When you begin to speculate with trading altcoins and tokens, one lesson you have to learn is the importance of trading the right pair at the right exchange. While a digital asset might be listed on many exchanges, usually the bulk of the trading volume is concentrated in a particular pair on a particular exchange. Trying to trade an asset in a market that few people use is not a good idea for several reasons.

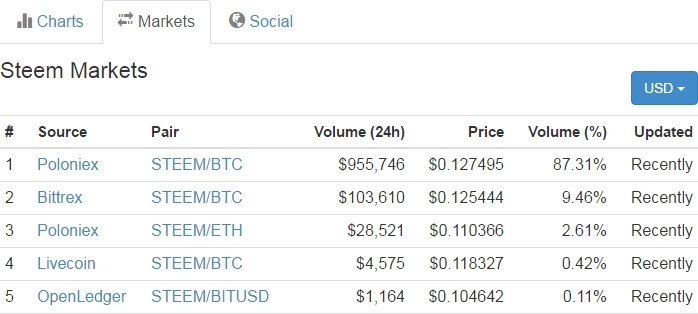

Let's use STEEM as an example. Coinmarketcap.com is a great resource for finding the best place to trade. At the time of writing, the "Markets" section of the STEEM page shows that Poloniex handles over 89% of the daily trading volume in STEEM:

The spread at Poloniex STEEM/BTC is currently 0.00000195 BTC and they have a very deep order book:

By comparison, the #2 market, STEEM/BTC at Bittrex, has a spread of 0.00000739.

Granted, this is still less than a penny USD, but it is common for such spreads to be much wider. A more serious problem is the very shallow order book. At the time of writing, this pair has less than 20 BTC in bids on the books. Placing a market order here will incur a lot of slippage. To avoid the slippage, you'll have to trade using limit orders which means you'll be sitting around and waiting for your order to be triggered. But, that could take a long time due to low volume.

Better to go where the action is, even if these means you have to deal with the hassle of using multiple exchanges.