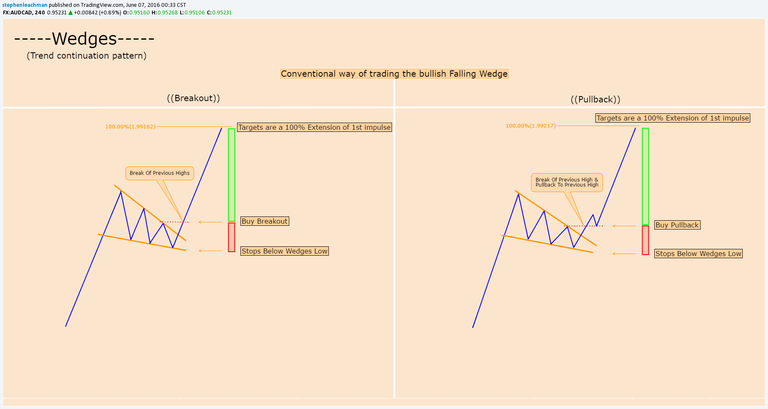

The wedge pattern is both a trend continuation and a reversal pattern, here

I will only talk about trend continuation. The wedge start with an impulse

move followed by consolidation and a retracement. the consolidation and

retracement squeezes price together forming a wedge . In a up trend the

wedge will fall calling it a falling wedge and in a down trend the wedge

will rise calling it a rising wedge . In any case ounce price breaks the wedge you

could look for a 100% extension of the initial impulse move

-----Breakout-----

(1) Wait for a clear falling wedge to form.

(2) Buy a break of the previous high.

(3) Stop below the previous Lows. (Low of wedge )

(4) Target is a 100% extension of the first impulse move.

-----PullBack-----

(1) Wait for a clear falling wedge to form.

(2) Wait for price to break and close above previous high.

(3) Buy pullback at prior high.

(4) Stop below the previous Lows. (Low of wedge )

(5) Target is a 100% extension of the first impulse move.

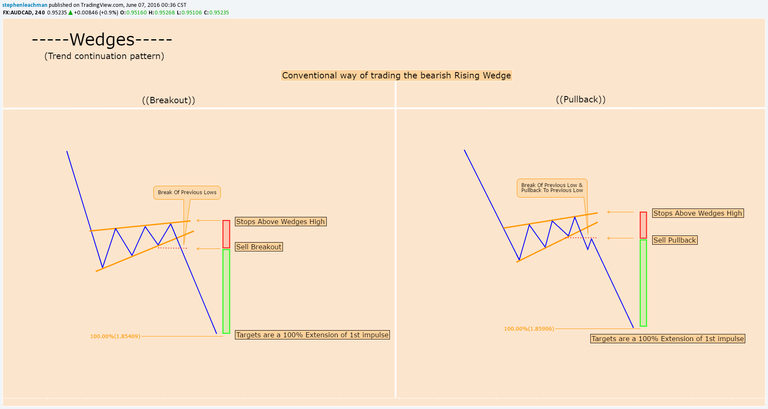

-----Breakout-----

(1) Wait for a clear rising wedge to form.

(2) Sell when price breaks the previous low.

(3) Stop Abouve the previous High. (High Of Wedge )

(4) Target is a 100% extension of the first impulse move.

-----PullBack-----

(1) Wait for a clear rising wedge to form.

(2) Wait for price to break and close below previous low.

(3) Sell pullback at the broken lows.

(4) Stop Abouve previous High. (High Of Wedge )

(5) Target is a 100% extension of the first impulse move.