

@cryptographic, I am planning to buy EOS and want to learn more about Graphene blockchain! @stan is a great reference for that! Yeah buy at dip, that's what I want to do too! I will check ADA also! It's concept also so powerful!

Cheers~

Great post! Risk management is always key in great investing. I enjoy reading your post but actually got a bunch of information from the comments section because you reply so much which is awesome! Thanks for being engaged with the community.

In case you missed it my BTS loving friend....here is @stan's latest.....

https://steemit.com/bitshares/@stan/bitshares-enterprise-alliance-part-1-alice-s-hero-hub

Everything ETH and BTC ever wanted to be . . . and never will!

Thanks for keeping me up-to-date!

I am a great fan of bitshares and I took this when bittrex delisted it and the price hit 0.06 but I took the position and it paid me well but I booked profit when it was 0.46 and after that it again sky rocketed to 0.86, so I think I lost opportunity but 7X is also not that bad, after all it gave 7X profit in just 2 months.

Sometimes "fear of success" emerge in when u hold a profit coin.

I like your modified crypto market cycle chart. Sometimes you've just got to tilt the chart!

I can call you a portfolio master because managing 10X return in just 2 months is not a joke, here people wait for years to get those return. And your a seasoned risk manager of your portfolio @cryptographic.

Thank you for sharing your risk management module here.

Steem on and stay blissful.

Nice market and economic cycle contributions. Thanks.

That's perfect way to deal with crypto market and we need to strike balance in between emotion speculation and intuition and you are kind of one who knows how to deal in a best way with these three.

Thank you @cryptographic for writing this good article. Have a great day.

Thanks for those market cycle graphs!

By the way, if you're a Wyckoff fan, this is something you might like (if you haven't already seen it): https://www.scribd.com/document/28001506/Anatomy-of-a-Trading-Range-by-Jim

Cheers

yes...yes...thank you so much for giving the link here...this is certainly my area of interest.

Thank you again.

@cryptographic Thanks for the update. Looked into bitUSD and wanted to ask if the position is a hedge for BTS. Do you expect the value of bitUSD to increase in price like SBD did, which were both created to peg a dollar in USD? I'd assume your bitUSD position will be used to sell rips in BTS and buy dips using bitUSD and trade within the BTS platform.

Also - with the proceeds from the sales, are you waiting to load up more in current positions?

The proceeds are going into real estate, which was underweighted, and which I view as a very safe long term hedge against fiat debasement similar in potential now to precious metals, or maybe even better. Not as good as crypto though, but much less risky, so there's a balanced trade-off there. On the other hand, you've got to make good picks, and in that regard, real estate is a lot like crypto, or stocks for that matter - location, location, location when it comes to real estate.

BitUSD is a much harder pegged instrument than SBD, but it could still get very scarce in a panic. That having been said, I've chosen to use it as a cost effective hedge against a crypto bear. Dry powder, as it were, with which to buy back on any major pullback. Syscoin will remain on my radar along with ADA and EOS, and if opportunities arise, I'll trade them. Neither ADA or SYS are listed on BitShares, so I'd have to go to Bittrex, for example, but that's no problem as they would immediately go to their respective wallets. I don't rule out other possibilities that we come across either, but, right now, I'm pretty bearish and I'd only be scalping if I did anything.

Congrats on the real estate made possible by your savvy investments. You truly practice the well-balanced portfolio mindset and I would have to agree that is the best way to go. A load of pressure was released after I re-balanced my oversized LTC and ADA positions recently.

May start blogging about swing trading in and out of BTS once I accumulate enough shares. Curious to know what % of bitUSD you have on the sidelines ready to buy a significant pullback.

Following best practice portfolio management has made all the difference in my life.

I've only got around 20% BitUSD right now (crypto only portfolio) basically because I'm so bullish on STEEM and BTS that I think they will be up even in a down market.

Good to know! Appreciate the info and guidance. I'll updating my technical analysis on BTS/STEEM and more in my posts. Trying to get into a routine of making daily posts: https://steemit.com/trading/@dirkboy41/bts-eos-steem-update-good-bounce-today

Hello @dennisschroeder,

Extraordinary good article with exceptional advice. The graph you used gives a clear idea about what you want to tell us.

Here I'm attaching BTC graph of 2017 - 2018, as you said yes, after we made the profit better take the profit & re-balance the portfolio. You did the best method of Risk mitigation a best trading experience & exceptional risk management lesson as well.

.jpeg)

Your viewpoint of 2018 crypto world is exceptional either. You understood PoW is the expired version & now it's time of BTS, STEEM and few other new generation cryptos. This is the most extraordinary good article I read about the preparation to welcome 2018 crypto world. Specially you did it with an idea. Impressive & absolutely a brilliant thought. Thank you.

~@mywhale

Risk management is the name of the game!

Yes, I think this could be the end of the line for POW. 2018 might not just be a big year for the transparent and fully compliant cryptocurrencies, it might also be the year of the big shipwrecks for those who are at the opposite end of the spectrum, and if they're POW, probably guaranteed.

That BTC chart is an interesting parallel, but we need to keep in mind that was a 1 year 20x at highs, compared to my Alt portfolio which was a 1 year 1,000x into highs (just a 10x in the last 2 months). The model portfolio posted in May on Bitcoin Forum was a 100x. I didn't have much choice other than proceed with a massive rebalancing.

This gave me a sigh of relief.

I was wondering if you were going to sell them...I am glad I am not the only one who is super optimistic on both. Hodling them, to me, is a no brainer. In fact, they are the part of my portfolio that I think will provide the high multiple returns. I still have a bit of BTC and ETH (wish I had more the way that one is running). If I am overweight in anything it is LTC which I still have a decent holding in (number three in terms of total dollars behind STEEM and BTS.

My hodlings in dollars...

2, BTS

Yeah, I guess that when it gets down to brass tacks, I still view both STEEM and BTS as strong buys at this point, and I can't really say that about anything else - of course, I'm not abreast of everything out there either so I'm sure I've overlooked something.

I have been looking at PRE a bit closer...I dont have much but a small position is forming.

Decentralized search is a rather interesting project... a multi-year development time.

i invest and reblanced nicely between the top crypost cardano seems to be my currently top favorite and then iota is yet to show its upward moves apart from that some new coins like ethlend,electroneum holding for long what else you would suggest for long term holding

The only thing I can say is be careful. Fully research and understand what you've got. There are going to be nasty surprises in the coming months and years. Huge blow-ups will happen, and it's never pleasant to be part of them. Cardano is a peer reviewed, mathematically proven safe crypto with huge potential and that I think is here to stay, but a bit pricy right now in my opinion. Price aside, I put it up there with STEEM, BTS and EOS as one of the best.

My brain says that you have done stupidly, but your heart understands. I can not understand why, but I have a premonition that steem is able to bypass all the crypto-currencies in the capitalization race, even bitcoin, and get off to the clean first place. Appreciate life. Good luck to you and good.

Me too. That's why I sold very little STEEM.

The question was: get greedy and risk losing a lot, or play safe and risk missing out on making a little bit more? Just a little bit more because if our premonitions are correct, the gains are going to be so big, that my recent profit taking is going to look like peanuts. 😉

Good post HR/Cryptographic, I have been mulling re-balancing the portfolio as well following a recent run up in the speculative part.

You mentioned that you cashed out of SYS, GRS, NLG and DGB and have most in STEEM and BTS.

Just curious, did you convert what you had in SYS/GRS/NLG/DGB into BTS & STEEM or converted into fiat so that you can buy another set of coins later?

Took it to fiat to put into real estate.

It is true that PoW is becoming obsolete day by day and that we should be moving to PoS soon. I find ADA a pretty good choice. Tge rest are awesome, even though they may not be so bulltish. I would also go for XLM as it seems very bullish too, even though it has a big correction now. Nice time to buy isn't it?

