All along, price might have been the only thing you look out for when analyzing the integrity of a cryptocurrency coin. Well, you aren't totally out of context in doing that. However, there are some other pointers you should know and look out for before rating how well a coin is doing.

Market Capitalization

Market cap is the total amount of money invested in a cryptocurrency. Market cap is a representation of the total amount of fiat currency that a cryptocurrency is worth.

Market Cap = Price of one coin * Total number of coins in circulation

Price

Price is the amount it cost to get a unit of an asset; In this case, a coin. So the price of a bitcoin for example, is the amount it cost to get a BTC.

Circulating Supply, Total Supply and Maximum Supply

Circulating Supply as the name implies, is the amount of coins that are currently in circulation.

Total Supply is the total number of coins that have been mined.

The difference between Circulating supply and total supply is a bit dicey. The best way to look at it is that circulating supply is that value that depicts how much of that coin is in public hands (in the market). Some coins could be mined but not available to the public. For this reason, the total supply and circulating supply values differ (but by a very small amount). Generally, what you want to look out for is the Circulating Supply.

Maximum Supply on the other hand is the total amount of that coin that can ever exist. That is, the total amount to be mined ever.

Volume

The volume of a coin depicts the amount of that coin that is actively being traded over a particular time period ( usually 24hrs in the case of cryptocurrencies).

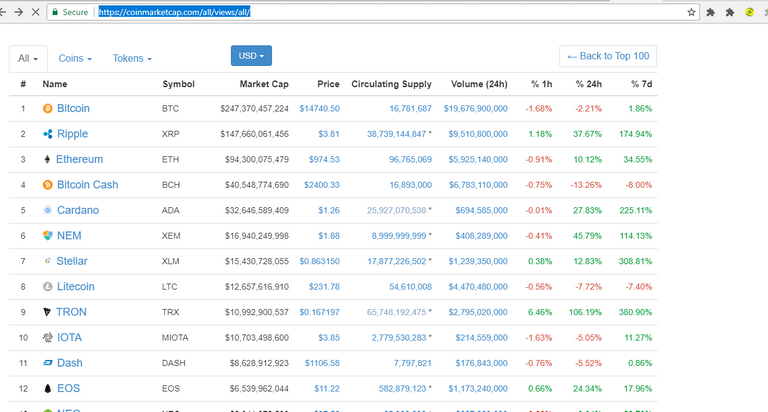

ImageSource

Top 12 coins in order of their market cap

What are their Significance?

The market cap tells you how successful a coin is. It shows how much value that cryptocurrency is worth. A coin could have a higher price than another but still have less market cap, and so therefore it is not as successful as the later. In going long term for a coin, you should always look out for its market cap. A coin with a very low market cap is one with less confidence from investors and consequently low potential to succeed.

So what affects the price?

The price of a coin is a function of the volume. As I earlier mentioned, Volume is the total amount of coins traded within 24 hours. One mistake many make is to assume that increase in volume means an increase in price. That is a wrong school of thought. Price is not proportional to volume; As a matter of fact, an increase in volume could result in a decrease in price.

Here's how it works...

Whether or not price increases, is a function of demand and supply. While increased volume depicts an increase in trading activities, it doesn't explicitly represent an increase in demand. It could be a greater number of people supplying to a less enthusiastic set of persons demanding. A coin's average price would only go up if demand for it superceeds the supply. Here's an example: If Mark Zuckerberg wakes up tommorow morning and declares that Facebook is going to adopt Steem as its currency for accepting advertisement fee, there would instantly be an increase in the volume of Steem coin. Many people would want to buy Steem. The demand for steem ultimately increases. However, not many current owners of Steem coin would be willing to sell their Steem coin as they now know the potential of their current investment. They'd prefer to HODL it. The ones willing to sell will do so only at a very high rate or nothing else. Demanders for the coin have no choice but to buy at that high price. Ultimately the price of Steem shoots up!

However, if investopedia makes a blog post that the CEO of shitcoin was involved in fraud, we'll also notice an increase in volume. Only this time, more persons putting up their coins for sale and less people wanting them; thereby crashing the price.

Where Circulating Supply comes in

Circulating supply is also affects the price of a coin. If a coin with market cap of $1M has 500,000 coins in circulation, then the price for one coin becomes $20. However, if the number of coins in circulation was 1,000,000 then the price of one becomes $1. The ability of a coin to grow in price now also depends on how many coins are released into circulation. Before investing, look at the circulating supply and the amount in volume of it, that is being traded. Investing in a relatively inactive coin market usually turns in the negative direction because an inactive market definitely implies low potential for a coin.

Before deciding to invest in a coin you should put into consideration all the market pointers and analyse carefully so you don't end up chasing a wild goose!

I hope you gained something new today. If you have any questions or contributions, feel free to shoot in the comment section below.

Please show some love by upvoting and Resteeming this post!

Gracias

Reference: https://coinmarketcap.com/faq/

STEEM WitnessYou got a 1.57% upvote from @upme requested by: @johnesan. Send at least 1.5 SBD to @upme with a post link in the memo field to receive upvote next round. To support our activity, please vote for my master @suggeelson, as a

Nice one

Great point. "Use case" is also important. Some coins have no purpose