Hello there!

Today we will take a look at the very basics of trading using technical analysis. you will learn what types of traders figure on the market and what kind of charts and patterns are they looking at. This is a very important part of TA and many people overlook it. I even heard youtubers, who litteraly teach TA on their channels, advise you to pick a timeframe where, and im quoting this, "the chart looks good".

What is Technical Analysis?

It's analysis that focuses on the statistical analysis of price movements.

Technical analysis may appear complicated on the surface, but it boils down to an analysis of supply and demand in the market to determine where the price trend is headed. In other words, technical analysis attempts to understand the market sentiment behind price trends rather than analyzing a security’s fundamental attributes. If you understand the benefits and limitations of technical analysis, it can give you a new set of tools or skills that will enable you to be a better trader or investor over the long-term.

Types of traders

In order to understand what diference is in using different timeframes, you need to understand what types of traders use TA and how they use it.

1) Scalpers

- Most short-term traders

- They trade against every other timeframe and don't care about fundaments

- Trading with huge positions and they leave them open for seconds or minutes at maximum

- Largely taken over by computer algorithms

2) Intra-day traders

- They start and end every day with all positions closed

- They add liquidity to the market

- Mostly oriented on TA

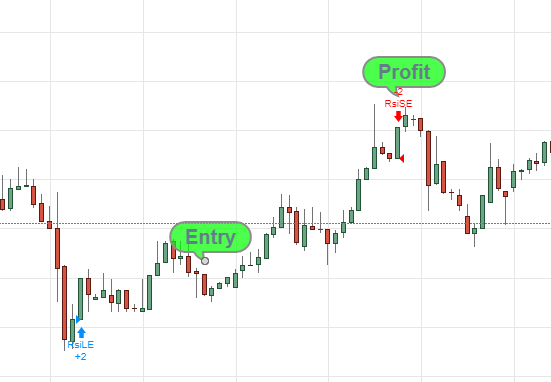

Typical intra-day trade for illustration would be this 2 hour position.

)

)3) Short term traders

- Also called swing traders

- Most risky and most rewarding trade in my opinion

- Timeframe is 3 - 5 days

- They open positions based on both technical and fundamental analysis

Typical swing trade for illustration would be this position, where in 4 - 5 days i made around 15% gain.

4) Mid and Long term traders

- Profit targets are much higher

- Timeframe is in months to years

- In most cases proffesionals, banks and other big institutions are in this category

Finally about timeframes?

If you understand every type of trader on the market then there is not much to explain. Instead i will just give you key points with a picture illustrating why is this important.

- You should always set a timeframe relative to the trade you are doing in your trading plan.

- Stick to your timeframe, but analyse all of them

- Never change your timeframe mid trade just because the chart "looks better"

Picture below illustrates different traders / timeframes on a single chart. If you are diligent with your analysis, you will be able to find entry points where more types of traders enter the market making your chance for succes exponentionaly bigger.

At the end of the yellow rectangle is the time when major resistance was being pushed through, so both mid term short term if not some long term traders will be looking for entry points making it relatively safe to assume the price will jump

I really hope this will help some of you

Thanks for reading

This is really good for starters. I, myself, started as a short-term trader since my mindset before was to earn money quickly. I use the profit for my guiltless spending or to invest in others. Great post! Resteemed! :)

Thanks!

Congratulations @grimmyx! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP