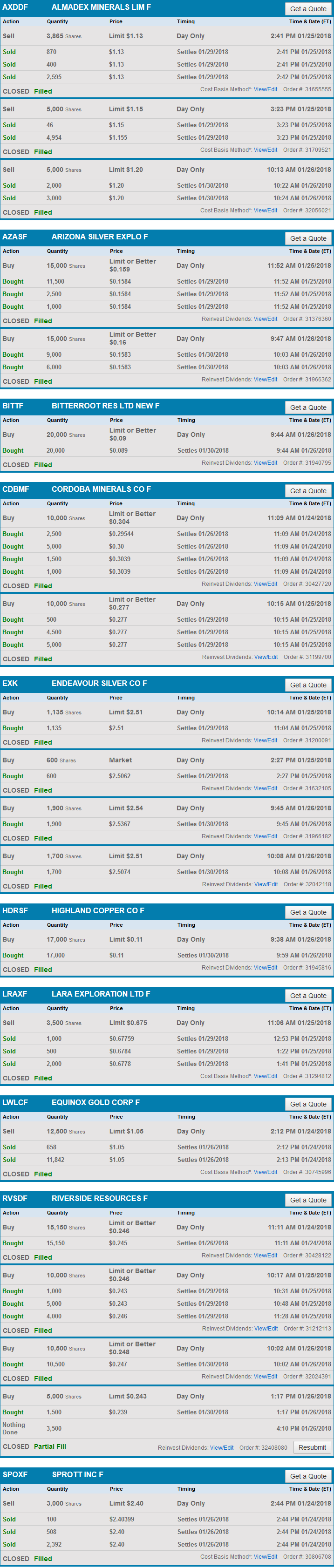

This week we saw significant price increases in gold, silver and many gold and silver stocks. I primarily focused on selling small portions of the positions that had become the largest in my portfolio, or stocks that I felt had gotten ahead of themselves. I've been re-investing the money in other gold and silver stocks that I feel retain more upside potential. My favorites that I've been adding to my portfolio recently have included Riverside Resources, Endeavour Silver, and Cordoba Minerals. I like all of the companies I follow, I just get price sensitive and when a stock moves ahead more than the other stocks in my portfolio, I follow a rule that I call 'Leland's law of relative value' and I sell the over-valued stock and buy the one I feel has the best risk reward ratio at that particular moment.

.png)

I'm really excited by the risk/reward opportunities offered by silver investments at the moment, so that is where I've been primarily investing this week. Endeavour has a large market capitalization and plenty of liquidity compared to most of the other stocks I follow, so it has been a favorite of mine to purchase lately.