I think now is the perfect time to look into one of the biggest stocks around, FB.

A quick background of my interest in this stock:

Trump a few weeks ago started to talk about the big tech companies getting on his bad side. You can see a quick example of that here:

LastWeekTonight on HBO posted a nice hit piece on Facebook that certainly rips them a new one. You can watch that here:

Meanwhile, there is a growing interest in search result bias'. Here is a simple example of that with Twitter's Jack Dorsey.

When you step back and take a look at this, there is clearly a growing push back against giant tech companies abusing the people. The time for them to answer for their actions may be drawing near. This could result in major moves in the price of these stocks.

One last big picture thing to point out is the lack of new users for Facebook. This will mean either the company has peaked, or they will have to get inventive and find new ways to increase profits. With tensions already increasing with government and the people, I think anything they try to do will hit a brick wall.

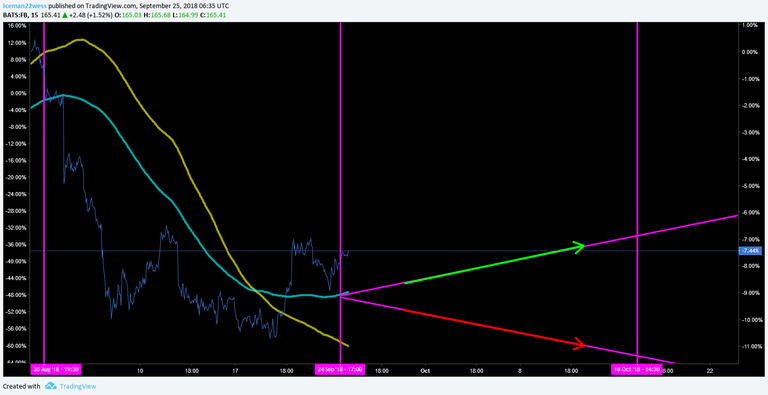

Getting into the stock chart itself, things are looking pretty cut and dry.

The purple lines suggest the two paths the moving average could go based on the OBV in a bullish or bearish correction. Either is viable. However, the price is $2-3 above the bullish moving average correction after just forming a higher low, and probably in the process of forming a lower high as the stock tries to cool off.

This paints a picture that tomorrow COULD be an up day, but if so, Wednesday and Thursday would be very likely to be down days. I think the play I am interested in here is taking multiple short positions, scaling in more as the price rises.

Shorting in the range of >/= $165-166

Taking profits around the bullish correction line ~$162-163

These targets could change slightly if the price moves right without volume in which both the entry and exit remain true, but would rise equally.

Two interesting trends in the OBV are also catching my attention.

Here, a solid downtrend was being well respected with a powerful breakout. Rather then retesting the original trend, it is now respecting a flat support with a 4th test underway at the moment.

In a bigger picture, this is actually a 5th test...

What does all that mean? Well, The price is making new lows, and the OBV is not, this suggests the price could be making a low, and getting ready to change direction back to the upside. However, this would be a signal to traders looking to trade for the next month or two bullish. Then again, the price is RIGHT on that support of volume, and investors may be much more interested in the dollar this week than FB. All in all, I think this raises some caution signs about taking a short position, but doesn't discourage me in a day trade. Scaling in more slowly and less aggressively would be the answer in this situation.

Morale of the story here is that the price action down has been completely justified by the volume and there is no reason to think this stock has any reason to go up quickly without strong resistance holding it back. The most bullish path I can see is a very slow grind up, while the bearish path has plenty of room to fall. This makes me very interested in a short position at the moment.

Thanks for reading,

-Icee-

Please leave me an upvote and remember this is not trading advice.

introduction post or the other great posts I already resteemed.Resteemed by @resteembot! Good Luck! The resteem was paid by @moderndayhippie Check @resteembot's