Oh, I don't know if it's such a good time to buy or not. I like low risk, and when prices are high, that's hard to find. That having been said, there are still lots of cheap coins, but how many really have the potential to become a top 5 cryptocurrency in the future? Got to find undervalued crypto that has big potential, and once you've got that, I guess any time is a good time to buy . . . although the overall market's health can still have an impact one way or another.

Yep, I have kept an eye on Cardano's ADA even since it was on 20'th place. Now that it got to top 5, I don't know if it can grow much more from here, but I can hope for a small profit. For sure other coins which are undervalued right now, have much more potential to bring good profits, just as you have said. But this is so hard to find, I guess a lot od research effort has to be involved in the process...

Yeah, and then there's the idea of trading, which I didn't mention above. In that arena you can play the cheap coins for a pop higher here and there, but always keeping very much in mind that you're playing with a "shitcoin" and doing your best not to become an accidental bag holder. Just recently I remember seeing a couple of folks talking about DOGE when it was around 20 SAT last October. Well, it recently hit 100+ once again, but that was after it spent a couple of months trading sideways and as low as 15. That would have driven me nuts since I consider DOGE's long term viability to be questionable. (That having been said, it is still theoretically about 200 times undervalued.) For someone with the time to monitor it closely with the trading experience needed and trading in appropriate size, that was a good trade. I have a very low risk tolerance and I'm very conservative, don't have the time, and the size that would be appropriate for me would make it a waste of my time. Sometimes it's better just to stay away, and, in fact, the inverse is almost always true: never try to rush things when it comes to trading and investing.

When someones portfolio is up 5-10 fold, be crypto, be stocks or other paper, one could have hard time going wrong, converting at least some smaller part of that gains into some kind of tangible assets that you have physical ownership of.

Silver and gold comes to mind, since they are showing some signs of life again. This would be a position for a next few years - diversification. Or maybe a piece of land somewhere. Something tangible.

Interesting analysis! I have also approached crypto as just a part of my overall investment portfolio and theory (hoping to write some fuller blog posts on this soon) and also a hedge against the overall equity markets. Since the question is increasingly when, not if, the equity markets will correct, wondering if you (@cryptographic) or anyone else view crypto as a sufficient hedge as well (as opposed to just a speculative investment)?

I've historically leaned towards commodities to hedge against equities but see some value in crypto as a hedge, despite the higher volatility.

I've got a lot of cash on hand earning practically zero interest just in case we see a "cash is king" moment somewhere down the road.

I can remember years when I look at rebalancing with a suspicious eyes. Perhaps the previous year's market-driven trend may be stronger in the next year, for example, so I want to let the winner run for a time without any sales. But look back in 2017 and I have no general obligation to move forward in 2018. I hope to revisit the most important sectors in the new year like the new year of 2017, since they are near the very precious market.

upvoted and resteem

When the market is growing, we are in favor of our tolerance for instability, and when markets are shrinking, we feel very scared.hey great man @cryptographic ......................... good topic and useful information.

upvoted // resteem

I have no good trading knowledge Sir... But with your guidance I went to step by step selling & with low risk I made that nice profit... Sir portfolio re-balancing I never did before... I'll do it as you said Sir... With your guidance I know I can make a good profit, with basic trading knowledge Sir... Thank you for giving us this wonderful opportunity Sir...@cryptographic - Sir, you are the person who told us about maintain a crypto portfolio & I did... Sir nice to tell you it worked me well Sir... As you said I decided to convert 0.2 of my BTC & buy few small coins... (Less value) it made me huge profit in 1 month of time Sir... 50 times profit I made by following your methodology...

+W+

Have you looked at gold? I had to Google that BTS was bitshares. lol

You can buy BitGold on BitShares.

. . . and it's probably safer than anything out there that isn't physical.

