The HaasOnline Trading Server (HTS) is a fully featured cryptocurrency trading platform that integrates a wide variety of trading tools and automation features. This article will show you how to create a more advanced setup with the latest version of the HaasOnline Order Bot.

School for Trader Development. When following this strategy, you risk maximum 5% of your entire portfolio on a particular idea. You take a position at Reload Zones or bottom of ranges and sell half your position every time the price doubles. You risk 100% of the position and have no stop loss.I will implement the Little Old Lady (LoL) Strategy, a venture capital risk management strategy that @bbeamish teaches in his amazing

I prefer even smaller trade sizes allowing me to own more different coins. Each coin/idea I limit to only 1-2% of my portfolio. If there’s extremely strong technical information to support bullish activity then will add on the W market structure. Max is 5% no matter what though. After working a while with this strategy, I did also modify the price levels when I sell more of my position.

By using the HaasOnline Order Bot I can automate the whole process. When the buy order gets filled, the sell orders become active right away.

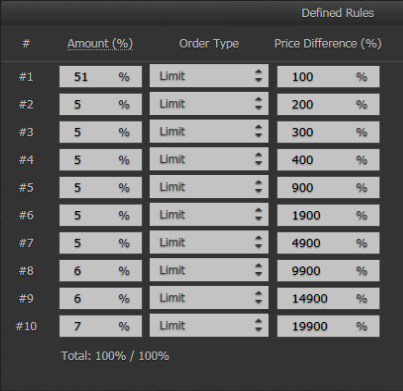

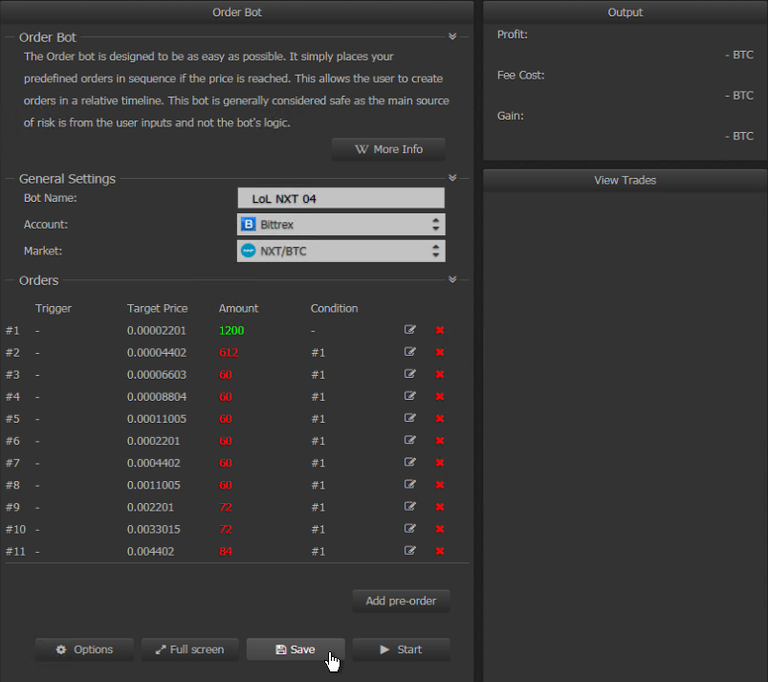

- Rule #1 - Get my investment back quickly: First sell order – sell half of the quantity (51%) that I purchased before on a double (100% price difference). This allows me to get a free position quickly and and will also cover the trade commissions.

- Rule #2 - Take profits on the way up: Next sell order is sell 5% of the initial quantity on a 200% price difference, then according to the table below.

There are several reasons why I did decide to automate the LoL strategy with the HaasOnline Order Bot.

- Exchanges like Bittrex don't like stale orders on their platforms. Once an order is older than 28 days, it will be canceled automatically by the exchange. A lot of these orders are placed to fake buy or sell support for specific cryptocurrencies without any expectation that they will ever get filled.

- Coinigy restricting pro account users to a maximum of 250 stop limit orders and no longer allowing trial users to utilize the stop limit order type and any more advanced upcoming order types.

- Many exchanges limiting the number of open orders per account.

When using the Order Bot, there is no need to refresh any open orders and there is no risk of reaching the limit of open orders. The order bot places the individual buy and sell orders only when when the pre-defined target price is reached.

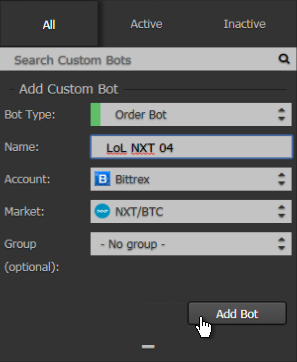

We create a new bot by selecting the Order Bot type from the custom bots and selecting the account and market.

