I’m a firm believer in behavioral finance. This is a subset of finance that examines why people make irrational decisions. Out of this relatively new field of science, several important studies have emerged. In a series of articles I will go over some of the more important biases we as humans hold and how they impact our trading.

Bagholding AKA ‘The Endowment Effect’

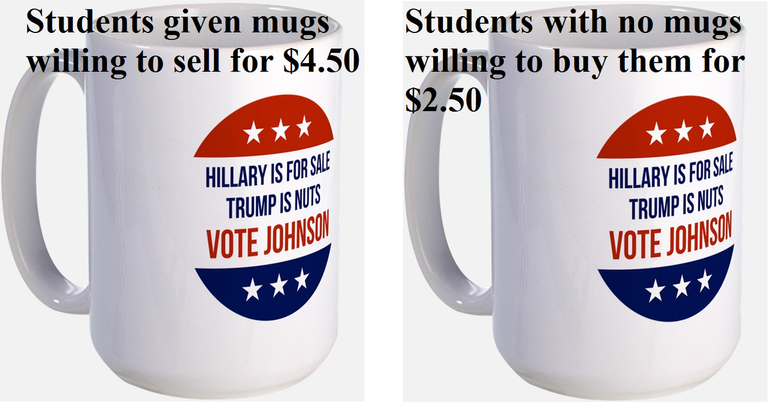

No the actual name of this bias is not ‘bagholding’ but ‘Endowment effect’. The endowment effect is means that people ascribe more value to things simply because they own them. In one study participants were given a mug and then offered the chance to sell it for pens of equal value.

Not the actual mug used in the experiment

After they were given the mug, Researches found that the amount participants required as compensation was approximately twice as high as the amount they were willing to pay to acquire the mug. Similar studies were done with other goods and found a similar bias.

How does this affect your trading?

What we learned above is that people ascribe more value to things they already own and this includes stocks, bonds and even bitcoin. How many times have you read posts from bitcoiners that eloquently explain their reasoning as ‘HODL’.

If you’re trading discretionary, you should set rules for exiting your trade BEFORE you enter. For extra commitment, consider writing down your exit rules, whatever they may be (technical or fundamental). Remember that once you buy bitcoin or other crypto-currency, your mind will start to value it more and play tricks on you.

Lot of these behavioral biases are interconnected. The ‘Endowment Effect’ It is somewhat tied to other biases like ‘Loss Aversion’ but we’ll cover that one in a separate article.

That’s it for now, please follow me at https://steemit.com/@forextrader for more posts. If there’s enough interest I will go over more of these biases and how they affect your trading.