Young Padawans, a very important lesson to be learnt is that being prepared is the ultimate defensive strategy; the Alt Wars can be brutal and leave much “blood in the streets”. For the uninitiated and the unprepared, inaction to protect one’s wartime assets could leave you with less resources and in a weakened strategic position.

Today we will master the art of shielding and growing our valuable resources, our financial holdings.

Not all of us are completely invested in crypto currencies, some may have holdings in the fiat zone and furthermore, some of you may be situated or invested in the unpredictable Eurozone with threats of Brexit looming on the 24th of June 2016 and may be concerned about the potential down-side and volatility. Well you should be…many fiat exchanges have issued warnings and increased their margin requirements as much as 5 times their normal levels in preparation for the worst scenario which may or may not present itself for the EUR and GBP currency pairs.

My personal strategy is to leave half of my Euro holdings in place and the balance to be hedged in another form.

Option 1 – Gold

Gold is a fairly good safe haven at the moment, there is renewed hype around this resource in light of global financial turmoil. Financial news publications are once again advocating gold investment.

For me, the easiest onramp to Gold holdings was to invest with Bitgold, where you can make direct international payments from your bank account to Bitgold, or fund Bitgold with a credit card and even with Bitcoin.

Your first deposit over 1 gram will entitle you to a once-off 5% gold bonus which offsets their 1% deposit fees and any bank charges you may have incurred and still allows you to come out with around 3% additional gold than you invested (own bank fees and currency conversion charges dependant) . So instantly you have your funds hedged in gold and achieved a 3% immediate growth, win-win. With Bitgold a gold-backed VISA card can be applied for and delivered worldwide at no charge, with 1% transaction fees as opposed to 3% transaction fees on other crypto currency credit cards.

I personally hedged one quarter of my EURO holdings using this method, I don’t earn any interest on my gold holdings but I benefit from hedging and any growth that may be realised in the value of gold.

Option 2 – Invest in a Dashpay Masternode

If you have 1000 Dash or roughly 7000 EUROS available you can invest in a Dash Masternode, otherwise referred to as the Crypto Bonds of the future. In layman’s terms all you are required to do is store the 1000 Dash in your Dash wallet and all the while host a Masternode on your local PC, a Raspberry Pi or a cloud VPS Server, depending on your preference. There are many how-to-guides on Google, I won’t get into the technical aspects here however.

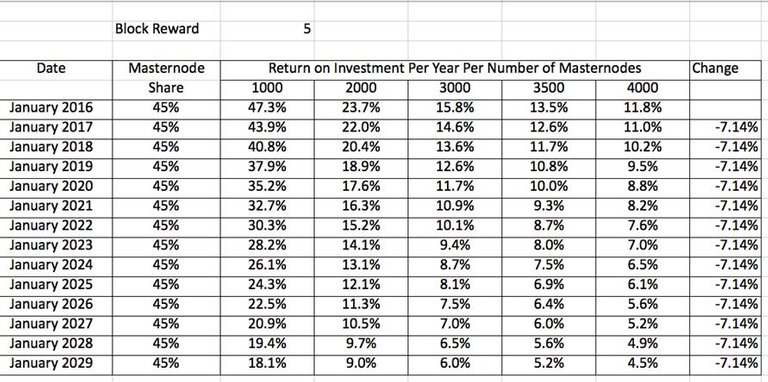

The table below will show you the current return on investment per annum in running a Dash Masternode.

Basically the Dash blockchain rewards you for your holdings of Dash (min 1000 Dash) with further Dash rewards which accumulate to the rates shown on the table much like a Proof of Stake (POS) scenario, however the Dash community calls it Proof of Service due to active voting requirements of node operators. If I am not mistaken, interest payout is effected approximately every 6 days.

Dash Masternodes are a nice decentral way to hold your funds and reap interest income as well as any capital growth on the value of Dash itself. The blockchain rewards masternode holders in proportion to the supply and demand of the number of Mastenodes in existence, the higher the Masternode supply the less the system has to pay to recruit more Masternodes. Currently there are between 3000 and 4000 Dash Masternodes, so work with the last column on the right, in our current year 2016 the annual return is projected to be 11.8%.

Dashpay as a crypto currency is less volatile than ETH and BTC at the moment, less controversy and has excellent DAO style corporate governance by means of masternode voting coupled with fast payment and anonymity features. As a stable alternative to EUR fiat while offering competitive annual interest, DASH may be a good option.

May the Fork be with you during the coming Brexit vote!

Original content written for Alt Wars by Ricardo Goncalves (TheCryptoDrive.com)

Resources:

http://www.bitgold.com/r/JwuQNi

http://dashmasternode.org

https://www.dash.org/masternodes2/

https://www.dash.org/forum/threads/masternode-on-raspberry-pi-2-model-b.4083/

https://dashpay.atlassian.net/wiki/display/DOC/TAO'S+SETUP+GUIDE+FOR+DUMMIES

Upvoted you

Excellent information. I've been considering running a Dash Masternode for a while, but wasn't sure about the ROI. Thanks for sharing the links.

no problem! :)