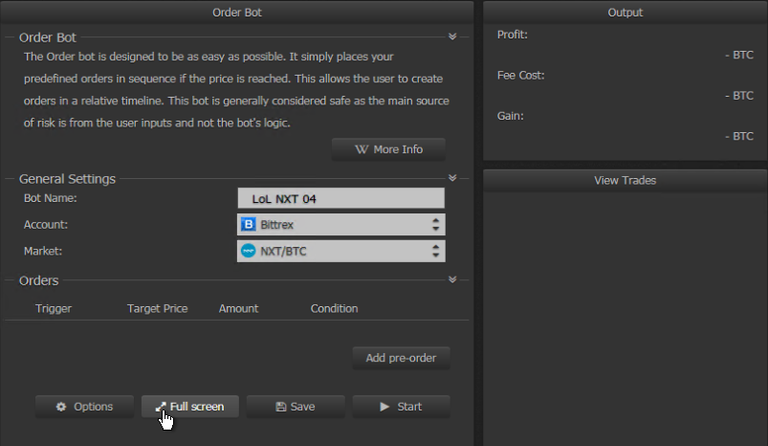

We need to go to the Full Screen mode to find the advanced options.

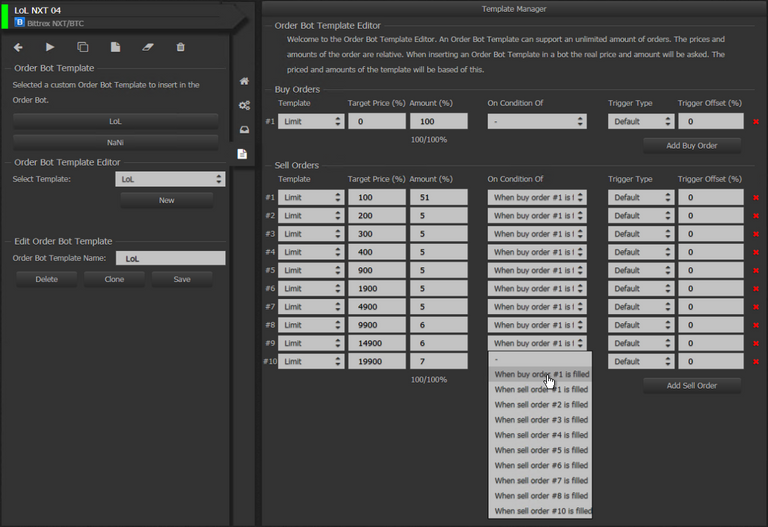

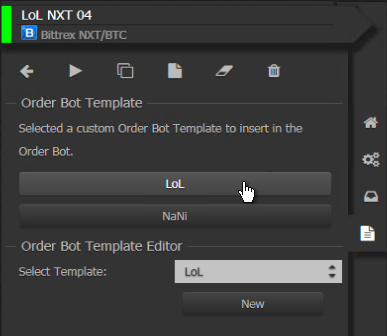

When creating the first bot with the LoL strategy, we need to create an order bot template. Here we can define the buy and sell orders, the prices and amounts are relative and will be converted based on the price and amount that will be entered when using the template. The template needs only to be created once.

After saving the order bot template, we can use it to insert the order lines into our order bot.

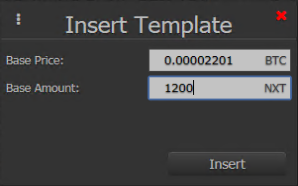

We enter the base price and amount, in the case of my LoL template this is the amount and price where I want to buy the coin.

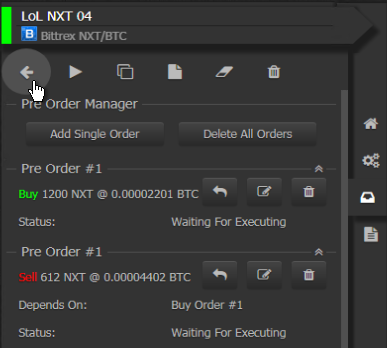

After selecting the Pre Order tab, we can see our buy (green) and sell (red) orders on the chart. On the left side, all orders are listed.

Now we can leave the Full Screen mode again.

On the start screen, we have a pretty overview of all orders with the target price and amount. Better save than sorry, we click the Save button to be sure everything is saved. Then we can click Start to activate the Order Bot.

We're done, now we have an Order Bot active that will first buy the defined amount of coins at the target price. It will after the buy automatically execute sell orders of portions at the pre-defined sell levels when the price reaches the target.

One last feature to mention, the allocation of the needed currency to buy will only be done when the target buy price is reached. This allows you to create Order Bots for many markets exceeding your current available coin amount and therefore give you a possibility to increase your chances to buy some of these coins when they reach their bottom of the range.