Is that the one Peter Schiff is promoting? I'm a fan of the gold miners until February ends. Thank you for the huge vote by the way. :) Hopefully someday I can return the favor when my earning finally come in. lol

Very greate information bro..when i was entered into the cryptofield that time the market is very low and the most the peoples are dont now about the crypto and what is the crypto ..in my country if i said to any one about crypto all wwre saying its a fake ita a not legit but now every one want to invest and every one want to trade on the crypto..the fever which is spreaded around the world like this..anyway thank you for sharing info with us...@cryptographic

Interesting, crypto is actually a decent chunk of my portfolio, more like 20% but I'm a small fish. I also am with you on BTS and steem but hold others as well because I like them.

I think EOS is gonna blow us away so want to stockpile more of that. Steem I'm just getting here, thought I'd see how well I could do without investing in it to begin with, but I'm regretting not buying at $2.50. I'm just waiting for BTS to get going, I think it needs some love from people.

excellent idea to rebalance the portfolio & mainly focus on steem & bts. world is seeking for fiber optic performances in transactions. not copper type transactions like btc & eth ;) @cryptographic

reteemed & upvoted & commented & followed@resteemia

Hi @cryptographic ! You are doing things that are difficult for the initiated trader and even for good traders. Selling entire parts of your portfolio to put all the energy on the top cryptos for you, and I am with you on Steem and BTS being the best and fastest of all crypto, and we are closer to the time when huge loads of people start to realize! SMTs will be huge for this.

Regards, @gold84

Note: I sent you a couple of more comments on previous post this last days, and I imagine you have not seen them, right?

Interesting, crypto is actually a decent chunk of my portfolio, more like 20% but I'm a small fish. I also am with you on BTS and steem but hold others as well because I like them.

I think keeping BTS and Steem for the long run is a nice idea because tehre's no competitor for steemit as such and this si doing really well. Although, we have a lot of spammers and what not but that is bound to happen. Overall I think EOS, Steem, Litecoin are going to cut through in the long run. I want to buy a lot of stuff but then gotta save up for all of that haha!

Steem coin $100 up this year.

My porfolio consists of 2 things: 75% I hodl, the rest I daytrade.

great information thanks for sharing upvoted and resteemed

This is so great! You got the great point here......

owo GOOD WORK my friend keep it up

You're so incredibly intelligent! @cryptograpic thanks for share!!1!

thanks for info @cryptographic

I bought Ripple at a bit of a high it seems guess i'm just going to have to hold......

@anikearn - I think you are in a wrong train lol :)

+W+

@cryptographic good news

This post has received gratitude of 0.48 % from @appreciator thanks to: @cryptographic.

This post has received a 12.50 % upvote, thanks to: @cryptographic.

This post has received a 3.3 % upvote from @boomerang thanks to: @cryptographic

This post has received a 1.16 % upvote from @booster thanks to: @cryptographic.

Steem Bot Tracker websitevote for @yabapmatt for witness!You got a 1.61% upvote from @postpromoter courtesy of @cryptographic! Want to promote your posts too? Check out the for more info. If you would like to support development of @postpromoter and the bot tracker please

@ cryptographic Out of the 4horseman (ADA BTS SYS STEEM) do you have any favorites?

I'm debating re balancing my portfolio, but keep wavering between my decision. Plus, I'm still looking to allocate some long term capital...

Decisions, decisions...

Also, what did you mean by, "We'll have to wait and see, but right now I'm thinking that it might be a good January (for you know who), or at least not a bad one." Didn't catch this one...

Not got that much of it but yes it does indeed feels good to go high up once portfolio rises .

Got Smartcash ,Ethlend ,ETN and ofcourse Steem looking quite good for now ,hoping to get into more !

Any Suggestions buddy !

Your portfolio made more profit according to my :( How you did it.

This is something that I need to do as well, but am questioning whether it’s the right move. I’ve been happy that STEEM and EOS have done so well on the speculative end of my portfolio, but like you, I’m questioning whether they’re actually speculative at all, or have moved up a rung. There is certainly no way I want to sell either, but thy certainly aren’t as stable as they could be.

Risk management is key. Gotta keep your portfolio in balance!